One of the most common questions facing families and individuals is whether to accelerate mortgage payments and forego the potential mortgage interest deduction or borrow as much as possible, make minimum debt payments, and save for retirement. Simply, is it better to save or pay off debt? The question comes in a variety of flavors:

- Should I buy a home with debt or pay cash?

- Should I pay off my mortgage or invest?

- Should I accelerate payments on my mortgage?

These questions are phrased differently but they’re all getting at the same issue. Like most of financial planning, the answer is not black and white and depends on your specific situation – items like your tax rate, portfolio allocation, risk tolerance, and propensity to save.

Economics of the ‘Pay off Mortgage Early’ Decision

In a world without emotional or behavioral biases, we would all rationally evaluate the economics of the mortgage trade-off and make a choice based on the probability-weighted outcomes. To help understand the economics of the mortgage decision, we evaluated the historical evidence by comparing the option of paying down a mortgage to the alternative of investing. We tested the following scenarios over the course of 42 years, although the amount of money involved is arbitrary:

Scenario 1: Family borrows $200,000 or simply maintains a $200,000 mortgage, refinancing for 30 years. This is considered the “mortgage and invest approach”.

Scenario 2: Instead of borrowing, the family uses $200,000 of savings to either pay cash for a home or pay off a mortgage balance.

The family from the first scenario keeps a mortgage and is left with $200,000 to invest (an implicit assumption for anyone asking the ‘mortgage or reduce debt’ question is that there are outside funds available to avoid or reduce debt). The $200k is assumed to be invested in a portfolio of 70% stocks (S&P 500 Index) and 30% bonds (BarCap US Govt/Credit Index) and rebalanced annually back to these targets. Assumptions are made for the tax drag of investing to keep an apples-to-apples tax comparison.

The family in the second scenario is assumed to invest nothing at the onset but each month invests what would have otherwise been the eliminated mortgage payment, less the foregone tax deduction from the mortgage interest deduction. The same investing assumptions are applied.

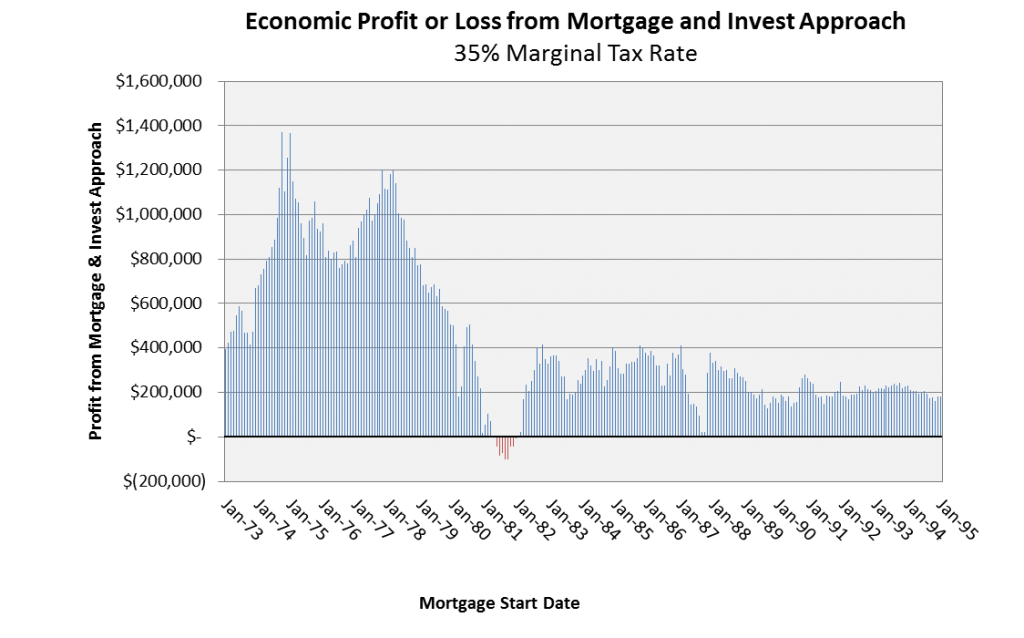

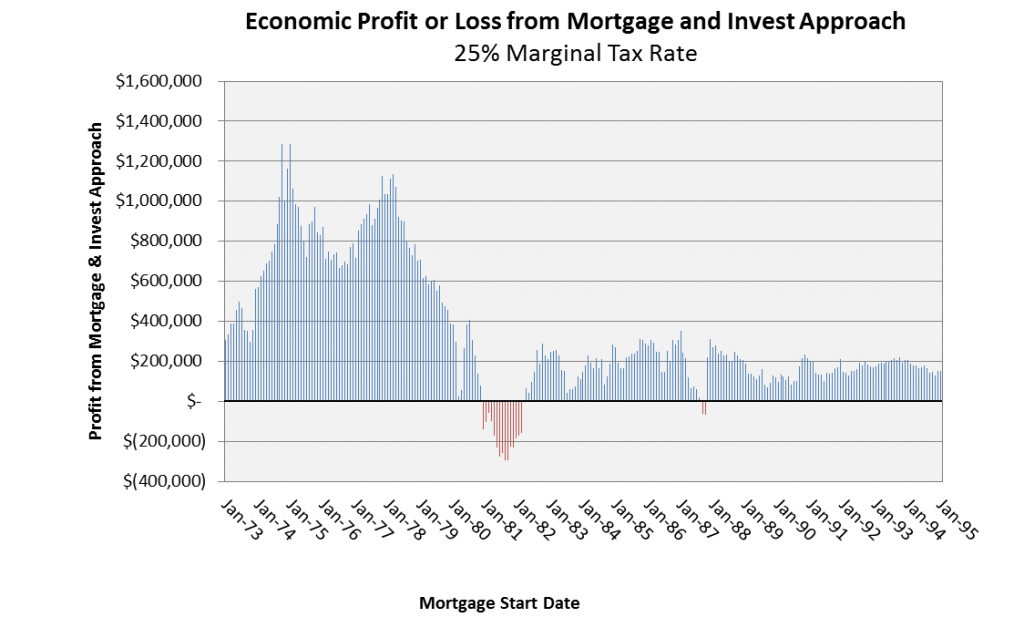

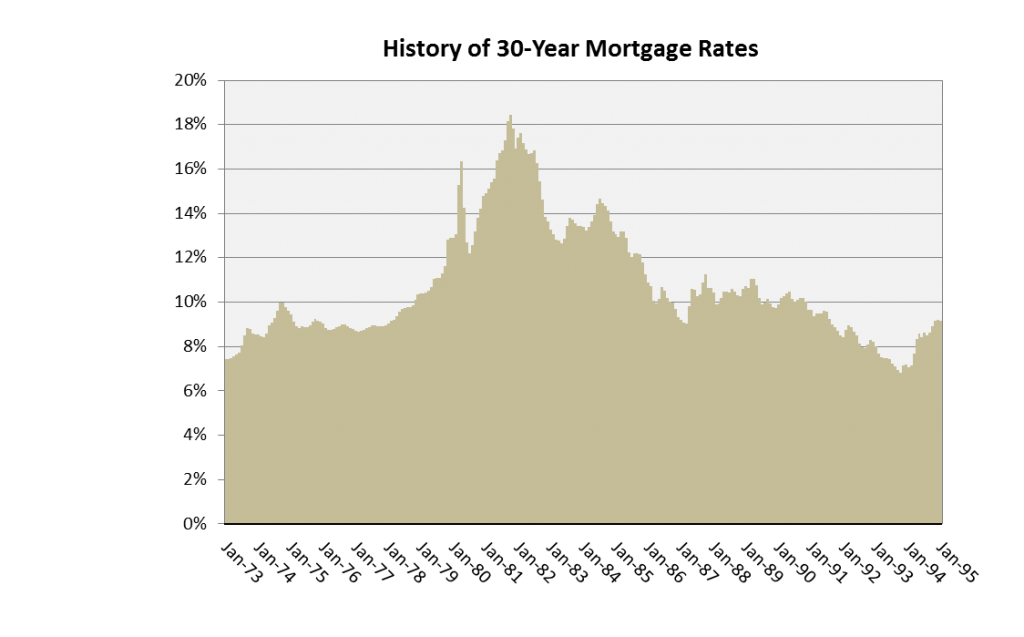

In the mortgage scenarios, we assume that the beginning mortgage is never refinanced over the remaining life of the loan. The available history of 30-year mortgage rates goes back to the beginning of 1973 so the analysis begins at that point and we examine how the two scenarios compare for a mortgage starting in January 1973. We do the same thing assuming a start date of February 1973, then March 1973, and then every month thereafter until January 1995. Each analysis is run for 30-years or through January 2015, so that we have at least 20-years of evidence in all scenarios. The results are presented below, using 35% and 25% tax rates.

- Using a 35% marginal tax rate assumption, the borrow and invest approach provided a positive outcome in 97% of the time periods. The only period during which it would have been better to simply pay cash was between May and December 1981. Importantly, mortgage rates during this 8-month period ranged between 16.4% and 18.5%.

- The average financial benefit of the borrow and invest approach during the entire horizon was $428k.

- Using a 25% marginal tax rate assumption, the borrow and invest approach provided a positive outcome in 93.2% of all time periods. The average benefit was $342k.

- Appreciation or depreciation of a home has no impact on these results. Homeowners benefit from appreciation in the exact same way whether or not a mortgage is outstanding.

- Importantly, this analysis ignores the opportunity to refinance at a lower future rate which would have only improved the borrow and invest approach results, especially for mortgages originated during the high rate periods of the late 1970’s and early 1980’s. If we allowed for a refinancing option, 100% of scenarios would have favored the borrow and invest approach.

Assuming that history is a useful guide and ignoring behavioral biases, the economics of the decision provide a compelling argument for the borrow and invest approach. Yet we would be remiss to ignore some of the important factors.

Other Considerations in the Mortgage Payoff Decision

Tax Benefit

People often fret at the thought of paying down a mortgage and reducing or entirely eliminating the mortgage interest deduction. Yet the tax benefit of the mortgage interest deduction merely reduces the after-tax cost of the mortgage. Paying $1 of mortgage interest may save you 20-40 cents but the mortgage interest still costs you 60-80 cents. Moreover, families with few itemized deductions other than mortgage interest often get little or no true tax savings from the mortgage interest.

Generally, the tax benefit of the mortgage interest deduction is most meaningful for families with high income and significant other itemized deductions.

Investment Allocation

A valid criticism of the economic analysis is that comparing a mortgage payoff to a 70/30 stock/bond portfolio is not an apples-to-apples risk comparison. Using $200,000 to pay off or avoid a mortgage is effectively equivalent to using $200,000 to purchase a portfolio of bonds. The analysis above, however, compares the mortgage payoff with investing in a portfolio of stocks and bonds.

This 70/30 portfolio, or even a more conservative allocation, should have a higher expected return than the mortgage cost because it is simply more aggressive. Generally, the more aggressive the competing investment allocation, the better the mortgage and invest approach compares economically with paying off the mortgage.

Propensity to Save

One benefit of maintaining a mortgage is that it creates a form of forced savings by way of the required mortgage payment each month. For families or individuals who lack a strong savings discipline and tend to spend what is available to spend, the economic analysis favors the borrow and invest approach even more because of this forced savings.

Additionally, behavioral studies conclude that people who pay off a mortgage tend to feel poorer even though their net worth has not changed. It might then be concluded that by feeling poorer, these individuals are more compelled to save. Behavioral research suggests the opposite is true. The more wealth people have, the more likely they are to save. This behavioral element again favors a mortgage, depending on the savings discipline of the individual.

Credit History

In the analysis, we use the 30-year Freddie Mac mortgage rates. Borrowers with weak credit or other circumstances that prevent obtaining competitive mortgage rates would obviously find the math of borrowing to be less attractive than the numbers above. Such borrowers may be better served to reduce the mortgage rather than invest.

Peace of Mind

Although the behavioral side is covered in other places above, we should address the “sleep-at-night” or “peace of mind” benefit of a reduced mortgage. In many cases, the behavioral and emotional benefit of not having mortgage payments (or at least reduced payments) can far outweigh the economic benefits expressed above. Some individuals prefer the peace of mind that comes from being debt-free than a few hundred thousand dollars of potential economic gain. Individuals must weigh the emotional benefit of paying off a mortgage (which varies by person) against the potential economic cost of doing so.

What is the Answer?

From a purely quantitative standpoint, the economic benefit to maintaining a mortgage and investing the difference has been significant for most homeowners over the past several decades. That is to be expected. Investing in a portfolio of stocks and bonds is more risky than using the same funds to reduce a mortgage and, resultantly, should have a higher expected return. Moreover, the cost of a mortgage is subsidized by the government in multiple ways (support of Fannie Mae & Freddie Mac, the mortgage interest deduction) which creates an easier “hurdle”. The future, of course, may hold different outcomes.

Yet, the mortgage decision is rarely ever a simple economic decision. Behavioral factors including “peace of mind” can provide substantial benefits that are not measurable in dollars and cents.

The decision ultimately has to be considered against three paramount words of financial planning: avoid unnecessary risk. Without a definitive need to assume additional risk, it is hard to justify the mortgage and invest approach even if the potential economic benefit is significant. Many families have far-reaching goals (earlier retirement, spend more, etc.) that can justify the additional risk for the higher expected economic benefit. In those cases, the behavioral elements and other factors above have to be measured against a potential, but uncertain, financial benefit. Without such goals that justify taking additional risks, the answer clearly favors debt reduction over additional investing.

Leave A Comment