The history of the qualified charitable distribution (QCD) feels a lot like the ‘Friends’ relationship of Rachel and Ross. Off. On. Off. On. Off. On. There has been enough disruption in the availability of this tax-saving opportunity that it has been hard to remember if it is on or off. Good news…it’s on.

The brief history goes back to 2006 when Congress first authorized the QCD in the Pension Protection Act – but only for two years. It lapsed in 2008, 2010, 2012, 2014, and 2015, only to eventually be reinstated each time. In late 2015, Congress permanently reinstated the QCD. Finally, tax filers have some clarity on the opportunity and it makes more sense for them to begin understanding that opportunity.

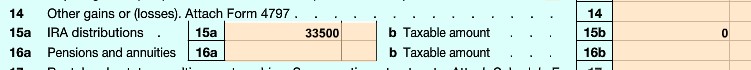

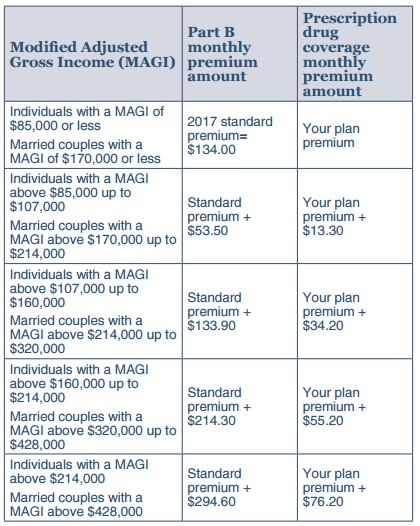

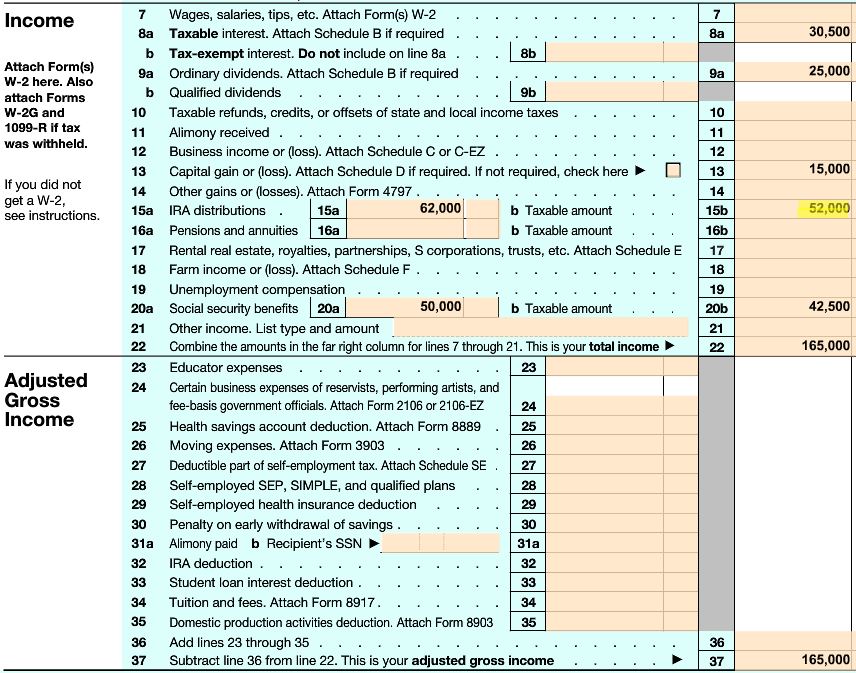

Although public awareness is growing with expanded coverage of the QCD in personal finance publications, we find that many consumers and financial advisors are either not aware of the QCD at all or just do not understand the simplicity or the benefits well enough to put it to use. Other than anecdotal experience, how do we know that QCD understanding and use is still extremely limited? Up until last year, large financial custodians with literally millions of customers were so unaccustomed to having clients or advisors use the qualified charitable distribution, that they did not know how to properly execute the technique Despite its lack of use, the qualified charitable distribution is not a complex tax planning vehicle or a tax strategy that only applies to a small fraction of taxpayers. The QCD rule simply permits taxpayers to make IRA distributions directly to a public charity without treating the distributions as taxable income. That is, money goes directly from the IRA to the charity without passing go. Consider the following attributes of the QCD: Large Base of Potential Users. Any taxpayer over age 70 ½ who owns an IRA is eligible to use the QCD. This represents approximately 25 million Americans. Tax Benefits for Low Income, Middle Income, and High Income Taxpayers. The QCD is not a tax strategy that only benefits high income earners or low income earners. In fact, married couples with gross income below $44,000 can achieve significant benefit from the QCD as can married taxpayers with income in excess of $300,000 (all explained below). Simple and Effective. The QCD is very simple to execute. It reduces one number on the front page of the 1040 with no complex calculations or separate schedules. In the 1040 example below, note line 15. Under normal circumstances, this taxpayer with a $33,500 required minimum distribution reports 33,500 on line 15a (IRA distribution amount) and then the same 33,500 on line 15b (taxable amount). In this example, the taxpayer directed all of the $33,500 required distribution to charity which, in turn, meant that line 15b – the taxable amount – was $0. This has important ramifications, which will be explained later. What are the Requirements of the Qualified Charitable Distribution? There are several important (but easy to fulfill) qualifiers: Without the QCD, a taxpayer would take his or her required minimum distribution (RMD), donate the amount of the distribution to charity, and then take a charitable deduction to offset the income. In some cases, this would result in a perfect offset and no net impact to the tax liability. However, in many cases, the offset is not dollar for dollar due to how the IRS treats income and deductions. Notably, when a taxpayer uses the QCD, the amount of the distribution never gets reported as income and is not additive to the taxpayer’s adjusted gross income (AGI). This reduction in AGI has important benefits which we describe below. Here are some of the most common scenarios where tax filers can exploit the QCD. Tax filers who claim the standard deduction can receive a tax benefit from charitable gifts made by way of the QCD that they would not otherwise receive. The standard deduction in 2016 for a married filing jointly couple is $12,600. A retired family who owns a $500,000 home without any debt, does not incur large medical expenses, donates $2,500 to charity each year, and has modest taxable income may discover that the $12,600 standard deduction exceeds their itemized deductions. In this case, the $2,500 of checkbook charitable gifts provides no tax benefit to the retired couple because their standard deduction of $12,600 exceeds their itemized deductions (meaning they’d pay the same taxes had they given away nothing to charity). However, if the same couple makes use of the QCD to distribute the same $2,500 to charity, they reduce their income by $2,500 which, in turn, reduces their taxes. Even taxpayers who itemize but would claim the standard deduction were they not to make any charitable contributions benefit from utilizing the QCD. Presently, they get some benefit from the charitable contributions they make but not the full benefit. Using the QCD would allow them to fully benefit on taxes from 100% of charitable contributions. Couples with more than $170,000 of modified adjusted gross income and individuals with more than $85,000 of income can use the QCD to avoid higher Medicare premiums. Medicare B and D premiums are tied to the modified adjusted gross income (MAGI) of taxpayers. Single taxpayers with modified adjusted gross income of more than $85,000 and married filing jointly taxpayers with MAGI of more than $170,000 pay an additional Medicare premium amount, known as income related monthly adjustment amounts (IRMAA). For example, a married taxpayer with modified adjusted gross income of $170,001 would pay an additional $133.60/month or $1,603/year compared to a couple with $170,000 of income – just $1 less. The income thresholds in the leftmost column above are based on modified adjusted gross income – which means they are not reduced by itemized deductions (i.e. charitable gifts). A married taxpayer with $175,000 of adjusted gross income who donates $10,000 to charity via checks has to pay the higher Medicare premiums. However, if the same taxpayers use the QCD to donate the same $10,000 to charity, MAGI is reduced to $165,000 and the tax filer does not face the additional Medicare premiums – a simple and quick one year tax savings of $1,603. Here’s what that looks like. Note the highlighted figure on line 15b which shows the taxable IRA distribution reduced by $10,000 from $62,000 to $52,000. Tax filers with meaningful medical or dental expenses can use the QCD to increase their medical deduction. Although the medical expense deduction has become harder for taxpayers to utilize over the past few years because of a higher threshold, it still presents a tax-saving opportunity for retired taxpayers with modest income. Starting in the 2017 tax year, only medical expenses[ii] that exceed 10% of adjusted gross income can be deducted for all taxpayers. Let’s say your AGI is $100,000 and that includes a $20,000 IRA distribution. Also assume that you make $20,000 worth of checkbook donations to charities and have $12,000 of medical expenses. In this scenario, you’re only able to deduct $2,000 of medical expenses – the amount that exceeds 10% of your $100,000 adjusted gross income ($10,000). However, using the QCD to make the $20,000 of charitable gifts reduces your AGI to $80,000 which means that the medical deduction hurdle is now only $8,000 (10% of $80,000). Making the charitable gifts directly from the IRA allows you to claim an additional $2,000 of medical expense deductions for a total of $4,000. Married tax filers with over $250,000 of AGI or single filers with over $200,000 of AGI can use the QCD to reduce the 3.8% Medicare tax. The 3.8% Medicare tax on investment income only applies to married filers with more than $250,00 of AGI or single filers with more than $200,000. Utilizing the QCD technique can either relieve taxpayers of that tax completely by reducing AGI below those levels or can reduce the amount of investment income that is subject to the 3.8% tax. For example, a taxpayer with $50,000 of charitable contributions who is subject to the 3.8% Medicare tax on $125,000 of income beyond the thresholds can save $1,900 in taxes ($50,000 x 3.8%) by simply making use of the QCD. Married tax filers with over $313,800 of AGI or single filers with over $261,500 of AGI can use the QCD to reduce the personal exemption phase-out and the Pease itemized deduction limits. Don’t be deterred if you’re not studied up on the personal exemption phase-outs or the Pease deduction limitations. Most tax filers, whether subject to these items or not, are not aware of these covert taxes. Simply understand that anyone with adjusted gross income above these levels in 2017 is going to pay higher taxes because deductions and exemptions are limited as income exceeds these levels. Once again, reducing AGI by utilizing the QCD reduces or even eliminates the impact of these covert taxes. Rental property owners who actively participate in the property’s rental activity can use the QCD to qualify for a larger taxable rental loss. If you own a rental property and meet the requirements to qualify for active participation (make management decisions related to the property, etc.), the tax code allows you to deduct up to $25,000 of rental property losses each year. Importantly, to claim the rental losses as an offset to other income, your AGI must be below $150,000 (or $75,000 for single filers). Since the income threshold is determined by AGI and not by taxable income, this presents another opportunity for the QCD to reduce income and, resultantly, to allow the taxpayer to claim a larger tax loss. Tax filers who receive Social Security and have limited other income sources can use the QCD to reduce or eliminate the amount of Social Security that is subject to taxation. The IRS looks at something called “combined income” to determine how much of your Social Security will be subject to taxes. Combined income consists of AGI (less Social Security) plus tax exempt municipal bond interest plus ½ of Social Security benefits. If your combined income is below $44,000 (for a married couple; or $34,000 for a single individual), then the amount of Social Security subject to taxation is reduced. Anyone close to these thresholds could benefit from utilizing the QCD to reduce combined income. Tax filers who are constrained on the size of their charitable deduction can use the qualified charitable distribution to realize a larger tax benefit from their charitable giving. For taxpayers who itemize deductions, the IRS limits the size of the charitable deduction to no more than 50% of adjusted gross income and, depending on other factors, sometimes 30% or 20% of AGI. As a result of these limits, taxpayers who make large charitable gifts each year can have their deduction limited. The QCD allows taxpayers to make charitable gifts without being subject to these limits. Importantly, none of the advice above suggests giving more dollars to charity simply for tax benefits. As we noted last year when we wrote about the merits of donor advised funds, the amount of charitable giving is a personal decision that should not be determined or driven by potential tax savings. We made the case then and make it again here that the method of gifting can often be optimized to have a profound impact on the tax benefit of a gift. The intent here is not to suggest that the qualified charitable distribution has benefit for all individuals who are over age 70.5. In fact, the QCD is not going to be of any value for many tax filers. Individuals who do not make charitable gifts, who don’t fit any of the criteria above, or have large, low basis stock positions are likely not going to benefit from the QCD. Instead, the intent here is to expand awareness on what the QCD is, how it works, and how you might benefit from its use. Simply understanding that it exists and how it can be utilized likely separates you from the majority of Americans. [i] The rule has always mandated that QCD checks be sent directly to public charities and yet custodians recently still had rules in place that prevented IRA distributions from being sent or directed to anyone besides the IRA owner. [ii] Importantly, the medical expense deduction includes Medicare Part B premiums, Part D premiums, and Medicare Supplemental premiums in addition to any out of pocket medical or prescription drug costs.What is the Qualified Charitable Distribution?

How Does the Qualified Charitable Distribution Work?

What are the Tax Benefits of the Qualified Charitable Distribution?

Who Can Benefit from the Qualified Charitable Distribution?

Closing Comments

Leave A Comment