Since the advent of the Great Financial Crisis in 2008, catalyzed by successive rounds of quantitative easing and ever more stimulative monetary policy from the Federal Reserve, we have found ourselves in an environment of extremely low interest rates. In this environment, fixed-income investors and savers seeking stable income streams have been punished, receiving ever lower returns in exchange for taking the same, if not more risk. For people seeking a secure income (especially in retirement), these scant returns present challenges that could require making difficult decisions in order to maintain a desired standard of living. Gone are the days of 10-year U.S. Treasuries with 4.5%+ coupons. Today those same risk-free bonds pay just 1.6%. Put another way, if you tie up $1,000 for 10 years you can expect to receive just $16 per year in exchange. And that is before factoring in the prospect of inflation, which further erodes purchasing power (a dollar doesn’t go nearly as far today as it did a few years ago). While the decline in rates has been a boon for spenders who use debt to finance large purchases like houses and cars, the owners of the debt for whom the interest payments represent an income stream, the opposite is painfully true.

To be sure, during this period of declining interest rates, the stock market has been incredibly strong, rising sharply from the depths of the Great Recession. While certainly a welcome development for those willing and able to assume more risk that comes with owning equities, there have been several painful corrections and setbacks along the way, the timing of which could wreak havoc on an investment portfolio. You have probably heard the phrase that “past performance is no guarantee of future results.” As such, we should not be quick to assume that the incredible market performance of recent memory will continue unabated. Even so, having significant capital allocated to riskier assets like stocks may not align with an investor’s risk profile. This is especially true as we age, our investment horizon shortens, and our risk tolerance decreases, as we are less able to absorb the impact of market corrections and financial setbacks. With that in mind, what options do investors have in this low-rate environment?

- Invest more aggressively

Just take more risk and hope to earn higher returns. Problem solved! This is a strategy that many investors may attempt in order to compensate for sub-par returns. With stocks continuing their rapid ascent and safer bonds providing mediocre returns, many investors feel compelled to increase their exposure to higher-risk assets like junk-bonds, preferred stocks, REITs, longer-duration bonds or even employing leverage to squeeze more juice out of their investments to meet their projected cash needs. While this strategy may work when times are good and risks are ignored, when the unpredictable yet inevitable correction occurs this strategy can also have severe consequences. Recent history provides several examples like the Dot-Com bust, the housing crash, Great Financial Crisis and the recent Covid Crash of 2020 when fortunes were wiped in short order. The timing of these episodes is nearly impossible to predict though they serve as stark reminders that the risk pendulum swings in both directions. An investor who has assumed too much risk and is in need of capital could find himself forced to sell at distressed prices, resulting in a permanent portfolio impairment, jeopardizing his financial objectives. Thus, while taking more risk is a strategy that could work for some, it is, as its name suggests, riskier and thus not prudent if one’s goal is financial security and the desire to sleep at night.

- Get out of the market and wait for more favorable conditions

This strategy translates to selling all of one’s investment holdings, putting all of his cash in a mattress and waiting until conditions look more favorable. This may be one of the most financially destructive choices an investor can make as cash earns next to nothing and will lose purchasing power when not used to produce a return. There is a famous saying by Warren Buffett that “The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.” On the one hand, this is sage advice from the Oracle of Omaha as it instructs investors to be patient and not to chase investment ideas that may be “out of their strike zone.” However, this should not be taken to mean a person should not invest and stay out of the market until they get a “fat pitch.” In fact, Buffett himself is a major proponent of passively investing in low-cost index funds precisely to avoid having to wait for a perfect pitch while still being able to participate in the market’s long-term growth.

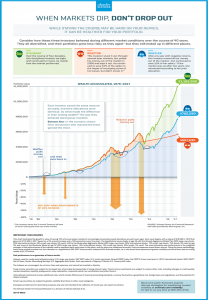

It is futile, if not impossible to successfully and repeatably “time the market.” While an investor may successfully evade one market setback it is also difficult to then re-enter with good timing, missing the bad and capturing the good. Show me an investor who claims to have consistently missed market setbacks while capturing the market’s long-term advances and I’ll show you a liar. Studies show that investors who have stayed invested (in an appropriate investment portfolio) with a long-term focus have performed better than those who managed to avoid some of the market’s darkest days. While we would all love to avoid the market’s worst days, it is often the case that the market’s best days are clustered nearby these uncomfortable downdrafts. Trying to day-trade one’s way to success around bouts of market volatility, being “all-in” or “all-out” at any given moment is not investing, it is just gambling on one’s intuition. Further, as the following infographic from Schwab shows, long-term investors who have stayed the course with their investment portfolio, holding through both bull and bear markets, have actually produced greater (and more tax efficient) returns than those who have tried to avoid the setbacks. An investor’s worst enemy is usually himself and his emotional response to the loss aversion he feels when markets turn for the worse. When Markets Dip, Don’t Drop Out (schwab.com).

- Do nothing and hope things work out.

Hope is neither a plan nor a strategy. We wouldn’t recommend this course of action any more than we would recommend driving a car without a steering wheel and hoping to avoid an accident!

- Start with a well-conceived plan, don’t panic and adjust accordingly.

The wisest and most prudent course of action in any environment may ironically be the most difficult pill to swallow because it requires making adjustments to plans and habits as opposed to rearranging investments in an effort to have one’s cake and eat it too. This strategy means incorporating lower return assumptions into a financial plan and adjusting those variables that are actually controllable. For example lowering spending, increasing savings, and/or extending one’s targeted retirement date. Further, by regularly monitoring a plan we can catch minor deviations before they become significant headwinds and make minor tweaks as needed to preserve the integrity of the plan, avoiding the need for larger and more painful adjustments down the road. While some of these changes may be undesirable, the strategy is generally more prudent and provides a higher probability of success than the other aforementioned strategies.

At RPG, we advocate and make use of this fourth option which we call Planning Right. While no one who is preparing for retirement prefers an environment of lower investment returns, neither should one assume that the above-average market returns seen in recent memory will continue in perpetuity. In fact, future returns may be significantly lower. While this is not a reason to avoid investing, it is a very good reason to make sure investment assumptions are reasonably conservative.

When we construct a financial plan for the clients who trust in our expertise and judgement, we strive to incorporate realistic return expectations, increasing the chances of successfully achieving our clients’ objectives. If and when changes are necessary to ensure success, we won’t simply expose clients to greater risk or change our assumptions to make the plan look more achievable. We identify the variables that can be controlled and then discuss how we can make adjustments that are both practical and palatable, increasing the chances that our clients will achieve their financial objectives safely and without taking undue risk.

Interested in learning more about how we help clients Plan Right and Invest with Confidence? Click Here to schedule a call with one of our advisors who will share how we do things differently.

Warm regards,

Resource Planning Group

Leave A Comment