Note: An updated version of this article was posted in May 2018 to reflect the new tax law under the Tax Cuts and Jobs Act. It can be found here: https://rpgplanner.com/college-tax-planning-strategies/

Most questions in life that begin “Can I…” ideally ought to be prefaced with the question of “Should I…” The distinction is important. “Can I” implies that the item in question is a good idea in the first place. Often, it is not.

When it comes to taxes, many people want to know if they can claim various deductions or credits without stopping to ask if they should. According to Google data, the phrase “Can I claim my child as a dependent” receives roughly 6.5x more searches than “Should I claim my child as a dependent”. Other “can I” derivatives of this phrase, which are far more popular searches than their “should I” counterparts, include:

- Can I claim my child as a dependent if he/she is in college?

- Can I claim my child as a dependent if he/she has a part time job?

- Can I claim my child as a dependent if he/she doesn’t live with me?

- Can I claim my child as a dependent if he/she is in graduate school?

When Claiming a Child as a Dependent May Not Be Useful

The requirements for claiming children as dependents are fairly simple until they go off to college. At that point, dependent rules start to become more complex, especially when the student has a job and pays for a portion of support. It is important for families to understand whether a college-age child qualifies as a dependent since this impacts eligibility for tax exemptions, credits, and deductions. However, the more fundamental question that rarely gets asked is “should I claim my child as a dependent?”

Taxpayers are historically trained that additional real estate taxes, state income taxes, tax preparation fees, investment fees, or number of dependents will reduce taxable income and resultantly reduce federal income taxes. The reality is that many financially successful families – those with annual earnings between $200,000 and $500,000 – are likely to fall into the trap of alternative minimum tax (AMT) and resultantly obtain no benefit from these traditional federal tax savings. This income range of the AMT trap widens for families in high income tax states (e.g. New York, California, North Carolina, and South Carolina), families with high value real estate, families with large miscellaneous itemized deductions, and families with several children. Moreover, families with even higher income (>$500k) also tend not to benefit from many of these traditional tax breaks because of recently renewed limitations (Pease limitations and Personal Exemption Phase-Outs which were renewed in 2013).

Example – The Reality of High Income and Missed Tax Breaks

Consider a family of four with adjusted gross income of $225,000. Assume that this family has $5,000 of charitable deductions, a $15,000 mortgage interest deduction, $5,000 real estate taxes, and $20,000 state income taxes. This results in a federal tax liability of $35,107. What happens to the tax liability if this same family adds a child during the year and becomes a family of five rather than four? It remains $35,107. In fact, this family pays the same federal tax whether they report 1, 2, 3, or more dependents because of the alternative minimum tax.

This example can be instructive for families with children in college or graduate school. Consider now that this same family of five has a child in college. They’re gaining no federal tax benefit from claiming this fifth child as a dependent because of the alternative minimum tax. What about other tax breaks for college costs?

- Tuition and Fees Deduction – This front page deduction can reduce income subject to taxes by up to $4,000 but is not available to a married couple (filing jointly) with more than $160,000 of modified adjusted gross income.

- American Opportunity Tax Credit (formerly the Hope Credit) – This credit can reduce taxes by $2,500 but is entirely phased out for families with modified adjusted gross income over $180,000.

- Lifetime Learning Credit – This education expense credit can reduce taxes by $2,000 but is not available for families with over $120,000 of modified adjusted gross income.

A family with modified adjusted gross income above $180,000 does not qualify for any education-expense credits or deductions. Additionally, we know from the AMT-example above that the same family does not benefit from claiming additional dependents at the federal level

[i]. With this in mind, it is worth evaluating the option to ignore the child as a dependent on mom and dad’s tax return and instead let him file on his own[ii].

If the student is working or has investment income and is paying education expenses, he can claim the Lifetime Learning Credit or the American Opportunity Tax Credit on his own return that his parents are ineligible to claim because of high income. These credits offset income meaning the student can earn $20,000 or more and generally eliminate any tax liability. While it may be uncommon for a college student to earn income this high, it is more common for a graduate student with outside work or paid internship. There is also the underutilized possibility of creating income for a college student when zero or limited earned income exists.

Tax Planning Opportunity for Parents with College or Graduate Students

Up to this point, we have assumed in this example that the student cannot claim the dependency exemption on his own. With a few exceptions, IRS rules state that a full-time student under age 24 can only claim the dependency exemption on his own if he is providing more than 50% of financial support (food, shelter, clothing, education, medical, etc.). In a situation where parents earn too much to claim the education credits or the dependency exemption, what happens if they make a gift of appreciated assets to the student which are then sold and proceeds used for support?

Consider that this college student has annual support needs of $50,000 to cover tuition, living expenses, etc. and the parents jointly gift $28,000 of appreciated securities (the gift of $28k falls within the annual gift tax exemption so no gift tax is due). If the student then sells the assets to cover some expenses while mom and dad supplement the remaining $22k of needs, he now meets the requirement to cover at least 50% of financial support which means he can claim the dependency exemption. It gets better.

Those with good knowledge of the tax code are aware of the “kiddie tax” which applies to this hypothetical example. The kiddie tax impacts this student because we assume he is in college (not graduate school), under age 24, and he does not provide more than 50% of financial support from earned income (wages from a job). Resultantly, the tax due from the sale of appreciated securities (minus a small exemption) is subject to the parent’s tax rate. However, the student’s ability to claim the personal exemption and education tax credit, which the parents could not claim, ends up eliminating any kiddie tax as demonstrated below.

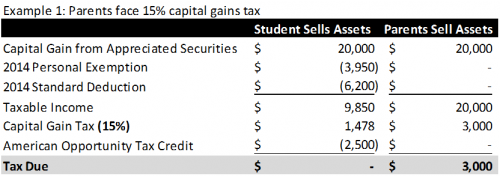

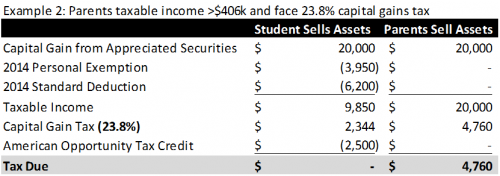

We use two examples above to demonstrate the possible tax savings from this strategy for different levels of parental income. The first example depicts a family with enough income to disqualify them from education credits and additional dependency exemptions. In this case, the total one-year tax savings is $3,000 as the student makes use of the credits, deductions, and exemptions which were not available to the parents. The second example depicts a family with more than $406k of taxable income which subjects them to a higher 23.8% capital gain tax rate in addition to the lost credits and exemptions. In this case, the tax savings in just this one year is $4,760.

For high income families that plan properly, the annual tax savings from shifting income like this can be in excess of $5k per year, per child. Over the course of college and graduate school, families with multiple children can save $60,000 – $100,000 in taxes simply by smart tax planning.

Closing Comments

In a new reality of alternative minimum tax, personal exemption phase-outs, and (Pease) limitations on itemized deductions, the tax code is far from simple. Complexity of the tax code has its drawbacks but importantly presents significant college tax planning opportunities. Rather than simply completing tax forms and checking boxes, it often makes sense to consider all the possibilities and take advantage of the complex laws. The above scenarios present just a few of the graduate school and college tax planning opportunities available to families by going beyond simple tax preparation and thinking outside the box.

What are your thoughts? Have you utilized or prepared to utilize some of the strategies described above? Please do not hesitate to comment with your suggestions or questions.

[i] There is a benefit to claim additional dependents at the state level but the benefit is relatively small. In Georgia, an additional dependent saves $180 in taxes for most families. In states with no state income tax such as Florida, there is no state tax savings.

[ii] Prior to 2014, not claiming a child as a dependent could make the child ineligible to remain on the parent’s health insurance plan. The Affordable Care Act (ACA) ended this concern. Per the ACA, children under age 26 can remain on a parent’s plan regardless of whether they are attending school, financial dependents of their parents, or married.

Leave A Comment