At various points in life, individuals begin to avoid roller coasters, back flips off the high dive, cartwheels, and full contact football. They take more frequent breaks in their weekly tennis game and aspire to completing a marathon rather than finish one in less than 3-hours. Instead of travelling to Spain to run with the bulls, they travel to France to drink wine and tour the countryside. The point is, most people do not simply stay at home and live in a bubble just because their bodies are aging.

The current investment environment bears a lot of similarities to an aging body. This is not to say that stocks, bonds, and cash are nearing the end of their lives (although to be fair, they have been around a while) but rather to say that they have limitations which change the way investors ought to think about them. In financial terms, investments around the globe have reduced yields, higher valuations, and lower expected returns. They may still be equipped to run for long distances but at a slower pace.

We wrote last year about the low interest rate environment and how this creates a fairly well-predictable low return environment for bonds over the next 10-15 years. We also demonstrate in our 2015 capital market assumptions (email us for the 20 page presentation) why the expected return for stocks is likely to be lower over the next 10-15 years from the impact of low interest rates and historically rich valuations. Several of the valuation metrics can be viewed here. This is not a conservative prediction about the future or the painting of a doomsday scenario but an evidence-based expectation of likely outcomes.

So what does this mean for investors? Short of just not caring, we think there seem to be three routes that investors can take in this low return investment environment.

1) Keep playing the back tees and just swing harder

So what if yields are lower and you can no longer achieve a 7% annual return with the same comfortable investment approach you’ve used in the past? You can simply invest more aggressively to achieve a higher expected return. The analogy would be recognizing that you are not making enough money by buying lottery tickets and deciding that the solution is to purchase more lottery tickets.

Many investors have taken this route over the past several years – investing in assets such as junk bonds, preferred securities, higher yielding REITs, longer duration bonds, or aggressive stocks. In fact, many investors infamously did these same things in 2005-2007, buying riskier assets amidst what was then a global liquidity glut where houses were ATM machines and underwriting was a thing of the past.

Perhaps the most fundamental rule of finance is the steadfast relationship between risk and return. Higher expected returns rarely come without enduring higher risks. Sometimes the higher risk is justifiable based on probabilistic outcomes whereas many times the increased risk is simply increased risk. To their detriment, individual investors often fail to understand the risks they’re enduring or fail to properly assess their ability to withstand the eventual downside of a risky investment. They merely purchase riskier assets with higher yields or higher expected returns just because they need a certain portfolio return to make their retirement plan work. For investors near retirement or already in retirement, this approach can have disastrous consequences.

2) Quit the game, awaiting an anti-aging wonder drug

In investment terms, the second approach is to sell stocks and bonds and sit on the sidelines in cash until there is a feeling that times are right to reinvest. It sounds good in theory but this approach can be even more financially destructive than the first approach. Consider the key problems:

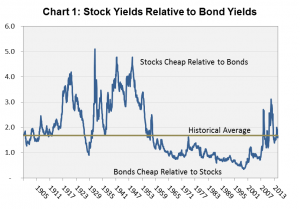

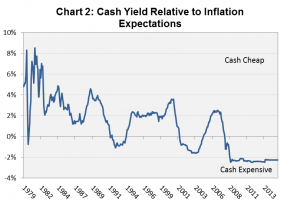

a) Evidence actually suggests that from a relative perspective, cash is the most expensive asset – not stocks and bonds. Chart 1 compares the earnings yield of stocks to the yield of bonds and suggests that stocks and bonds are fairly valued relative to one another. Moreover, as of July 7, the 10-year Treasury yielded 2.25% more than cash (90-day US T-Bills) compared to a historical average of 1.59% – an indication that bonds are historically cheap relative to cash. Chart 2 demonstrates the relative expensiveness of cash using the yield of cash (90-day US T-Bills) vs. 10-year expected inflation at the then current time.[2] Despite the reduced yield of stocks and bonds, they both appear historically cheap relative to cash. b) The second challenge with temporarily holding cash is that the strategy implies that stocks and bonds will precipitously fall in price, bringing them back to more reasonable valuations. The statement of lower expected returns is not a prediction of market collapse. It is more likely that we simply experience lower stock and bond returns in the intermediate future rather than a one-time market collapse. c) The final challenge, and the reason that market timing (a different name for this strategy) has been a failure for nearly all lured by its appeal, is that this approach requires getting timing right on both the exit and the entry. For investors who get one side right, failing to get the other side right generally makes this a painful use of time and money. The third option for investors in light of the lower return environment is to invest in a diversified portfolio, stick to a sound investment course, and plan more diligently. This strategy simply means incorporating lower return expectations into a financial plan and making necessary adjustments to spending, saving, retirement date, or other variables that are controllable. It’s the least palatable of three options and yet the most prudent. We advocate for and make use of this third option. No one preparing for retirement likes or wants an environment of lower investment returns but strong historical relationship indicate that investment returns over the next decade or so are likely to be lower than they have been over the past century. This is not a good reason to avoid investing but a good reason to address the first two words of our business logo: Plan Right. We spend a significant amount of time building out realistic return expectations and we then incorporate those expectations into your retirement plans. If changes to your plan are necessary to achieve a successful result, we do not simply go the route of covertly or overtly adding risk to the portfolio. We identify the variables that are within your control and then have a substantive conversation about which options are most practical and palatable to change. Greek austerity, the Chinese market correction, Federal Reserve policy, and recent employment data are interesting topics to debate but represent unpredictable noise and disruption to a long-term financial plan. Roller coasters and running with the bulls may have their place at various stages in life but not when it comes to your retirement plan. We invite you to contact us if you have any questions about your finances or wish to review the health of your financial plan. With warm regards, Resource Planning Group [1] We use the 10-year cyclically adjusted price to earnings ratio for the S&P 500 Index (“Shiller P/E”) and compare this to the 10-year US Treasury yield. [2] 10-year CPI inflation expectations come from the Philadelphia Fed’s Livingston Survey and from the Blue Chip Economic Indicators. The Livingston Survey is taken in June and December. The Blue Chip data is taken in March and October.

3) Move to the forward tees, avoid long forced carries, and play the course differently

Leave A Comment