In financial planning, the right answer to most seemingly simple questions is nearly always “it depends”. How much life insurance do I need? Should I contribute to a traditional 401k or a Roth 401k? Should I use a will or revocable trust for my estate? How much can I plan to safely distribute from my portfolio in retirement? If questions such as these could be answered in 15 seconds without gathering other data, there would be little need for financial planners, tax advisors, or other planning professionals.

However, we often face one issue that I think has a definitive answer and does not require any judgment calls – the best retirement plan for self-employed individuals.

More than a decade ago, most self-employed individuals used either a SEP IRA or a SIMPLE IRA as the retirement vehicle of choice. These plans were both easy to administer and provided a larger allowance for tax-deferred savings than just a conventional IRA, resultantly becoming commonplace for self-employed business owners.

The passage of the Economic Growth and Tax Reconciliation Act of 2001 (EGTRRA, actually passed in 2002) changed the game. The Act provided self-employed individuals the same advantages of a conventional 401(k) plan without the administrative burdens that multi-employee businesses have to undergo. Annual contribution limits to an individual 401(k) permitted deferring significantly more than either a SEP or SIMPLE plan and individual 401(k) plans were allowed to include a Roth contribution option, which neither the SEP nor the SIMPLE provided. Widespread adoption failed to begin immediately and it was not until 2006 when EGTRRA rules were made permanent that the individual 401(k) took hold as a legitimate option.

Key Advantages of the Individual 401(k) Plan

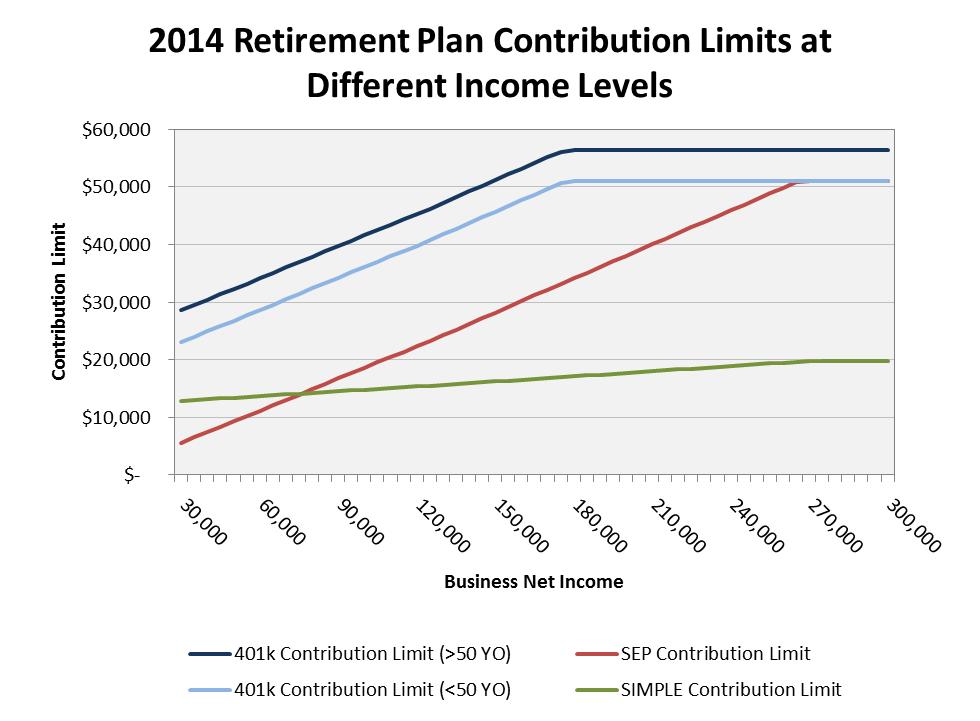

Significantly higher contribution limits. The most important factor favoring the individual 401(k) versus other small business retirement plans is the higher contribution limit. The chart below demonstrates well that at any level of income below $270,000, the individual 401(k) contribution limit exceeds that of a SEP or SIMPLE, and in many cases the difference is significant (Note that for individuals over age 50, the individual 401(k) allowable contribution is higher at all income levels).

Consider a 50 year-old individual with $100,000 of self-employment income. She has the potential to defer $41,587 of income to a 401(k) plan according to federal limits but only $18k to a SEP or $17k to a SIMPLE. For someone in a position to save towards retirement, this is a tremendous advantage.

Catch-up contributions for individuals over age 50. An individual 401(k) permits anyone over age 50 to make a “catch-up contribution” – an additional $5,500 in 2014. SEP IRAs do not have this feature.

Tax-free Roth feature. Unlike SEP or SIMPLE plans, the individual 401(k) offers the flexibility of contributing to a tax free Roth account which can be advantageous depending on the situation.

Better creditor protection. Laws on this are state-specific but 401(k) plans provide better creditor protection than SEP or SIMPLE plans, being totally protected from creditors.

Plan loans. While it may not be an oft-used feature of individual 401(k)’s, these plans do allow for loans which is not true of SEP or SIMPLE plans.

Dispelling Cited Drawbacks

Despite the clear advantages of the individual 401(k), many self-employed business owners still use SEP or SIMPLE plans. I find this is largely the result of being misinformed or just the longer legacy of SEP plans, where long-time business owners failed to change plans following the adoption of EGTRRA.

This said, some articles occasionally cite the greater ease or lower cost of SEP plans vs. 401(k) plans. I find these arguments to be misleading. While individual 401(k) plans may have been more administratively difficult immediately following the adoption of EGTRRA, they now require no more paperwork or administration than other plans. I address below all of the cited limitations of which I am aware and why they’re really not relevant in 2014 and beyond.

Paperwork requirements. One outstanding personal finance website makes the claim that “there’s much less paperwork involved with the SEP than there is with the 401(k).” This claim often comes up and may be true at some custodians but the paperwork required to open an individual 401(k) at Charles Schwab is actually much less than that of a SEP IRA – 8 pages for the 401(k), 14 pages for the SEP. Completing the paperwork to establish an individual 401(k) can literally be done in 2-3 minutes.

Higher administrative fees. A 2010 Wall Street Journal article made the case that individual 401(k) plans can have higher administrative fees or setup fees. Again, this is custodian-dependent but neither of the custodians we use, Charles Schwab nor TD Ameritrade, charge any fees for individual 401(k) plans. They are completely free to establish and administer.

Administrative requirements. There is a requirement that once an individual 401(k) reaches $250,000 in assets, the owner is required to file the IRS Form 5500. First, kudos to the individual business owner who is able to amass $250,000 in this retirement vehicle without ever hiring other employees. Secondly, the two-page IRS Form 5500 is quite simple to complete. Finally, I tell clients who open these plans that if we ever run into the situation where the account size reaches $250,000 and there is an aversion to completing the Form 5500, we can simply close down the plan and roll the assets over to an IRA.

Substantial and Recurring Payments. A claim is occasionally made that individual 401(k) plans have less contribution flexibility than other plans. In practice, I have never seen this issue arise but IRS code indicates that “substantial and recurring” contributions must be made to qualified retirement plans, which include the individual 401(k) plan. IRS language says that failing to make any meaningful contributions in 3 out of 5 years could result in the plan being terminated. In reality, if someone does not have excess cash flow to make contributions to a 401(k) in 3 out of 5 years and was challenged by the IRS about this, then closing down the plan and rolling assets to an IRA probably is not a legitimate drawback.

Closing Comments

Financial advisors are well-known for making financial matters complex. In practical reality, the easy answer is often not the right answer. “It depends” is not only a justifiable response but the responsible way to address most planning questions. Yet when faced with the question of the best retirement plan for self employed individuals, the answer is really clear.

Have thoughts, comments, or disagree with anything above? Please do not hesitate to comment below.

Leave A Comment