Let’s have an honest conversation about things that are rare.

1) A perfect game in baseball

In over 210,000 Major League Baseball games spanning 140 years, there have been just 23 perfect games.

According to the Old Farmer’s Almanac, there have been 10 full moon winter solstices and 8 full moon summer solstices since 1793.

3) Pescado Stubfoot Toads

None were seen in the wild after 1995 until one was rediscovered in 2010. And none have been seen since 2010.

4) Snowfall in Atlanta on Christmas Day

You can count these occurrences on two fingers (at least in recorded history). 1882 and 2010. That’s it.

Now, let’s talk about things that are not rare.

1) Stock market volatility like that experienced in 2018

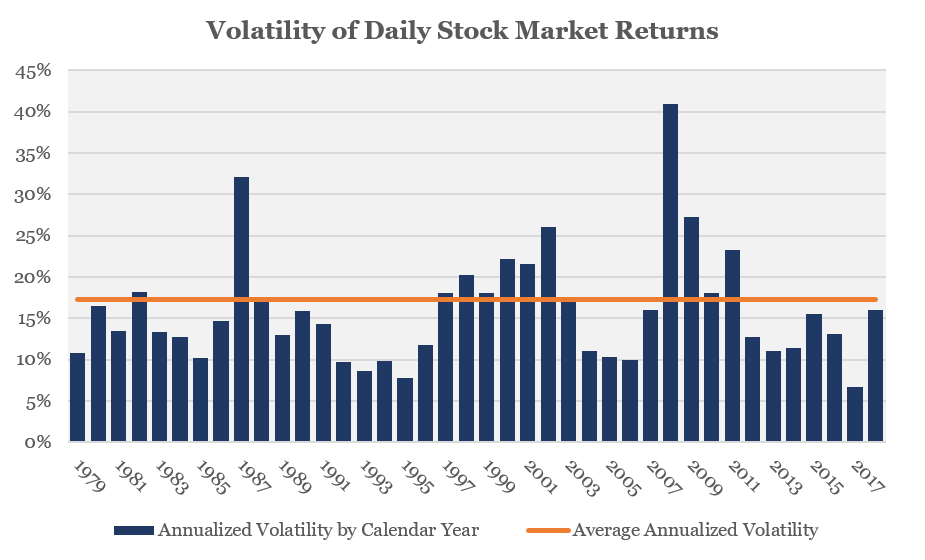

Through December 18th, the standard deviation of daily returns for the S&P 500 is 16.0%. That compares with an average daily volatility of 17.3% over the past 40 years. Which is to say that stock volatility in 2018 has been muted rather than extreme.

2) Stock market “corrections”

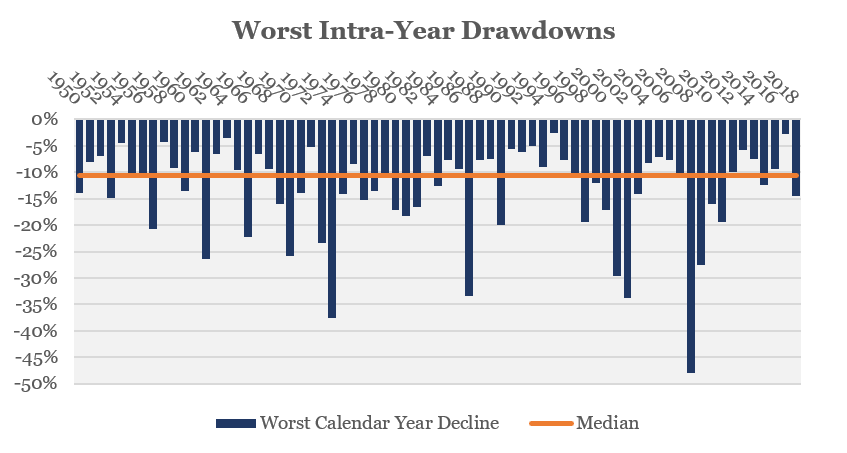

The unofficial definition of a stock market “correction” is a 10% decline from peak to trough. In 37 of the 69 calendar years since the beginning of 1950, the S&P 500 has experienced an intra-year correction. Which is to say that a calendar year is more likely to experience a 10% correction than to not experience one.

3) Stock market selloffs like the one experienced in 2018

From its September 20th, 2018 peak, the S&P 500 Index has declined 14.5% to its nadir on December 19th. This ranks the 2018 stock market selloff as the 24th worst calendar-year decline since 1950 and means that the 2018 stock market selloff doesn’t make the top third of worst market selloffs. Which is to say that a 14% peak-to-trough drawdown is not rare.

4) 12-month periods where stocks lose money

As of the December 19th close, the S&P 500 has lost 6.4% over the trailing 12 months (12/20/17 – 12/19/18). Dating back to 1950, the S&P 500 has lost money in 26.5% of all trailing 12 month periods. Which is to say that stocks losing money over any historic one year period is more common than a coin landing heads on back-to-back tosses.

Academics use the term “recency bias” to describe human’s inherent behavioral tendency to extrapolate recent experience as a baseline for what will happen in the future. As investors, our brains are conditioned to give more weight to what has happened recently than what it deserves. In the current investment context, this means that we are conditioned to use the last several years – a period of historically low volatility – as our guidepost for what we expect volatility to be.

The reality is that market volatility and losses this year are not rare. Losses and volatility are heightened in 2018 relative to the past several years but the anomaly is not 2018. The anomaly was 2017 where we experienced the lowest calendar year volatility since 1964 and the 2nd lowest ever. The anomaly was 2012-2017 where the S&P 500 Index experienced just 20 total days with losses of more than 2% amidst 1,509 total trading days.

2018 is what normal stock market volatility and drawdowns look like. Regrettably, this year has not been unique or unusual. But that does not mean that investors should abandon stocks. Just the opposite. It is this risk of stocks that provides a return premium over safer assets. If the stock market never experienced significant declines, the return premium we would expect to receive from stocks relative to holding the money in cash would be minuscule. The higher long-term return for stocks is what compensates investors for the heightened risk. It is, in the paraphrased words of Warren Buffett, the transfer of wealth from the impatient to the patient.

In fairness, none of this may not be comforting or reassuring. Just as you may not be comforted to know that there have only been 16 shark-attack fatalities in the continental United States over the past 29 years. Losses and volatility are, however, a reality of investing in stocks. What we say to that and do about that is explained right here. Successful investing is about being attuned to these risks and having self-awareness. In short, the most successful investors are those who establish an all-weather, diversified investment allocation that is in line with their risk appetite and then maintain that disciplined allocation through good periods and bad ones.

What are your thoughts on market volatility? Have comments or questions? We invite you to leave any comments, questions, or ideas in the comments section below.

Leave A Comment