It is a late-April morning and you are standing at the rim of the Grand Canyon, ready to hike down to the Inner Canyon. The temperature is a few degrees below freezing and an uncomfortably cold wind is blowing. You have come prepared and dressed appropriately to fend off the bitterly cold wind as you stand at the rim in advance of the day’s journey.

Over the next several hours, you descend from the rim to the Colorado River below. The strong wind subsides, the clouds give way to the scorching sun and you descend nearly 6,000 feet of elevation. All of this makes for a dramatic change in temperature. The thermometer climbs from 28 degrees in the morning to 94 degrees at the bottom.

This is no more than a typical day at the Grand Canyon. You shed multiple layers of clothing throughout the hike down to the canyon base as the morning chill turns to afternoon heat. By the time you reach the bottom, you are down to your base layer and feeling quite comfortable.

The ancient art / ancient science of layering

Layering. Experienced backpackers debate whether it is a science or an art. REI and Sierra Trading have lengthy webpages devoted to the fundamentals of layering and then sub pages to covering topics such as choosing a base layer. What the much larger community of husbands, wives, and parents buying life insurance could learn from the backpacking community.

The reality is that nearly all professionals, physicians, or business owners with dependents have a dollar need for life insurance that declines with every passing day of their working lives. This critical point escapes many people and it is not something that the life insurance industry has any interest in promoting. Each passed day means one additional day of earned income and one less day of lifetime spending. That is to say that most working individuals start with the need for many layers and need fewer and fewer layers with each passing year.

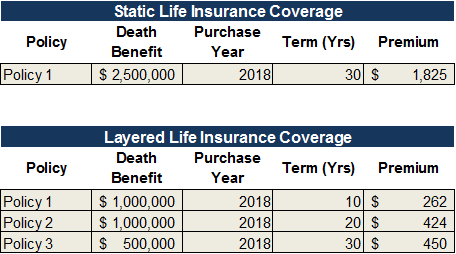

Consider Sandy, a 35-year old professional. Sandy will earn $235,000 of gross income this year and use that income to support two children and a husband. She expects a few wage increases over the next 30 years until she retires at age 65. Relying on a few other assumptions about taxes, anticipated future expenses, etc., the graph below reflects her declining need (or rather, her family’s declining need) for life insurance over the next two and a half decades. The only reason that the life insurance needs might materially change would be an unexpected update in the family’s financial plan like an unplanned child or an unexpected inheritance.

When it comes to life insurance, most people dress the same whether it’s 30 degrees or 90 degrees

Most people who need life insurance – because they have dependents – buy life insurance sometime between marriage and having children. This generally means purchasing life insurance when the death benefit need in dollar terms is at its lifetime peak. To revert back to the Grand Canyon analogy, this is the equivalent of the coldest and windiest part of the day – when you need the most layers.

Dressing in layers and shedding clothing as the temperature declines is terribly obvious for a hiker. Yet our experience is that the overwhelming majority of people buy one large term insurance policy early in their careers to cover the next 20-30 years. It is the equivalent of starting the hike to the bottom of the Grand Canyon with only one extremely heavy layer of clothing. By midday, you end up dressed for 30 degrees when it’s 90 degrees outside. In financial speak, you quickly end up with far more insurance than you need – and paying a real price for that excess.

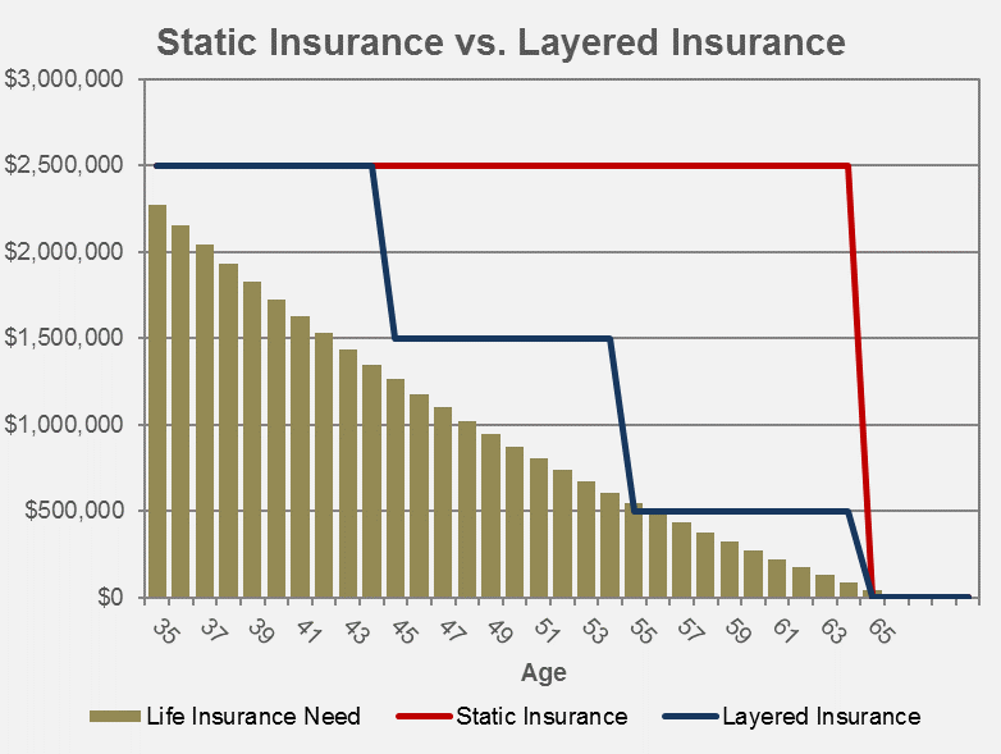

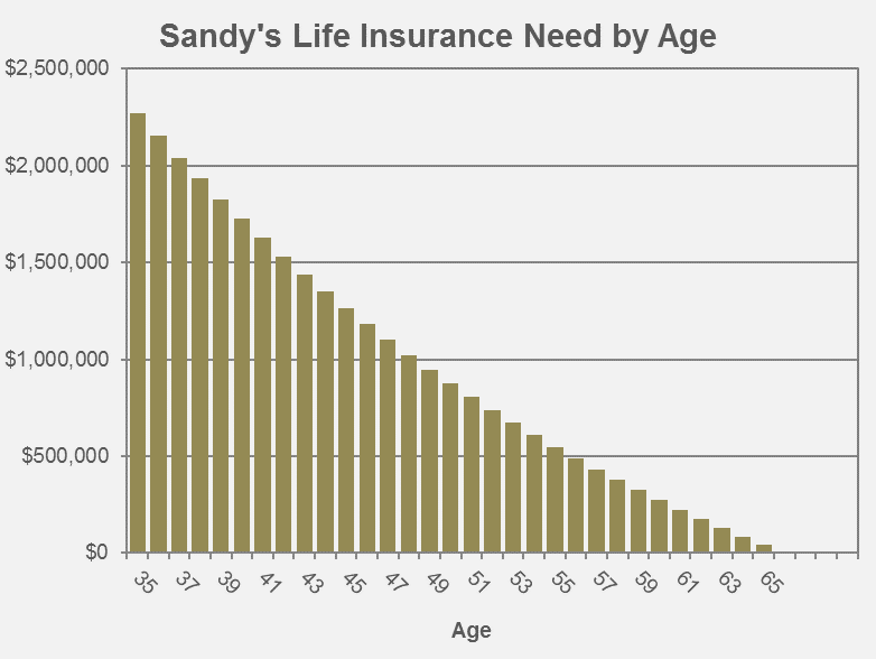

Back to Sandy. Based on her income, her expectation of working 30 more years, and a few other assumptions, her financial planner determines that Sandy’s immediate life insurance need is approximately $2,500,000. The overwhelmingly common course of action would be for Sandy to purchase a 30-year level-premium term insurance policy with a $2.5 million death benefit. Assuming preferred-plus non-smoker rates, Sandy would pay $1,825 per year for this coverage and a total of $54,750 in premiums over the next 30 years.

The problem with this outcome is that Sandy winds up with significantly more life insurance than she needs in a few years’ time. Concurrently, she winds up paying for lots of life insurance over the next 30 years that her family does not need.

Now consider an alternative course where Sandy layers three insurance policies with the same carrier – a 10-year policy, a 20-year policy, and a 30-year policy. Her $2.5 million insurance need is fulfilled for the next decade. After 10 years, $1 million of coverage drops off but her updated insurance coverage of $1.5 million is still more than enough to cover her projected need at that time.

Over the course of the next 25 years, Sandy has enough term life insurance to cover her family’s needs and she saves more than $30,000 in premiums over the course of 30 years. If she invests these premium savings and earns a real rate of 4%, the present value of her aggregate premium savings is $53,596. There is probably a lot that Sandy and her family can do with an extra $53k in lieu of purchasing unneeded life insurance.

The challenges to layering

None of the common challenges to layering life insurance are compelling. At all. Let’s tackle the most prevalent…

“Term life insurance is cheap so I can accept buying more than I need.”

Where to start in debasing this argument? Let’s start with the concept that buying more of things that are cheap, just because they are cheap, is not a sound life strategy whether it relates to purchasing life insurance, garbage bags, Christmas tree ornaments, or french fries at McDonalds. A second counter is that layered life insurance, done properly, still provides more insurance than you will likely need – just not egregiously more life insurance than you will need. A third counter is that every dollar of cheap term life insurance still has an expected return of -25 to -50%. You’re not buying more of a cheap investment that should deliver a nice return if held for a long-time period. You’re buying more of an investment that is expected to result in a huge loss. If you’re seeking cheap investments with an expected return of -25% to -50%, why stop at life insurance?

“I like the simplicity of one policy and want to avoid the hassle of buying multiple policies.”

Except that it really isn’t an additional hassle. As long as you are purchasing insurance from the same carrier, buying three policies still entails just one underwriting exam – no more effort than buying one policy.

“I can always just stop paying premiums on my single term insurance policy when I no longer need the coverage.”

Yes, and the same is true for the layered approach. Except that you pay significantly lower annual premiums using the layered approach during the period when you do need the insurance. And you can strategically drop policies as it makes sense rather than waiting until the day when you no longer need any coverage. This argument against layering actually makes the case for layering.

“I don’t really have a good sense for how much life insurance I may need in 10-15 years.”

Not to be self promotional here but this is what a good financial planner does – helps assess how much life insurance is needed for an individual – now and each year in the future. And not by using terribly flawed rules of thumb like some multiple of income but by assessing the individual circumstances including expected future income, expected number of years to retirement, college funding goals, expected spending, etc.

It is true that reality may – and probably will – deviate from planning assumptions. However, this is not an argument for purchasing one big term life insurance policy to cover the next 30 years. If you are able to reasonably estimate the amount of life insurance that you need today, then you can mathematically extrapolate the declining amount of life insurance you need each year in the future.

“I already own a large term insurance policy so it’s too late for me to enjoy the benefits of layering.”

Only if you are uninsurable now. Otherwise, there is little to prevent someone with a large term insurance policy that covers the next 25 years to apply for two or three new policies like Sandy in the example above and then drop the existing policy. The added savings will still likely be in the tens of thousands of dollars over a lifetime.

Closing thoughts

I definitely spend more time than I should evaluating the difference between a widget on Amazon that costs $12 from one that costs $17. Do I really need to spend the additional $5 for the upgraded features or because the $17 item has an average review of 4.5 stars and the $12 item only gets 4 stars? That decision – whatever the outcome – will have almost zero impact on my family’s financial success.

The purchase of term life insurance to best reflect what my family and I need, however, will have significant financial impact. In the simple example of Sandy above, the savings were not $5 – they were in excess of $53,000.

Despite these massive potential savings, there is no reason for any life insurance salesman or saleswoman to promote layering even though it better reflects the buyer’s life insurance need over time to go along with the savings. Because insurance brokers generally get paid a percentage of the premiums, the incentive is for a broker to promote the opposite of layering. “It’s cheap insurance and your family could always use the extra death benefit so why go through the hassle of buying multiple policies.” There you have the likely insurance broker counter.

Layering is not a complex concept. It’s generally no more complex to execute than buying a single, static policy. And despite the huge cost savings, the better fit of insurance coverage to insurance needs, and the relative simplicity of the strategy, it’s drastically underutilized.

Oh, could the average insurance buyer learn a thing or two from the backpacking community.

Leave A Comment