It is estimated that nearly 26 million Americans will be eligible for some form of health insurance subsidy starting in 2014 under the Affordable Care Act. For individuals and families with incomes well in excess of 4x the federal poverty line, these subsidies will be a non-event. However, there are several situations where the subsidies may create significant planning opportunities including pre-65 retirees without significant pension income and children who are no longer purchasing health insurance through their parents.

Media coverage of the subsidies has admittedly been confusing and, in many cases, inaccurate. The reality is that there are actually two distinct and independent subsidies provided by the Affordable Care Act: the Premium Tax Credit and the Cost-Sharing Reduction. These subsidies are briefly described below with links to provide a more detailed explanation of the calculation and the mechanism for obtaining them.

Premium Tax Credit. This tax credit is available to anyone purchasing insurance through the state exchanges (www.healthcare.gov) with income between 100-400% of the federal poverty level. This means, for example, that a family of four with income between $23,550 and $94,200 will be eligible for the credit. The tax credit subsidizes the monthly insurance premium and is paid directly to the health care exchange, unlike traditional tax credits which are received by the taxpayer. In turn, this federal payment to the exchange reduces the insurance premium for which the insured is required to pay.

Cost-Sharing Reduction. This subsidy is available to anyone who purchases silver-level insurance through the state exchanges and has income up to 250% of the federal poverty level. Unlike the Premium Tax Credit which reduces the insurance cost, this subsidy will automatically reduce the deductibles, copayments, and coinsurance expenses for which the insured is responsible. The dollar benefit of this subsidy is impossible to project in individual situations because the benefit depends on how much medical care is utilized during the year.

Income Planning for the Subsidies

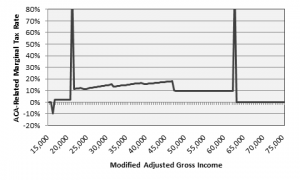

For those who potentially qualify for subsidies, the impact can be dramatic and the benefit of effective tax planning can be thousands of dollars. For health insurance consumers with income below 400% of the Federal Poverty Line, each additional dollar of income results in a smaller subsidy. The subsidies, however, do not decline at a constant percentage and effectively serve like a new marginal tax for planning purposes. The chart below uses the example of a 60-year old married couple in Georgia to demonstrate the marginal tax rates resulting from the Premium Tax Credit subsidy.

There are several conclusions that can be drawn from this chart but the biggest take-away is what happens when income for any family or individual goes above 400% of the federal poverty level. In this 2-person family example where 400% of the federal poverty line is $62,040, the couple would receive a $6,873 subsidy with $62,040 of income. However, an additional $1 of income ($62,041) would result in the subsidy being entirely phased out and, effectively, a marginal tax of $6,873 on that extra dollar of income. There may be no “tax” in our current system that is so dramatic for an additional dollar of income.

Closing Comments

The bottom line from this is that families with income at or near 4x the Federal Poverty Line will be well served to carefully plan their income. Families in this situation will need to consider actions such as deferring pensions, utilizing above the line deductions, deferring Social Security, or deliberately lumping income into a single year to best exploit the unusual nature of the health insurance subsidies.

Leave A Comment