You would never drive your car with your sight glued to the rear view mirror. You would likely wreck or find yourself lost. Yet many investors are guilty of that very thing. They select stocks, mutual funds and other investments based on past performance, despite the ever-present admonition in financial literature that “past performance is not indicative of future results”.

So, what should you, as a disciplined investor focus on? The future is uncertain, right? And in the inimitable words of Yogi Berra, “It’s tough to make predictions, especially about the future.” Well it depends. Interestingly, it is easier, when it comes to investments, to predict the longer term than it is to predict the short term.

Investors, whether amateur or professional, tend to suffer from a form of myopia (nearsightedness). Professionals are typically more concerned about keeping their jobs than obtaining the best long-term results for their clients. If short term results deviate too much from what their clients expect, they know that their job is at risk. Individuals are often so caught up in current events such as earnings releases, GDP growth, elections, and such, that they lose sight of the forest for the trees.

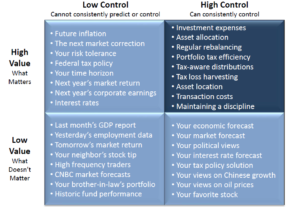

In our practice, we use the following grid to help us focus on the important things that we have some control over at the portfolio level:

In implementing a portfolio, and making specific investment allocation decisions, what should an investor focus on? Three things:

- Price – The more you pay for something, the less likely it is that you will turn a profit.

- Reversion to the Mean – Time is like a huge rubber band. When things get too far out of balance, whether in science, investing or anything else, they tend to revert to a more reasonable mean.

- Inflation – when you purchase an investment you are really purchasing a future stream of cash flow, so inflation matters.

Fortunately, there exists an elegantly simple tool that incorporates all three of these elements, and it can be used to inform us about our most important of investment decisions. The cyclically adjusted price earning ratio (CAPE), developed by Nobel Prize winner Robert Shiller, will be discussed in a future blog.

Leave A Comment