IRA Rollover or Leave Assets in a 401k?

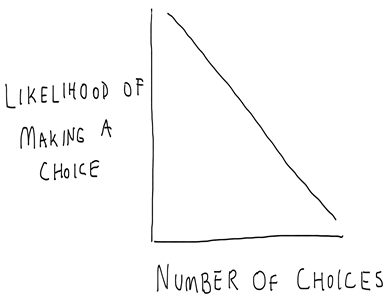

In a country founded on the idea of individual freedom, Americans value the idea of choice. We inherently believe that maximizing individual freedom increases our individual welfare or happiness and that the best way to maximize individual freedom is to maximize choice. A bar with 120 beers on tap is perceived better than a bar [...]