Well-known investor Howard Marks of Oaktree Capital has often said, “You can’t predict, but you can prepare.” While markets are cyclical, oscillating between bull and bear markets, you can never know with certainty when the market is going to turn, how quickly it may do so, how far it might fall, or when it will begin its next cyclical ascent. That is, until you have the benefit of hindsight and are able to identify the now obvious triggers for the change from bull to bear—something that occurs long after the bear market has established itself, possibly near the end of it. Empirical studies have shown that it is virtually impossible to consistently “time the market”. That is, getting out of the way of an impending bear market before sustaining significant portfolio damage, while also being able to get back in without missing the initial (usually very powerful) surges of the next bull market is near fantasy. Still, nobody likes witnessing their investment portfolio experience negative returns. To help avoid regret, if not negative returns over a period, there are several simple things an investor can do to be prepared for the inevitable bear market and to mitigate the risk that the next market finds them wrong-footed, potentially jeopardizing their financial security.

- Build a strategic cash reserve. The best offense is a strong defense. Whether it be a 6-month cash reserve or potentially longer (depending on an investor’s unique circumstances, objectives and near-term cash requirements), simply establishing and maintaining a liquid cash reserve creates a vital buffer between an individual and a variety of potentially catastrophic risks and uncertainties. While there are those who say things like “cash is trash” because an asset earning little-to-no return is an asset not being used productively, the reality is that cash serves as a front-line defense and life raft against a number of negative real-world scenarios, be it temporary unemployment/job loss, or potentially large and unexpected expenses (medical, home repair, etc.). In addition, cash provides a layer of protection between an investor and potential market setbacks, providing assurance that liquidity will be available for living expenses even in the midst of the ugliest of bear markets (when selling assets to raise cash would generally be unwise). A cash reserve could mean the difference between painful forced selling near the bottom and staying invested through the storm and being able to sleep better at night.

- Stick with the asset allocation defined in your Investment Policy Statement. It is not uncommon for investors to put excessive focus on the returns of the broader markets, or to be influenced by the returns their friends may boast about, chasing better performing assets because of FOMO (Fear Of Missing Out), while losing sight of the returns that they require to ensure financial success. One of a financial advisor’s most important jobs is to work with their clients to develop an individually tailored Investment Policy Statement (IPS) that considers their risk tolerance, risk capacity, cash needs, values, long-term goals, and objectives (among other factors). By going through a thorough discovery process with each client, a financial advisor will determine a portfolio investment allocation that is appropriate for that person. Then, allocating investable assets consistent with the IPS, an investor should be confident that they are not assuming more investment risk than they are comfortable with or that could jeopardize their objectives. Importantly, the IPS is a dynamic document that can be revised and updated as an investor’s financial circumstances change. However, a well-conceived IPS, incorporating reasonable and realistic return assumptions, should not require an investor to make significant and unpleasant lifestyle changes when market conditions change.

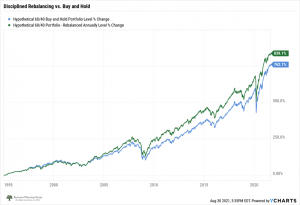

- Rebalance regularly. One of the least exciting yet most effective tools an investor has to manage risk is to regularly and systematically rebalance their portfolio. Doing so provides several benefits: First, it ensures that an investor maintains investment exposure that is consistent with the asset allocation prescribed by their IPS, preventing them from getting overly indexed to a particular asset class due to portfolio drift that comes with varying performance across asset classes. Secondly, regularly rebalancing results in the natural effect of “buying low and selling high” and without requiring any emotional decision making that may come with trying to decide specifically which securities to buy and sell vs. having a systematic, rules-driven methodology of doing so. Lastly, a portfolio that is regularly rebalanced tends to perform better over the long-term compared to a simple “buy-and-hold” portfolio (and with better risk management).

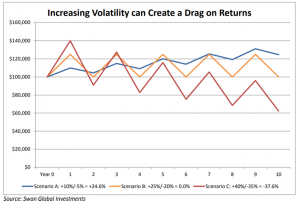

- Diversify, Diversify, Diversify. We’re all familiar with the term “diversification” as a way to manage risk but what does it really entail? It means more than simply owning a bunch of different securities within an asset class without placing too much emphasis on a handful of individual investments. It also means diversifying across asset classes—U.S. stocks, international and emerging markets, bonds, and alternative assets which have varying degrees of correlation with each other. When markets suffer meaningful drawdowns, the securities that make up a particular asset class tend to see their correlations rise and behave similarly. For example, when the broad stock market tumbles, stocks tend to fall broadly together, regardless of what industry or sector they are exposed to (while bond prices are often stable or rising). While investors cannot eliminate systematic market risk, they can mitigate it to a degree by investing in diversified asset classes and markets. A portfolio with a diversified asset allocation, (holding investments that have varying degrees of correlation among returns, including uncorrelated returns) generally provides for a more stable performance profile over the long-term. Not only does a more stable portfolio reduce stomach-churn, allowing an investor to sleep better at night, it also improves long-term performance by reducing the impact of volatility drag on investment returns. Put simply, volatility drag happens because annual returns are linked and the return in one year increases or decreases the available wealth to compound in subsequent years. This phenomenon can be particularly acute when an investor is actively withdrawing funds from their portfolio to support current spending needs. Selling assets at distressed prices to cover expenses when a portfolio is down 20% is far more detrimental to future returns than having to liquidate assets when a portfolio is only down 10%, as it would leave less money available for future investment returns when markets recover. A more stable portfolio with a more modest return profile can thus (somewhat paradoxically) do better than a more volatile portfolio composed of, more volatile, potentially higher-returning assets. Put differently, over the long-term an investor can make more by losing less while avoiding the need to chase risk and reach for returns.

Plan well. Invest Smart. Not sure how best to implement a program that includes planning and all of the above? Schedule a 20 minute Introductory Call, we’d love to chat!