“It might be the simplest play in all of sports, and the most effective. Give the ball to Michael Jordan, and everyone else get out of the way.”

These two sentences began an Associated Press article on May 28, 1989. The day prior, the Chicago Bulls had the ball in the closing seconds of a tie game against the rival Detroit Pistons. The reality was that everyone in the Chicago arena that afternoon and everyone watching at home expected the ball was going to a budding 26-year old superstar named Michael Jordan for the final shot. This collective expectancy did not stop Bulls coach Doug Collins from calling for the ball to get in Jordan’s hands while his four other players moved to the opposite side of the court. Jordan made the game winning shot to beat the Pistons that day – not the first nor last time this simplest and most effective play in all of sports was utilized.

In the investing world, most financial incentives run counter to this ‘simpler is better’ mentality. Stock brokers have an incentive to transact and provide reasons to buy this or sell that rather than stay the course. Financial pundits have an incentive to make bold short-term market calls because no one follows up to hold them accountable for bad calls and no one tunes in to hear about long-term discipline and rebalancing. Investment websites have an incentive to constantly create action-oriented recommendations that generate clicks, traffic, and transaction. Commercials such as this one and this one promote the idea that truck drivers, soccer moms, and busy executives can identify great stocks, buy them, and get rich. The whole financial world subliminally screams at us that transactions are exciting and that we need to do something. Who cares if these promotions are only motivated by profits for the broker, online trading platform, or business media – transactions are exciting and better for you, right?

Secrets of the Best Investors

An intentionally unpublicized Fidelity study that was leaked in September 2014 evaluated the investment returns of all Fidelity accounts between 2003 and 2013. The objective was to determine the commonalities of investors with the best and worst returns. Were investors of an age group, occupation, sex, geography, ethnic group, educational background, or other quantifiable metric better or worse investors than any other group? Could any conclusions be drawn from the massive amounts of data available to Fidelity?

The audit surprisingly revealed that the best performing accounts shared two types of investors: the forgetful and the deceased. That is, the common denominator of the most successful investors was that they never logged in to view or trade their accounts. When the auditors called the owners of these best performing accounts, the overwhelming majority had either switched jobs and forgotten about an old Fidelity 401(k) or the investor had died and the assets were frozen in an estate.

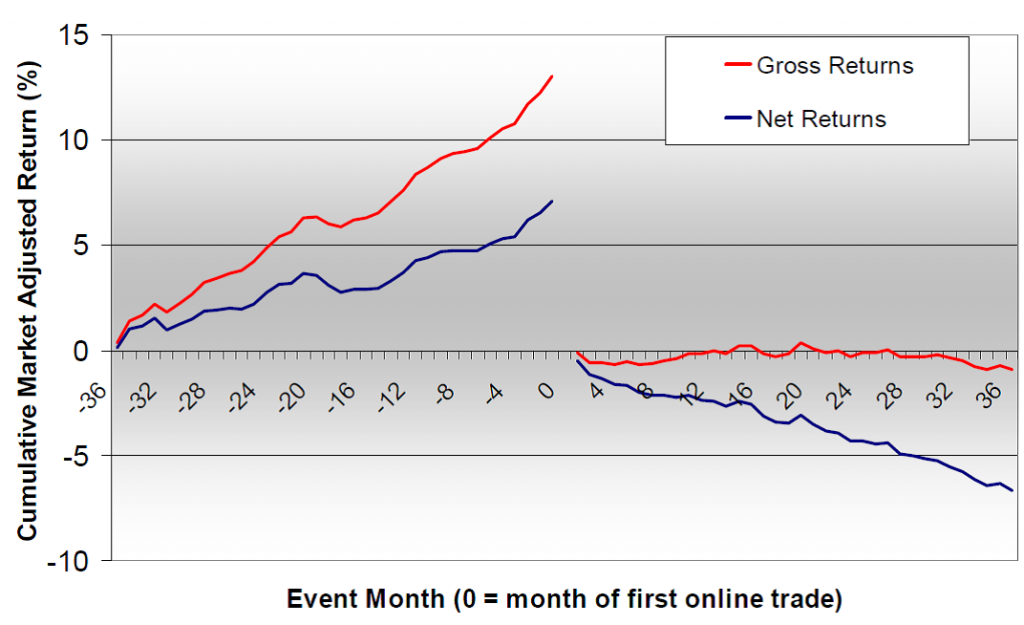

A related 2002 study examined the market-adjusted returns of over 1,600 investors in the 36 months prior to their first online trade and in the following 36 months. The findings revealed that investor returns exceeded the market by more than 2% per year in the period prior to online trading and then trailed the market by more than 3% per year in the period after online access commenced.

The ease of trading online coupled with an overconfident behavioral bias caused investors to trade more often and act more speculatively. The research literature summarized:

Overconfident investors were more likely to go online and once online the illusion of control and the illusion of knowledge further increased their overconfidence. Overconfidence led them to trade actively and active trading caused subpar performance.

The Intersection of What Matters and What Can Be Controlled

These studies are obviously not referenced to recommend an investment approach of benign neglect. The evidence merely provides real world reminders that the simplest answer can be the most effective.

We use the visual above in our investment discipline presentation to help explain how we seek to add value as advisors. While it may be glamorous to have and discuss a short-term market forecast, a prediction on oil prices, or a tax policy solution, these forecasts don’t add real value over time. As a result, we don’t spend time internally debating these items and we don’t spend time writing about them or promoting them. We also don’t expend resources on things we cannot control or consistently predict. Instead, we allocate our efforts to the intersection of what we can control and what matters.

There is really nothing exciting about this upper right hand quadrant. In fact, the relative dullness of the actions in this quadrant just mean that most investors, professional or not, don’t spend time in this quadrant despite the predictable and consistent long-term value these actions provide. The unexciting practices of consistent rules-based rebalancing, asset location, broad diversification, and keeping a disciplined allocation do not make for exciting cocktail party conversation nor entertainment of which financial entertainers like Jim Cramer are known.

Yet here’s the thing: a well-constructed explanation of why oil prices will go back to $70/barrel this year is interesting and will draw clicks or eyeballs but it may be wrong or really wrong. In fact, huge amounts of evidence demonstrate that expert predictions made by really smart people are worse than throwing darts. And if the prediction is wrong and you invest based on it – that is value destructive. Contrast this with the items in the top right quadrant of the visual above. They’re controllable and they consistently add value over nearly all time periods. They do not rely on bold predictions or forecasts. They are simple and effective.

Closing Thoughts

On that May afternoon in 1989, Chicago Bulls Coach Doug Collins could have drawn up a complex play where Michael Jordan came off two screens to get the ball and then made an unexpected pass to another player. Instead, he elected for the simple solution. It worked that day and on many others thereafter. In spite of the effectiveness, no one called Collins a great tactician or a masterful coach.

Similarly, we recognize that no one is going to sing the praises of our effective asset location or describe the brilliance of our transaction cost efficiency and regular tax-loss harvesting. Yet we, at Resource Planning Group, remain diligently committed to your long-term financial success and spending time taking these boring upper right quadrant actions is the best way we know to help you achieve that success.

We thank you for your trust and look forward to continuing to assist you in “Living Well”.

Leave A Comment