The following paraphrases a conversation that I have had many times before with friends and clients. It is obviously never the same dialogue but the underlying advice is the same – that you should generally not own your favorite investment or can’t-miss stock idea in a traditional IRA.

Me: Did you buy this stock because you expect it to go up or down in value?

Friend: What kind of question is that?

Me: Go ahead and answer. It is a not-so-subtle way of making a point. Up or down?

Friend: Up. Why else would I own the stock?

Me: Fair enough. Is it also fair to assume that you expect the stock to appreciate more than the stock market or your other investments?

Friend: Yes, absolutely.

Me: And how long do you plan to own it?

Friend: Several years. It is a great company with a ton of upside potential. You should buy it, too.

Me: I’ll pass but this sounds like an investment that you think could reasonably double in value over the next few years?

Friend: Without a doubt. It could easily double or triple in value in the first year.

Me: Great. And you chose to buy it in your tax-deferred IRA, correct?

Friend: Yes.

Me: But you could have purchased it in your regular brokerage account, right?

Friend: Yes. What are you getting at here?

Me: I’m hoping to make the case that if you’re convinced that this stock is going up in value, you should immediately sell the 10,000 shares of stock that you own in your IRA and concurrently buy 10,000 shares in your brokerage account.

Friend: Why?

Me: Because you expect the stock to appreciate – that’s why. Recognize, fundamentally, that your IRA is a partnership between you and the US Treasury. You and the Treasury share in your profits and you share in your losses. Whatever your ordinary income tax rate is – that is the Treasury’s partnership share. Assume that your ordinary income tax rate is 30% at the time when you eventually distribute assets from your IRA. If you earn $1,000 in your IRA, you get to keep $700 of that gain while the IRS diverts the other $300 to the US Treasury.

Friend: Yes, I understand but the Treasury also gets to keep a share of the gains you make in a brokerage account.

Me: True, but their partnership share is lower. Your tax rate for long-term capital gains in your taxable brokerage account is only 15% so they own a smaller percentage of that partnership. And if you believe these shares are going to dramatically appreciate, you probably don’t want to own them in a partnership where the other partner gets to keep a large percentage of the gain.

Friend: OK, but I don’t have to pay that tax now so there’s some advantage to deferring the tax.

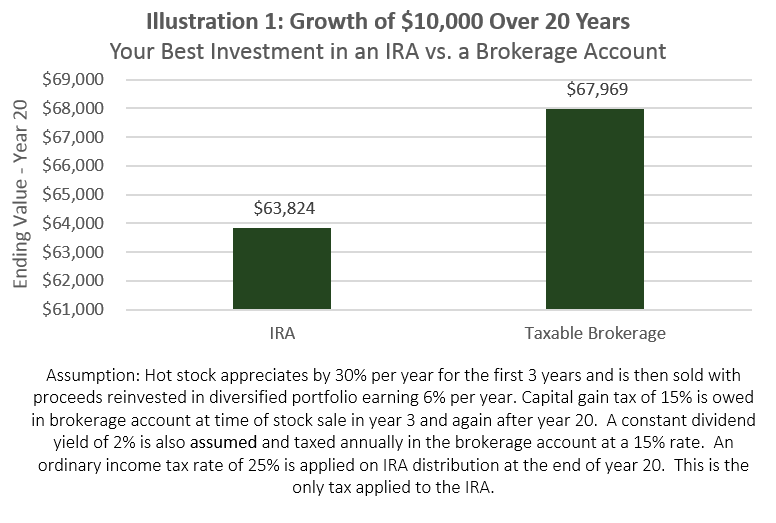

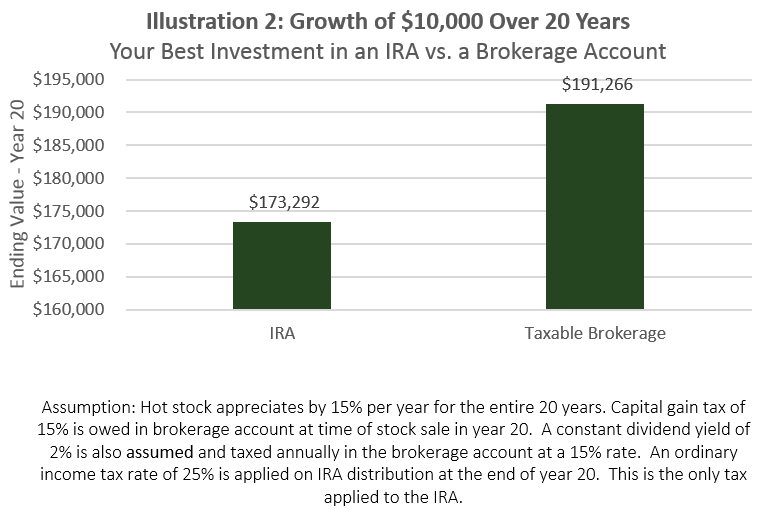

Me: Absolutely. It may be a long time before you distribute funds from your IRA and get taxed on this growth. There is a significant economic advantage to this tax deferral. But there is no avoiding the tax. And if you continue to be financially successful, you will likely be subject to a higher tax rate when the money eventually comes out of your IRA than you will if you just sell the stock in a traditional brokerage account. You see, the long-term capital gain tax you face if you own the shares in a regular brokerage is assessed at very favorable rates. While the tax deferral is clearly advantageous, it gets economically overcome by the difference in tax rates – the higher rate you will likely pay on future IRA distributions versus the lower long-term capital gain tax rate you will pay in a few years when you choose to eventually sell the shares.

And if you want me to keep convincing you to sell the shares in your IRA and buy them in your brokerage account, there are even more reasons I can lay out to help this case.

Friend: Such as?

Me: For starters, I know you’re charitable. If the stock appreciates like you think it will, you can gift appreciated shares to some of your favorite charities in lieu of your regular cash gifting and entirely avoid any capital gains tax. That is, you can effectively take your tax rate on any gain to zero in the brokerage account.

Or you can gift shares to your kids in the future and let them sell the stock at an effective tax rate of 0% – 5% to pay for the college costs that you would otherwise plan to cover. And if you are at all concerned that tax rates may go up in the coming decades – not necessarily for you but for all of us – then that makes the financial argument even stronger to avoid deferring what would have otherwise been a favorable long-term capital gain tax rate.

The best case for continuing to hold these shares in your IRA would be if you expected the stock to fall in value. Remember again that this is a partnership between you and the Treasury. If you lose money in your IRA, the Treasury shares in that loss.

Friend: OK, I think I understand everything but aren’t there some tax rules that prevent me from selling the shares in one account and immediately buying them in another?

Me: You may be thinking about the “wash sale” rule. But that does not apply here. Moreover, you won’t pay any tax if you sell the shares in your IRA. There is nothing to keep you from entering two orders – one to sell the shares in your IRA and one to buy the shares in your brokerage account. And you should.

Closing Thoughts

Let’s first be clear on one thing that was completely ignored in the dialogue above: hot stock tips from your neighbor, your brother-in-law, your college roommate, your coworker, your golfing buddy, your barber, and your stock broker are all likely to all be bad investments. Based on history, there is a roughly 64% chance that any stock will underperform a diversified index. But hot stock tips are not usually just any boring stock. They’re “hot” which makes them sexy, glamorous, and exciting. So, your chances of losing to a diversified index are empirically well in excess of 64%. The more exciting and can’t miss your stock pick is, the more you should expect to trail your diversified friends.

With that being said, if you own a stock or an investment that you are convinced will materially appreciate in value, it’s best not to own it in a tax-deferred IRA for the reasons explained above¹. If you currently own such an investment in your IRA, now is a better time than any to sell it in your IRA and buy the same position in your brokerage account.

¹Admittedly, it might make sense to own a stock in a tax-deferred account if a) you intend to day-trade the stock; b) you intend to own it for less than a year; c) the stock is highly tax-inefficient compared with other stock investments; or d) you do not have anywhere else to buy the fund.

What about a Roth IRA?

Hi Melinda, sorry for the delayed response but a Roth IRA would usually be the best place to purchase an asset/stock with a high expected return. The very different tax treatment of the Traditional IRA makes it the worst place for such investments whereas the Roth is usually the best location.