At this time of year, there is no shortage of holiday music on the radio, consumer electronic advertisements on television, and year-end tax planning suggestions in print media. Rather than add one more article about the ten tax steps you should consider at year-end, we thought it would instead be beneficial to review the framework we use when considering the tax consequences of year-end investment sales (or at any point in the year, for that matter). This may not pique the same interest as the RPG team singing Jingle Bells but we expect it will be less painful for both you and us.

Realizing Gains for Tax Purposes

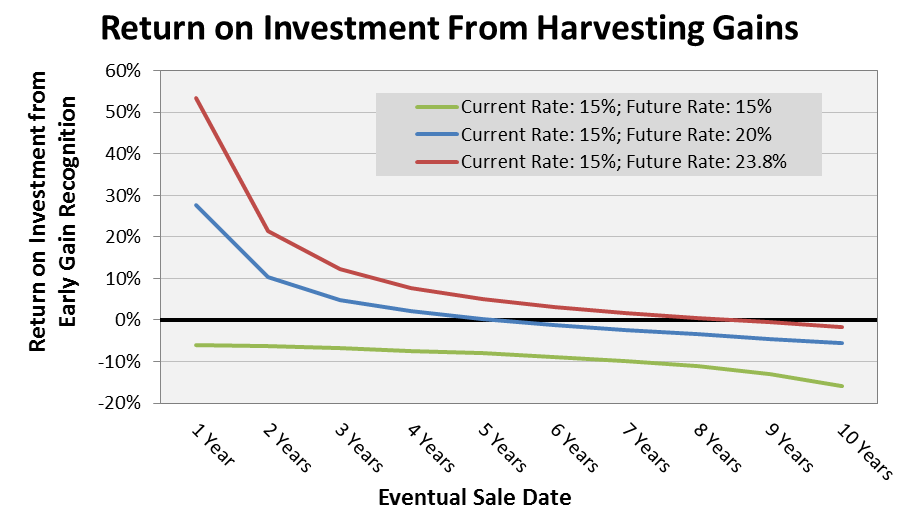

The concept here is that one might sell a position, recognize the gain, and repurchase the same position. Assuming that future and present capital gain tax rates are held constant, this action would never be an economically beneficial endeavor as it merely accelerates the payment of taxes (evidenced by the green line in the chart below).

However, there can be a tax justification for realizing capital gains early if tax rates are expected to differ across calendar years. For example, if you are subject to a 15% capital gains rate in 2013 but expect to be subject to a 23.8% tax rate in all future years, recognizing the gain in 2013 only to immediately buy back the same position can be useful (red line in chart below). The only other relevant variable in this example is the eventual holding period and unless it is more than eight years, recognizing gains early is advantageous under this scenario.

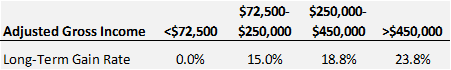

This form of tax-rate arbitrage was more common in 2012 as the then impending tax increases and Medicare surtax put many high income earners in a situation where gains could be recognized in 2012 at a lower rate than in future years. However, this opportunity still exists for investors where income fluctuates from year to year and they are well served to consider gain harvesting in low tax years. The table below summarizes the various adjusted gross income (AGI) thresholds that should be considered for long-term capital gain recognition purposes.

We should mention that we occasionally read year-end tax advice suggesting that investors realize capital gains prematurely to offset existing capital loss carry-forwards. We believe there is no useful tax benefit to this activity. Capital loss carry-forwards are a valuable resource that should be maintained unless there is a non-tax justification for selling.

Realizing Gains for Reallocation Purposes

A more common justification for realizing gains is to sell a position for economic or reallocation reasons. It could be that the investment to be sold is deemed expensive, the investment may have become too large an allocation, the underlying mutual fund manager retired, or any number of additional reasons. In all of these cases, the investor has a better use of capital.

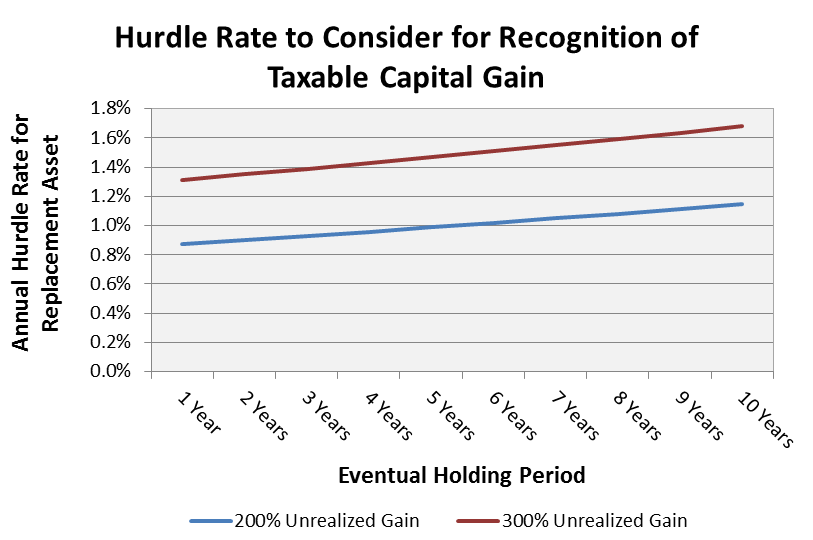

Anytime that such a capital allocation decision is made, one is well-served to consider the known costs versus the expected benefits. In the case of selling an appreciated asset where the recognition of gain results in a tax, the immediate cost is the tax that has to be paid. But the payment of this tax reduces the value of what can be reinvested and resulting provides a hurdle for the replacement investment. An example may be useful.

Assume an investor holds XYZ asset with a value of $60,000, a cost basis of $20,000 and the position has been owned for more than a year. Also assume that the investor deems asset ABC to be a better investment for the next five years. Option one is to sell XYZ in 2013, pay the resulting tax, and reinvest the proceeds, which would be $60,000 minus the tax cost (and any transaction costs), in ABC. Option two, the control, is to hold XYZ for the next five years and sell in 2018.

If XYZ achieves an annualized return of 7% over the five year period between 2014 and 2018 and the capital gain tax rate (federal plus state) is a constant 25% during that stretch, investment ABC has to achieve an annualized return of 7.99% just for option one (selling XYZ, buying ABC) to break even with option two (holding XYZ). This 0.99% annual return difference is not an insignificant cost that can be ignored. Investment managers who outperform a benchmark by 0.99% annually over a five-year stretch are considered heroes. This hurdle rate is even larger if the time period is extended or the realized gain is larger. The chart below uses this example and compares the cost of option one based on different gains and holding periods.

Realizing Losses

With a few exceptions, investors would be well-advised to realize capital losses in taxable accounts at every possible opportunity were it not for the wash-sale rule. This rule prevents an investor from recognizing a loss for tax purposes and immediately buying the same position so that there is no real economic transaction. Specifically, the rule disallows the tax loss for current income tax purposes in a case where an investor sells a position for a loss and purchases the same security or a “substantially identical” security within 30 calendar days (before or after) from the sale date.

Provided that an alternative investment is available, one that is not substantially identical, realizing losses is generally a good idea. These losses can be used to offset current year gains, future gains, or even ordinary income of up to $3,000 per year. The question then is when does it not make sense to realize losses and reinvest the proceeds in a similar, but not substantially identical asset?

1) Transaction costs will offset most of the tax benefit. If the combined cost of selling the asset at a loss and then repurchasing a replacement asset are significant, this threatens the economic benefit of loss harvesting. As the calculation is just a time value of money calculation, loss harvesting is more attractive when the loss is large and transaction costs are low.

2) The replacement investment is less desirable. This could be true for a number of reasons. Simply, the asset with the loss may be considered attractive and there is no good alternative. If the scenario amounts to selling one index fund to purchase a very similar, but not identical index fund, the hurdle rate for realizing the loss is far lower and loss harvesting is more attractive.

3) Future tax rates are expected to be higher. Consider the situation where any realized losses in 2013 would go to offset long-term gains taxed at 15% but if harvested the following year, would offset known short-term gains taxed at 35%. In this situation, it clearly makes sense to wait until 2014 to realize losses. This situation can also arise for investors who qualify for the 0% capital gains tax due to a low income year. Realizing losses to offset gains taxed at 0% in the current year should generally be avoided.

Closing Comments

The analysis we consider for loss harvesting or gain harvesting is simply a time value of money calculation. Some items like transaction costs and current year tax impact are generally known in advance whereas other items like the ultimate holding period, future tax rates, and future rate of return are unknown. Rather than blindly harvest gains or losses, it makes sense to develop useful assumptions for the unknown variables and then analytically estimate the hurdle rate or opportunity cost for the transaction. Once the hurdle rate is established, an informed decision can be made on whether to harvest gains or losses.

Leave A Comment