Investing in the stock market probably does not feel boring in December 2018. Scary, volatile, unsettling, and capricious are terms that might be used to describe investing over the past few weeks. But not boring.

Yet successful investing is boring. Beautifully boring. Famous hedge fund investor George Soros summed it up well: “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.” Which is to say one should make regular contributions to broadly diversified, low-cost funds, stick to a targeted asset allocation, rebalance at some regular frequency, and be boring.

In the investing world, most financial incentives run counter to this ‘simpler is better’ mentality. Stock brokers have an incentive to transact and provide reasons to buy this or sell that rather than stay the course. Financial pundits have an incentive to make bold short-term market calls because no one follows up to hold them accountable for bad calls and no one tunes in to hear about long-term discipline and rebalancing. Investment websites have an incentive to constantly create action-oriented recommendations that generate clicks, traffic, and transaction. Commercials such as this one and this one promote the idea that truck drivers, soccer moms, and busy executives can identify great stocks, buy them, and get rich. The whole financial world subliminally screams at us that transactions are exciting and that we need to do something. Entertainment. That’s what it is all about. Who cares if this promotion is only motivated by profits for the broker, online trading platform, or business media?

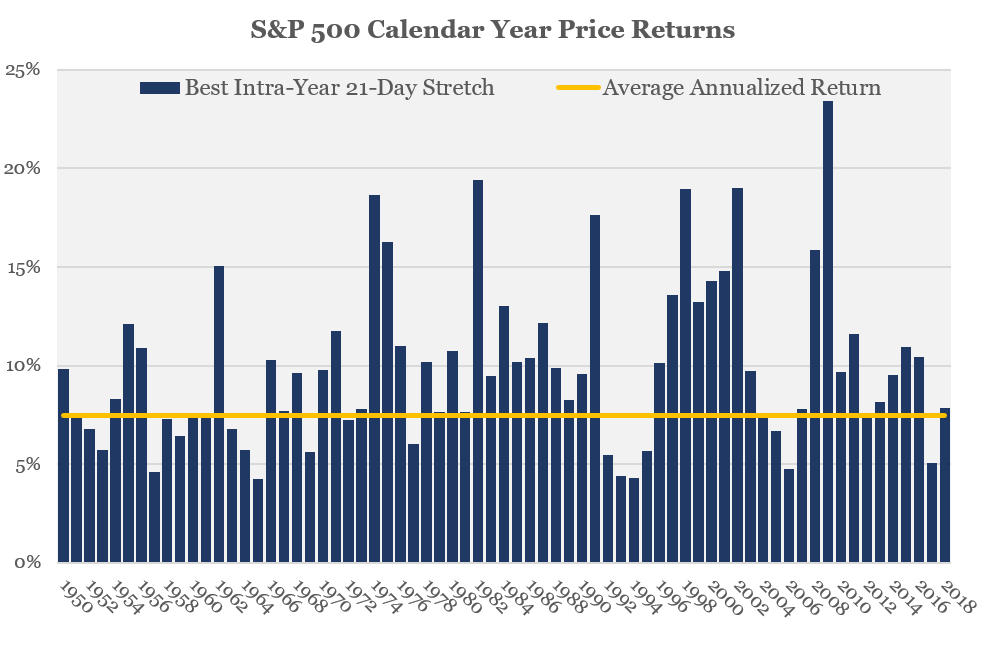

The reality is that the stock market is often a boring place to be. And that is not a bad thing. Consider the S&P 500, which tends to have between 247-254 trading days each calendar year – or 21 days per month, on average. In over half (37 of 69) of the calendar years since 1950, the S&P 500 had more than 3/4 of its return for the year come during a continuous stretch of 21 days. In more than 70% of calendar years, the S&P experienced more than half of its return during a 21-day stretch within the year. This is to say that the S&P 500 gets most of its gains in most years within the span of a month. Conversely, the other 11/12 of the year are, on average, disappointing. Or boring.

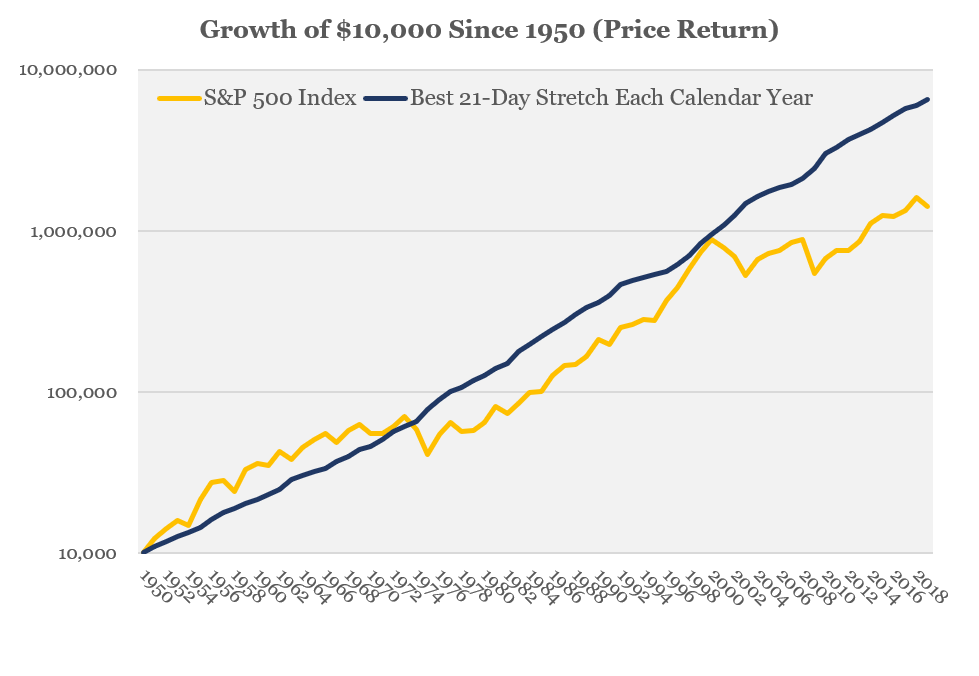

The S&P 500 Index has provided an annualized (price) return of 7.4% per year since 1950. A trader who managed to only invest in the best one month stretch each year and sit out the other 11/12 of the year would have achieved a return of 9.8% over the period since 1950. An initial investment of $10,000 becomes $6.5 million versus $1.4 million for a buy and hold investment.

Some will draw the conclusion that this data supports market timing. Forecast, in advance, that most prosperous 21-day stretch during the year, invest, and then sit out the other 11/12 of the year. Good luck.

Another conclusion is the boring one – that the gains from investing in the stock market are not consistent; that the stock market is often an unexciting place to be; and that you may spend 11/12 of the year disappointed with the results. So if you spend your days following the stock market and you do not find yourself disappointed or underwhelmed the majority of the time, perhaps you are doing it wrong.

Leave A Comment