“It is a habit of mankind to entrust to careless hope what they long for, and to use sovereign reason to thrust aside what they do not fancy.” — Thucydides

Immediately following the British vote to exit from the European Union (“Brexit”), we sent an email to you and other clients explaining the implications. A few days later, an RPG client wrote back applauding us for the prescient email. He also relayed that he had forwarded our email to a pessimistic neighbor. In return, the neighbor wrote back: “Your advisor should have set the email to the song: “Don’t Worry, Be Happy.”

Although our intended message was not one of unbridled optimism, it was a message to encourage patience in light of increased uncertainty. In retrospect, consider an alternative message we could have communicated. We could have inspired worry and fear by describing the foregone conclusion of a lousy global economic picture and the breakup of Europe. We could have communicated that such a scenario was inevitable and that we were selling stocks and other risk assets to prepare for the market sell-off to come. “Worry, Panic, and Sell” the background song for such an email might have been titled.

The Brexit vote was a known event with a binary outcome. We knew a year in advance that on June 23rd 2016, the Brits would either vote to stay in the European Union or to leave this decades-old marriage. Most U.S. presidential elections provide this same scenario: a known event with a binary outcome.

While our behavioral inclination may be to not just sit there but do something when these events occur, we hold to an investment discipline which does the opposite and ignores the temptations of speculation or immediate action. Still, some will ask why it is that we should not immediately change our investment approach depending on the outcome of the upcoming election or in advance of the election? To help answer this question, we have to dispel some fictions and highlight some important facts.

- Fact: Allowing emotion (fear, panic, depression, excitement, etc.) to impact financial or investment decisions is a terrible idea. In case this needs explanation or proof, refer back to our January commentary.

- Fiction: Given the uncertainty surrounding the election, it’s a good idea to hold cash and wait until after the election to invest. Since investment markets move higher over time, this line of thinking inherently presupposes that markets will perform poorly leading up to a presidential election and that the clarity of a winner will then lead markets higher. The truth is that the stock market has historically increased at a higher rate in the six months leading up to a presidential election than in the other 42 months of each 4-year cycle. Uncertainty is always a risk but risk is the reason that investors get compensated. Avoiding uncertainty or risk may help you sleep better but it comes with an economic cost.

- Fiction: Once the election result is known, we should reduce/increase risk if Trump/Clinton/Donald Duck is elected. Once the election results are publicly known, stock and bond prices should immediately reflect the result, positive or negative. In order to justify trading based on the result, we would need to have a better understanding of what the result means for global economics than the rest of the world or we would simply need to know the election outcome before the rest of the world. Quoting Allan Roth in the Wall Street Journal, “Extrapolating common knowledge into predictions of the future is really just following the herd, and that typically doesn’t go well.”

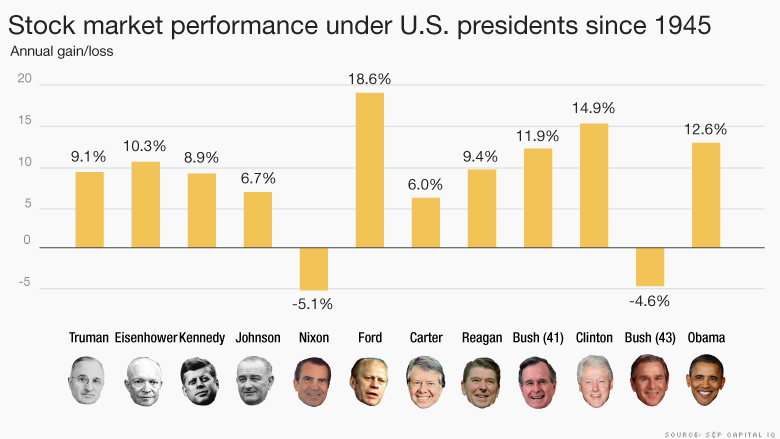

- Fact: The president is not as important to financial markets as people tend to believe. A few years ago, the team at Freakonomics dedicated a study to the topic, “How Much Does the President of the U.S. Really Matter”. Although their findings are not the end-all-be-all, the instructive conclusion of their research and the research of others is that the impact of CEOs, coaches, managers, and presidents does matter – just not as much as we think it does.

- Fiction: The ‘Fill in the Blank’ Party is demonstrably better for the stock market. Democrats will point to historical data and conclude that stock markets and corporate growth perform better when a Democrat is in the White House. The reality is that this deduction confuses causation and correlation. Outside factors such as changes in oil prices, global monetary policy, terrorist events, natural disasters, asset bubbles, and technological advancements have had far more impact on stock prices than presidential policy initiatives. Moreover, the data set is still too limited to draw significant conclusions given that there have been only 7 Republican and 7 Democratic presidents since the inception of the S&P 500 Index.

- Fact: We all have a damaging behavioral tendency to invest based on our political leanings. Our inclination is to look for information that confirms our existing views and weigh it more heavily while we readily ignore information that refutes our views. This “confirmation bias” explains why we are far more likely to view the convention of the political party that we support or more likely to read an article explaining the investment merits of gold than an article forecasting its demise if we are already bullish on gold. Furthermore, when the political party we support is out of power, we’re more likely to read/listen to/watch pessimistic commentary and negative forecasts. As a result, behavioral research finds that supporters of the losing party are more likely to invest conservatively while their party is out of power which leads to worse investment results.

What It All Means To You

Our intended advice following the Brexit vote was to avoid making investment decisions during emotional extremes. The same advice applies to election cycles. The reality is that our brains cause us to think we know more than we do, to think we’re better investors than everyone else, and to think we can forecast the future. Remaining disciplined and humble are possibly the most valuable attributes that we provide to you as financial advisors but also the most thankless and underappreciated services. You’ll find plenty of opportunities to bemoan an investment approach of disciplined diversification.

It is hard to admit that the future is unknowable and that even having the advantage of unique information sources will not allow us to predict the next market swing. We recognize it would be more fun for our clients and behaviorally satisfying for us if we operated under the overconfident guise that we could forecast the market’s short-term movements. But we are confident that the strict discipline of removing emotion and knee-jerk reactions from investing decisions will prove better in the long run.

Thank you for your level headed explanation of pro’s & con’s of investor reactions to current events. I feel comfortable with RPG’s “steady as you go” approach of not overreacting to events.

Thank you for this timely update!