My mother owns an iPhone but constantly gets frustrated at her perceived difficulty of answering a call. I am confident that she has never downloaded an app, sent a text message, or used the phone to open an email. She can solve the Sunday New York Times crossword puzzle but if you asked her to check the weather on her iPhone, she would not know where to start. It’s a safe bet that no settings have been changed on her phone since the day she left the Verizon store.

Apple persuading my mother to purchase an iPhone was a marketing coup. She clearly has no need for any device that does more than send or receive calls. The probable fact is that we all know some tech-challenged family member or friend who similarly purchased a piece of technology which will never be used in its rightful capacity.

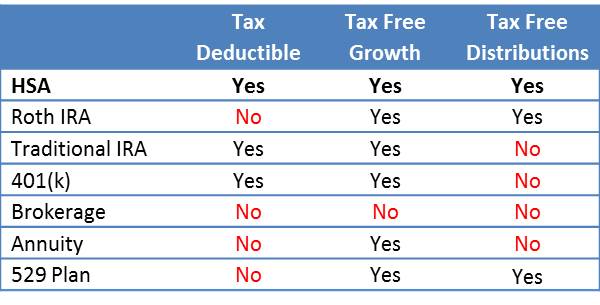

When it comes to iPhones, the majority of owners are downloading apps and utilizing many of the robust device features. My mother is in the minority. An analogy exists in the financial world, albeit with one big difference. A large percentage of the population probably knows about health savings accounts (HSA), an account-type that was established roughly three years before the first iPhone. According to Towers Watson, 80% of large companies offer an HSA-eligible health insurance plan and 10.7 million health savings accounts exist. Yet unlike the iPhone, the majority of consumers do not truly take advantage of the most tax-favored account type that exists in this country. Most consumers use an HSA like my mother uses an iPhone.

An HSA is the most tax-advantaged account that exists under current United States tax law but little promotion of these accounts exists. No single industry has good reason to promote HSAs to the public. Most large banks do not offer HSAs because the market is relatively small – HSAs represent 0.1% of the retirement account market. Large brokerage firms do not want to deal with the administrative requirements, which tend to be more cumbersome than a traditional account. Insurance companies offer HSA-eligible plans but have no real incentive to promote the associated HSAs, which are provided by another firm. As a result, consumers may know about these accounts but they really don’t know how to use them effectively.

The rules have changed on health savings accounts during their decade of existence so it pays to reevaluate the opportunity if a few years have passed since you last considered them.

Missed Opportunity #1: Ignoring HSA-eligible insurance plans because the deductible is too high.

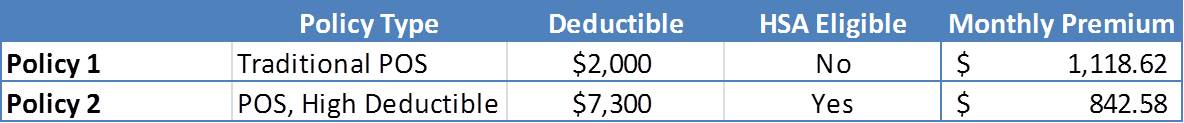

Many consumers look past high deductible policies that may be offered by employers or in the private marketplace, instead opting for traditional policies with higher premiums and lower deductibles. It is worth spending a few minutes to consider the underlying economics before simply disregarding the high deductible insurance. For a simple comparison, I used my own family and actual health insurance pricing from a large insurance provider.

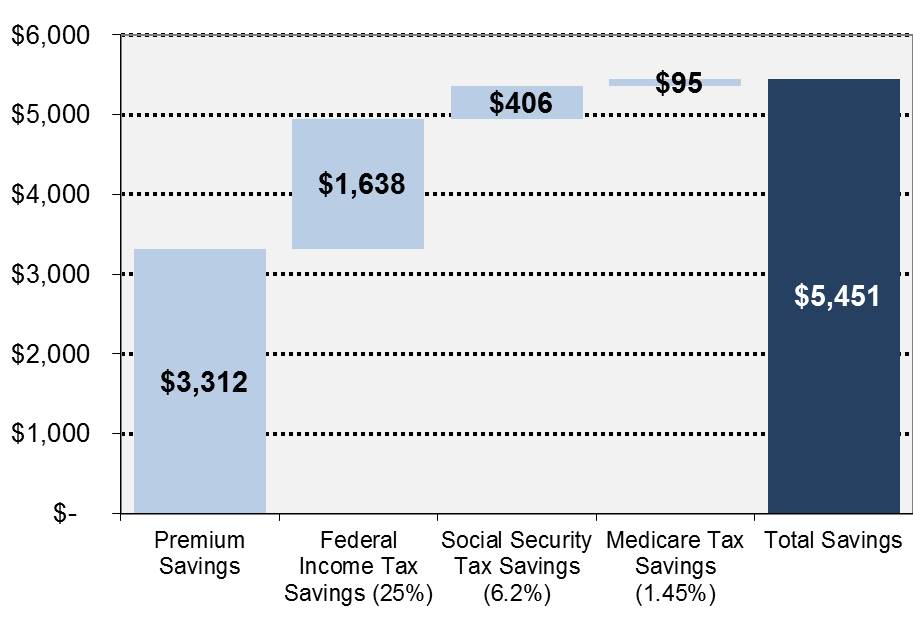

Of the two policies above, Policy 2 is $276 cheaper each month which results in $3,312 of annual premium savings. But the savings don’t stop there. In 2014, families with a qualified high deductible health plan (HDHP) can contribute up to $6,550 to an HSA (plus an additional $1,000 if over age 55). The HSA contribution is a front-page tax deduction, not subject to any phase-outs or income limits and reduces adjusted gross income (AGI) dollar for dollar. If I were to maximize the tax savings available with Policy 2, the total savings add up to $5,451 for the year, as depicted below (ignores state tax benefit and possible benefit of higher allowance of itemized deductions).

In the worst-case scenario, the deductible for Policy 2 is $5,300 more than Policy 1 ($7,300 minus $2,000). However, I know that I’m going to save $5,451 in taxes and lower premiums over the year so I still come out $151 ahead with Policy 2. In the best case scenario where my medical expenses are less than $2,000 during the year, I come out $5,451 ahead with Policy 1. Assuming that I am wise enough to make use of the HSA benefits, the high deductible plan (Policy 2) is always going to be financially optimal, despite the higher deductible.

Missed Opportunity #2: Having an HSA-eligible insurance plan but not using an HSA

This is simply leaving money on the table. Even if you have no savings and do not have the free cash to fully fund an HSA each year, you should at least be running all medical expenses through an HSA account. For someone in the 25% tax bracket with $2,000 of medical expenses, the all-in savings amount to more than $600, even after any HSA fees have been considered. If a no-brainer tax move exists, this is it.

Missed Opportunity #3: Using an HSA but failing to maximize contributions

We often run across situations where families use an HSA to cover medical expenses but do not make full use of the annual contribution limits ($6,550 for a family in 2014 plus an additional $1,000 for anyone over 55). This can be understood in cases where there are insufficient funds to make the full $6,550 contribution. However, be careful not to cast yourself in this bucket too quickly. Are you making an annual Roth IRA contribution? Consider diverting those contributions to an HSA where you can still invest for retirement with tax free growth and you get a huge tax deduction, as well. Do you have a brokerage account that contains retirement savings? Consider distributing funds from that account to fund the HSA. You still have retirement savings but you just reduced your current year tax liability and the retirement savings now grow free of tax. If you have an HSA-eligible plan, there are few situations where you should not be maximizing contributions.

Missed Opportunity #4: Not exploiting the tax free growth feature of an HSA.

There is no requirement that medical expenses be paid from an HSA, if one exists. The HSA is there if you need it just like a Roth IRA can be tapped if you need it. Just because you have a 1997 Tuscan red in the wine cellar, does not mean you need to drink it tonight. It will improve with age, just as the untapped HSA will.

When it comes to HSAs, the power-user does not stop at maximizing tax deductions but exploits the often-ignored tax free growth feature of these accounts, which can be extremely powerful. This means maximizing HSA contribution, investing the HSA assets largely in equities to take best advantage of tax-free compounding, and paying for medical or dental expenses with non-HSA funds.

Missed Opportunity #5: Not keeping medical invoices.

Ready for another beautiful feature of HSAs? Distributions from an HSA can be used to pay or reimburse qualified medical expenses in the current year or any prior year, as long as the expenses were incurred after the establishment of your HSA. This means you can save invoices and bills for medical expenses in the current calendar year (or any year in the future) and then reimburse yourself for these expenses from the HSA in 20 years from now when you’re drinking that 1997 Brunello. You may have enough medical expenses later in life but why take the chance?

Closing Comments

In summary, here are the basic steps to avoid ignoring the powerful features of an HSA like my mother and her iPhone:

- Annually fund an HSA to the limit. In 2014, the family limit is $6,550 or $7,550 if over age 55. If your employer allows it, have the contributions go through payroll to further benefit by avoiding payroll taxes.

- Invest the HSA assets aggressively. Tax free accounts should typically be invested in stocks to exploit the mathematical power of tax-free compounding.

- Pay medical expenses directly from other assets. Leave the HSA to grow tax free.

- Keep your receipts and invoices.

Thoughts or comments? We welcome you to share them in the comments section below.

Leave A Comment