26 days into my professional career, something that had never happened before, happened. And it was not an unprecedented event that largely went unnoticed – like the time, early in my career, when I inadvertently wore different dress shoes on my left and right feet. While that remains memorable to at least one person, the never-before event on August 31, 1998 was monumental to a much broader audience. In the institutional investment fraternity that had just initiated me, it was a historic event that most in that fraternity still remember well.

On that final day of August in 1998, the S&P 500 lost 6.8% to end an abysmal month for stocks. Although scary, that 6.8% loss (which would roughly equate to a 1,600 point decline in the Dow, using today’s value) was not unprecedented.

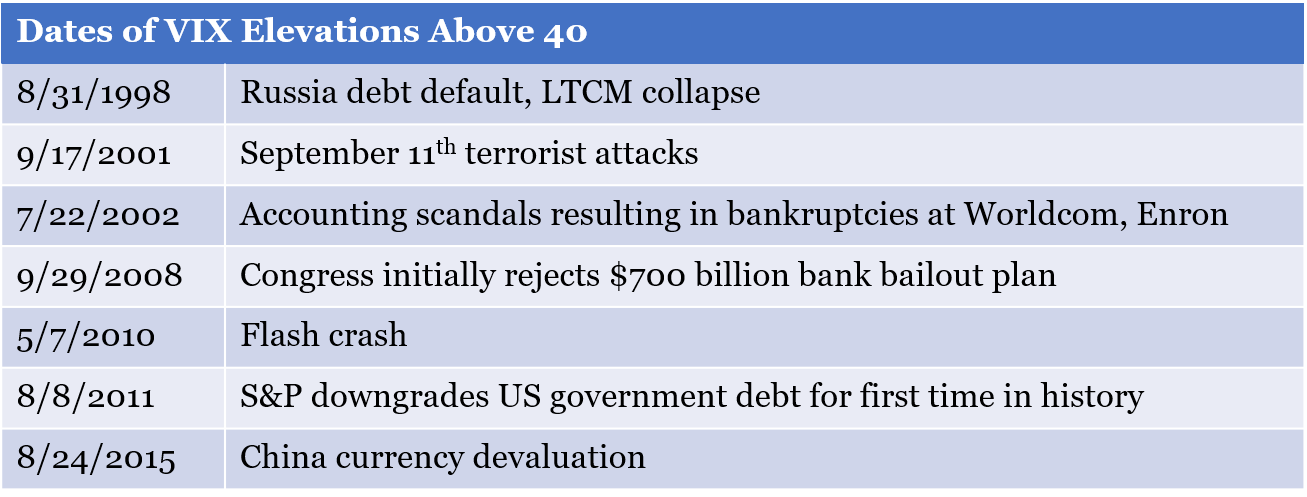

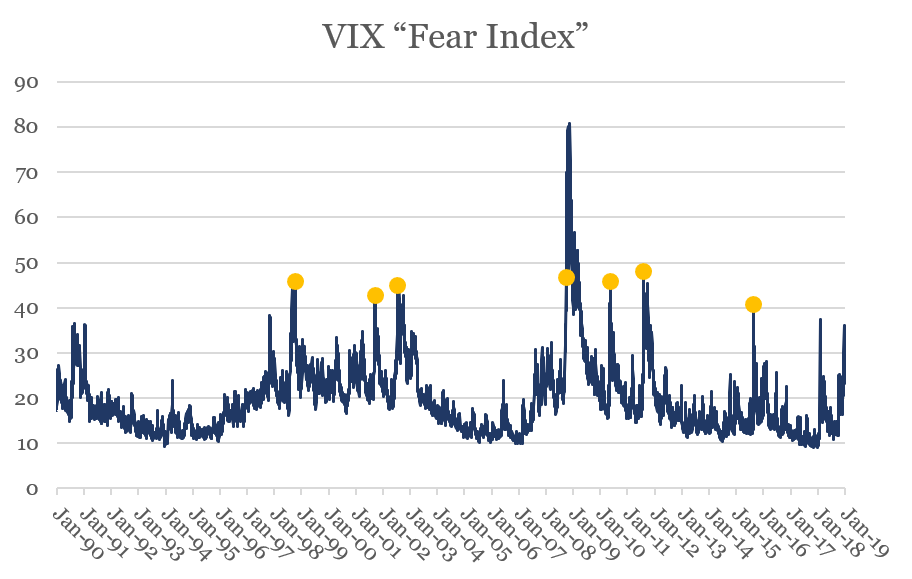

The unprecedented occurrence was the “fear index”, officially known as the CBOE Volatility Index or the VIX, rising above 40 for the first time on record. Without getting into too many details, the VIX uses option prices to quantitatively measure a market-implied risk level. At this time in the summer of 1998, investors were panicking and the VIX rising above 40 objectively represented that grave fear. The stock market was in turmoil. The Russian government had just abruptly defaulted on their local currency debt – a shocking turn of events that had previously been inconceivable given Russia’s ability to print more Rubles via the printing press to repay such debt. One of the world’s most successful and revered hedge funds – Long Term Capital Management – was losing billions of dollars and publicly collapsing in front of the world. The S&P 500 Index ended the month of August 1998 with a loss of 14.5% – it’s second worst one-month decline since the Great Depression. Fear was rampant.

What became evident with the passage of time was that this unprecedented event and the unsettling world events that led to it, represented a buying opportunity. Over the year that followed, the S&P 500 Index gained 39.8%. It was another representation of wealth transferring from the impatient to patient.

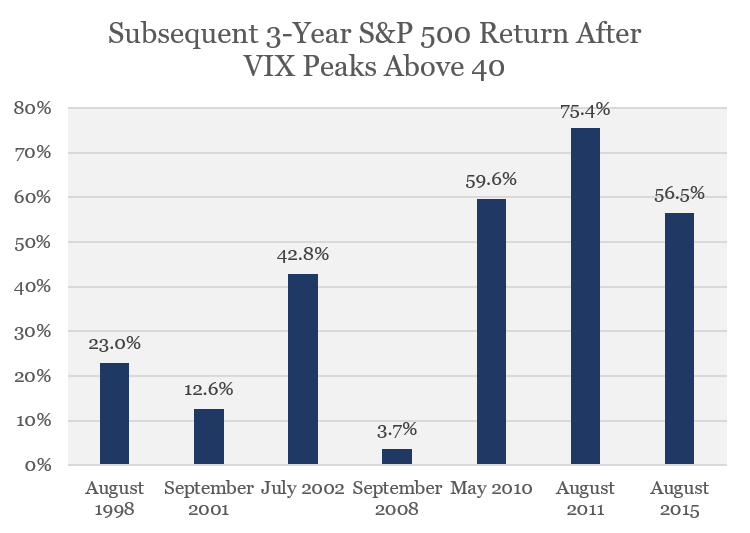

In the aftermath of the summer of 1998, the VIX eclipsed 40 on six different occasions. Following these seven occasions – August 1998 and the six times to follow – an investment in the S&P 500 Index would have yielded a positive return over the next three years every time. The average return over those seven 3-year periods was +37.1%. The median return was +50.9%.

This simply portrays some portion of the return premium that patient investors, who were buying at the time of widespread panic, received from impatient investors, who were selling as the market collapsed and fear was rampant.

This simply portrays some portion of the return premium that patient investors, who were buying at the time of widespread panic, received from impatient investors, who were selling as the market collapsed and fear was rampant.

Closing Comments

One of the many challenges of a volatile stock market for someone writing about that market is that things can change in a hurry and make yesterday’s commentary largely obsolete. When I initially calculated all the aforementioned figures in late December to write this post, the VIX had just gone above 35 on consecutive days for the first time since 2015. It was perilously close to the 40 level and headed in that direction. Sharp stock market rallies on December 26 and December 31 calmed investor fears and, at least for now, the VIX failed to hit the 40 mark.

Importantly, 40 is a very arbitrary number. If I had used 36.29 as the key VIX threshold to denote unusually high levels of investor fear, that feels like data-mining. 40 is a nice round number so it more easily passes the smell test. But, to be clear, there is nothing any more magical about 40 than there is about 36.29.

The point to remember is that when investor fear is elevated to unusually high levels as it was in late December 2018, and it feels like the world may be coming to an end, those times have historically represented excellent buying opportunities rather than times to panic and sell alongside the masses. Just a little something to remember.

Leave A Comment