Prior to 2018, the financial benefit for Georgia taxpayers to utilize the Rural Hospital Tax Credit and the Qualified Education Expense Tax Credit accrued only to those who faced alternative minimum tax (AMT). Georgia taxpayers who were not subject to AMT had the opportunity to direct the application of their state taxes to a specific cause but that benefit came at the expense of a net economic cost. In the case of the Rural Hospital Tax Credit, that net cost could be over $1,400 for a married couple. In the case of the Qualified Education Expense Tax Credit, the net annual cost for a married couple making the maximum $2,500 contribution was usually over $100.

These two Georgia state credits do not go away in 2018 under the new Tax Cuts and Jobs Act (TCJA) but there are several moving parts that impact their financial usefulness and the base of taxpayers who can benefit from them.

Most importantly, the personal alternative minimum tax (AMT) remains in the new tax law but the number of taxpayers impacted by AMT will decline dramatically. Moving forward, AMT will go from impacting nearly 4 million households each year to approximately just 200,000 – a reduction of 95%. The narrow set of taxpayers subject to AMT will largely be comprised of high income corporate executives who exercise valuable incentive stock options (ISOs) and retain the shares.

The intuitive conclusion might be that the value of these two Georgia tax credits will have a much more limited number of beneficiaries as the number of taxpayers facing AMT plummets. However, the new limits on state and local itemized deductions imposed by the Tax Cuts and Jobs Act simply change the beneficiaries of these credits. Beginning in 2018, any Georgia taxpayer with itemized deductions that exceed the standard deduction ($12,000 for single filers, $24,000 for married/joint filers) will benefit from these credits.

In fact, the highly publicized limits on state and local taxes (SALT) at the federal level that begin in 2018 create an incentive for states to adopt credits such as the Rural Hospital Tax Credit and Qualified Education Expense Credit. One way for states to circumvent the reduced deductibility of SALT taxes is to fund state programs with credits such as these – transitioning what would have been a non-deductible state tax deduction for taxpayers at the federal level to a charitable deduction that is not subject to any federal ceiling. Expect Georgia and other states with a state income tax to begin adopting similar credits and expand existing ones in light of the new tax law.

Rural Hospital Tax Credit in 2018 and Beyond

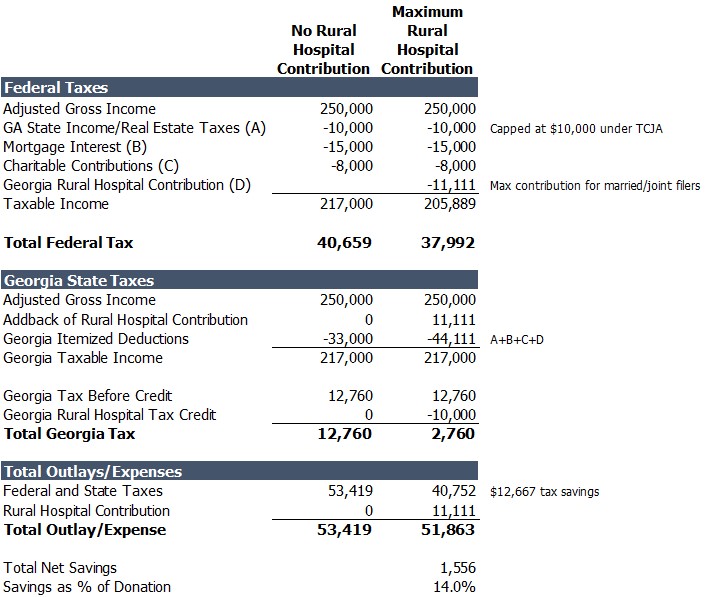

Georgia’s Rural Hospital Tax Credit will be most valuable for Georgia taxpayers with federal itemized deductions that exceed the standard deduction. For most taxpayers, this will mean that deductible mortgage interest plus charitable contributions (prior to the rural hospital contribution) plus state and local taxes (capped at $10,000) exceed $12,000 for single filers and $24,000 for married couples filing jointly.¹ For taxpayers who meet the criteria to itemize, the total net savings from making the rural hospital contribution can be as much as $3,000 annually². In the example below, the taxpayer has $250,000 of adjusted gross income which equates to a total net savings of $1,556.

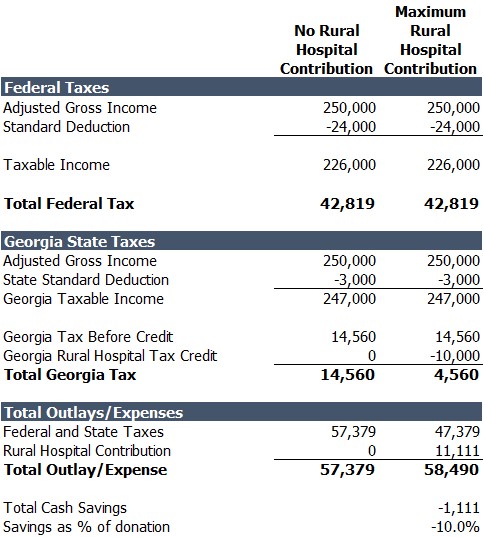

Alternatively, the following example shows how this credit works for someone who uses the standard deduction on the federal return.

There is now a net cost of $1,111 for this taxpayer – the value of the contribution ($11,111) minus the value of the state tax credit ($10,000). Notably, filers who would not itemize without the rural hospital contribution but would itemize with the contribution may get some benefit from the credit. The benefit math simply depends on the marginal tax rate and how close the itemized deductions are to the standard deduction before the rural hospital contribution is made.

Qualified Education Expense Tax Credit in 2018 and Beyond

Georgia’s Qualified Education Expense (QEE) Tax Credit has been far more popular than the Rural Hospital Tax Credit. Although both have existed for several years, much of the QEE tax credit’s popularity can be attributed to the marketing of private schools in Georgia. Private schools, as beneficiaries of the credit, have an obvious incentive to promote its use and generally have a loyal base of high income parents who benefitted from the AMT tax savings. As a result of this popularity and a statewide cap on the tax credit dollars, the dollar benefit of the QEE was less than 50% of its original benefit in 2016 and 2017. While popularity reduced the benefit, the credit still provided and will provide some benefit in the future.

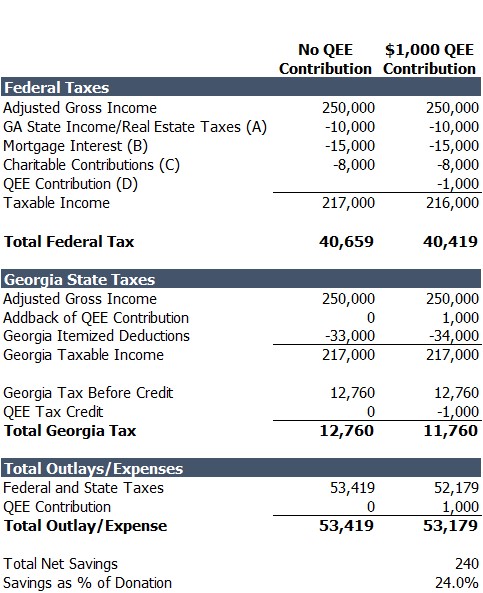

Starting in 2018, the same taxpayers who benefit from the Rural Hospital Tax Credit – those who itemize – will benefit from the QEE. The following example highlights this benefit for a married taxpayer with $250,000 of income who contributes $1,000 to a qualified educational institution. The calculated benefit of $240 in this example is the product of the taxpayer’s marginal tax rate of 24% and the $1,000 contribution amount. For taxpayers in the highest 37% tax bracket who itemize, the benefit in this example increases to $370.

An important benefit of the new tax law is that taxpayers who make the QEE contribution but then end up using the standard deduction will not incur any net cost (and will concurrently get no benefit). As explained in the opening paragraphs, there was a small penalty (net cost) in 2017 and prior years for taxpayers who made the QEE contribution but then ended up outside of AMT.

Closing Comments

Both the Rural Hospital Tax Credit and the Qualified Education Expense Tax Credit remain useful under the new federal tax law, albeit with the beneficiaries shifting now to include both high and low income taxpayers – not just those who pay AMT. We anticipate that similar tax credits will launch in Georgia and other states to circumvent the new SALT deduction limits – expanding the benefit of smart tax planning for those who take steps to exploit the credits.

¹These are not the only itemized deductions but will easily be the three most common itemized deductions under the Tax Cuts and Jobs Act (TCJA). Taxpayers will still be able to claim the medical expense itemized deduction but the 7.5% of adjusted gross income hurdle makes this less prevalent.

²The total benefit of the credit ends up equaling the marginal tax rate multiplied by the contribution amount minus 10% of the contribution amount (or simplified: (marginal tax rate – 10%) * contribution amount). For married filers in the highest 37% tax bracket, this equates to a $3,000 value.

Leave A Comment