Simple and Effective Investing

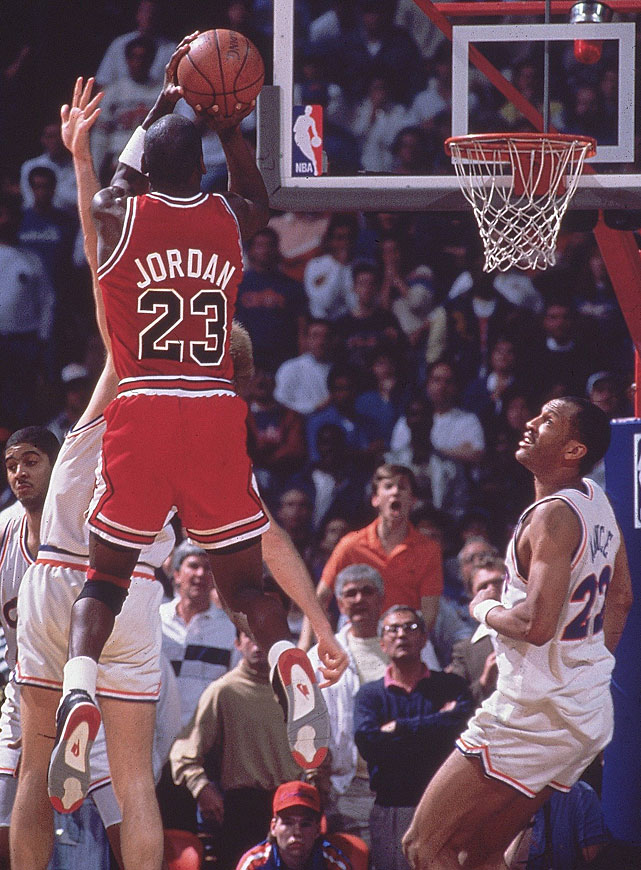

“It might be the simplest play in all of sports, and the most effective. Give the ball to Michael Jordan, and everyone else get out of the way.” These two sentences began an Associated Press article on May 28, 1989. The day prior, the Chicago Bulls had the ball in the closing seconds of a [...]