President Obama unveiled the Fiscal Year 2017 Budget last Tuesday (February 9th) which included several unexpected first-time proposals in addition to many crackdowns and “loophole closures” that have become annually recurring proposals. Experts contend there is little likelihood of any substantial tax change in the final year of the President’s term. However, we could see some of the smaller line items with bipartisan support wind up in near-term legislation that require revenue offsets to cover the legislation’s costs.

With this in mind, we address three loophole closures or crackdowns in the 2017 budget that could be on the chopping block in the near term and would have important financial planning implications. All three of these proposals impact financial planning strategies that we currently recommend and utilize (depending on the situation). In some of these cases, our advice or our evaluation of the economic benefit has already changed simply based on the potential of future crackdowns that would impact decisions made today.

End of Backdoor Roth Conversions

Like the 2016 budget proposal, President Obama’s 2017 budget calls for limiting Roth conversions to only pre-tax dollars which would prevent the conversion of any after-tax retirement plan (IRA, 401(k), etc.) contributions to a Roth account. As we learned in the fall when Congress closed several popular Social Security claiming strategies, any financial planning technique that gets commonly referred to by the media as a loophole draws the attention of policy makers. The backdoor Roth loophole has been widely exploited by affluent taxpayers since 2010 tax law change eliminated the income limits on Roth conversions. The growing popularity of backdoor Roth conversions coupled with the fact that the tax-saving strategy circumvents the intentional income limits put in place by Congress to prevent the strategy makes it likely that the loophole will be closed as soon as this calendar year.

Implications

Tax attorneys suggest that the mere fact that the 2016 and 2017 budget proposals include a provision to eliminate the backdoor Roth loophole provide a tacit endorsement of the strategy and quiet any small concerns that the backdoor Roth could be challenged by the IRS as a step transaction. As long as the backdoor Roth loophole exists, it is worth exploiting. For individuals who make too much to contribute directly to a Roth and can take advantage of the strategy, we recommend doing so in January of each calendar year until the loophole is closed. If the loophole is eventually closed, the backdoor Roth opportunity will be lost going forward but it will not impact anything that has been done in the past.

Apply Required Minimum Distribution (RMD) Rules to Roth IRAs

One of the lesser known, but hugely valuable advantages, of the Roth IRA is the ability to avoid required minimum distributions. Whereas owners of Traditional IRAs are required to take annual distributions based on the IRS life expectancy tables after reaching age 70 ½, Roth IRA owners do not face the same requirement. Avoiding mandatory distributions from a Roth IRA magnifies the economic benefit of tax free growth versus the Traditional IRA, where mandatory distributions stunt the benefit of tax-deferred growth.

The proposal to “harmonize RMD rules” is not a first-time budget proposal (also in the 2015 and 2016 proposals) so it is not surprising to see this one again. The push to harmonize RMD rules seems to be picking up steam although there is uncertainty about how such rules would be implemented. Specifically, there is the very consequential question about how existing Roth accounts would be treated. Taxpayers evaluated the decision to contribute to a Roth IRA or pay the tax to convert Traditional IRA dollars to a Roth IRA based on the assumption that there would be no required distributions during their lifetimes. Critics of this proposal suggest that applying the new RMD rules, without grandfathering existing Roth IRA accounts, would be both unfair and, in the words of IRA expert Ed Slott, a “tremendous breach of the public’s trust”.

Implications

There is great uncertainty about whether the proposal, if enacted, would grandfather existing Roth accounts or not. The possibility that Roth IRA accounts may face RMDs in the future would clearly change the math of Roth conversions and contributions and make both less favorable. Roth accounts would still maintain the benefit of higher effective contribution limits but Roth conversions would become entirely based on an evaluation of current tax rates versus future tax rates. There could still be some benefit for early retirees and people in low income years to exploit small Roth conversions but the appeal becomes more limited.

Given even the small possibility that Roth accounts may be subject to RMDs in the future without the benefit of grandfathering, we think it is prudent to now evaluate the math of Roth conversions based solely on present vs. future tax rates without the benefit of RMD avoidance.

End of “Stretch IRA” Strategy

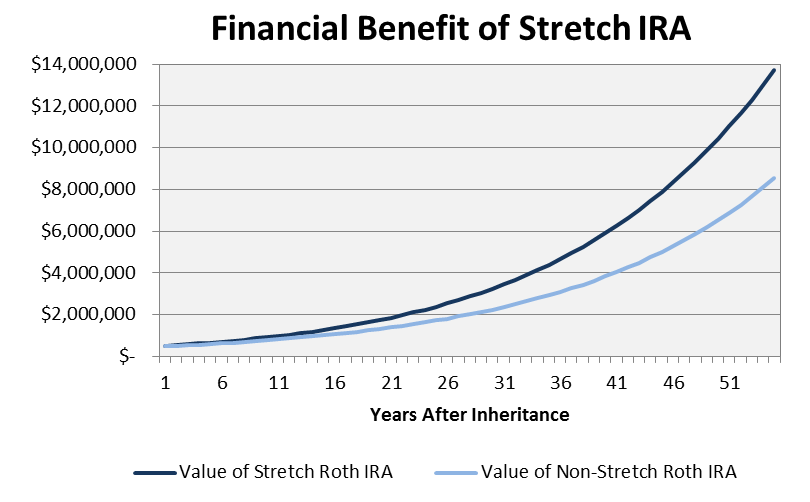

The Stretch IRA is not an official IRA or even a legally defined term – it is simply a financial planning strategy that many financial advisors suggest for non-spousal beneficiaries to maximize the tax efficiency of inherited IRAs. The currently available strategy permits an IRA to grow tax deferred (Traditional IRA) or tax free (Roth IRA) for an extended period after the death of the original account owner. A 30 year old who inherits an IRA, for example, can systematically distribute the IRA over the next 53 years (based on a table provided by the IRS) rather than distribute everything soon after the inheritance occurs and face a large tax liability. With wise planning, a young beneficiary (i.e. child or grandchild) can exploit the compounding effects of tax deferred or tax free growth while effectively creating a lifetime annuity.

The 2017 budget proposes to “require non-spouse beneficiaries of deceased IRA owners and retirement plan participants to take inherited distributions over no more than five years.” This proposal is again not new (also in 2015 and 2016 budgets) and would essentially end the stretch IRA strategy by requiring non-spousal beneficiaries to fully distribute IRAs within five years of death. Importantly, the provision would not impact existing inherited IRAs – it would only impact IRAs inherited after passage of this budget proposal.

The supportive case for this provision is that IRAs are individual retirement accounts and were never intended to be individual legacy planning accounts. In reality, the tax benefits that the administration projects for the proposal are small to begin with and may even be overstated since many people, because of bad advice, ignorance, or other reasons, already end up fully distributing inherited IRAs within a few months of the inheritance.

In many instances, the most financially valuable piece of planning advice that a good advisor ever provides a client comes after he or she is deceased when the advisor helps educate the IRA beneficiaries on the value of exploiting a stretch IRA and assists in avoiding the many logistical pitfalls that can disallow the stretch strategy. For a $500,000 Roth IRA inherited by a 30-year old beneficiary, the advantage of good advice can easily be several million dollars Implications This proposal has support among politicians and certainly could become reality in the next few years. There are several important planning implications if the stretch IRA strategy is killed: Nearly all financial planning or investment management decisions depend on an evaluation of possible scenarios – both the probability of an outcome occurring and the impact if the outcome occurs. Assessing proposed legislation is clearly not a science but we believe it would be irresponsible to ignore proposals either because of political beliefs or because they have not yet passed. The three proposals addressed above all have political momentum and financial planning implications which means they should be considered today, even if not yet law. As always, we welcome any questions on these proposals, the potential implications, or any additional proposals in the budget which were not addressed here. Please share questions or thoughts in the comment box below. [i] The ‘Stretch Roth IRA’ illustration assumes that a $500,000 Roth account is distributed based on minimum distribution rules for a 30 year old beneficiary with Roth assets growing at a pre-tax return of 7.0% and non-Roth assets growing at an after-tax rate of 5.5% ‘Non-Stretch Roth IRA’ illustration assumes a $500,000 Roth IRA is immediately distributed and grows at the same 5.5% after-tax rate.

Final Comments

Are these changes still on the radar of the Trump Administration? Do the budgets attach dollar amounts to the changes? If so, could it merely be a device to make the budgets appear more balanced, even though there isn’t a chance of actual passage?

Hi Tom:

As far as I know, none of them were on last year’s budget proposal but that doesn’t mean there is no interest to close these items in DC. It sounds like all of them were considered as part of the Tax Cuts and Jobs Act last year but Congress eventually chose to let all of them live.

The bipartisan Congressional Budget Office (CBO) does score any changes like these so they do get counted towards the expected budget cost. That said, the number that matters at the end isn’t the White House budget proposal but the actual budget that Congress passes so keeping these items in the final budget (not killing them) doesn’t do anything to help or hurt the projected deficit.