My family’s kitchen will not be profiled on HGTV as a model of organization. We face the practical limitations of 25-year old builder-grade cabinets and constrained space. We also face the reality confronted by many parents of young children. That is, the focus of children emptying a clean dishwasher is on getting it done quickly rather than on getting cleaned contents to the right place.

Yet despite these limitations, we still have a reasonable plan for how the kitchen should be organized. While it may not be implemented to perfection, it gets the job done. The supplies we use often like forks, spoons, cereal bowls, and cups go in easily accessible cabinets and drawers – often ones that the kids can reach. The kitchen items we use less frequently like martini glasses, a waffle iron, or our wedding china (most of which get used approximately never) don’t consume space in the most easily accessible drawers but are shelved away in hard-to-reach cabinets.

Most families similarly take a usage-based approach to efficiently locating kitchen supplies. In fact, this idea of organizing kitchen-ware is so routine that we may not give ourselves enough credit for the efficiencies.

Yet imagine a kitchen where every drawer has two forks, three knives, two plates, a coffee mug, and a can of soup. Each cabinet contains two wine glasses, two bowls, and a few plastic cups. Or separately imagine a kitchen where seldom-used specialty items and fine china are stored in the most easily accessible drawers and, conversely, everyday forks and spoons are stored in the upstairs linen closet.

No family I’ve ever encountered takes these approaches to the organization of their kitchen items because the concepts would be horribly inefficient. However, while these hypothetical kitchen plans are so laughable that no one would ever implement them, our experience is that the overwhelming majority of investors and investment advisors build their investment portfolios with such inefficient chaos. That is, instead of placing the investment equivalent of coffee mugs in the most appropriate investment cabinet, investors place them wherever there is room. Or, alternatively, they buy a separate chili pot for every investment cabinet.

Asset Location – Tax Efficiently Organizing Your Portfolio

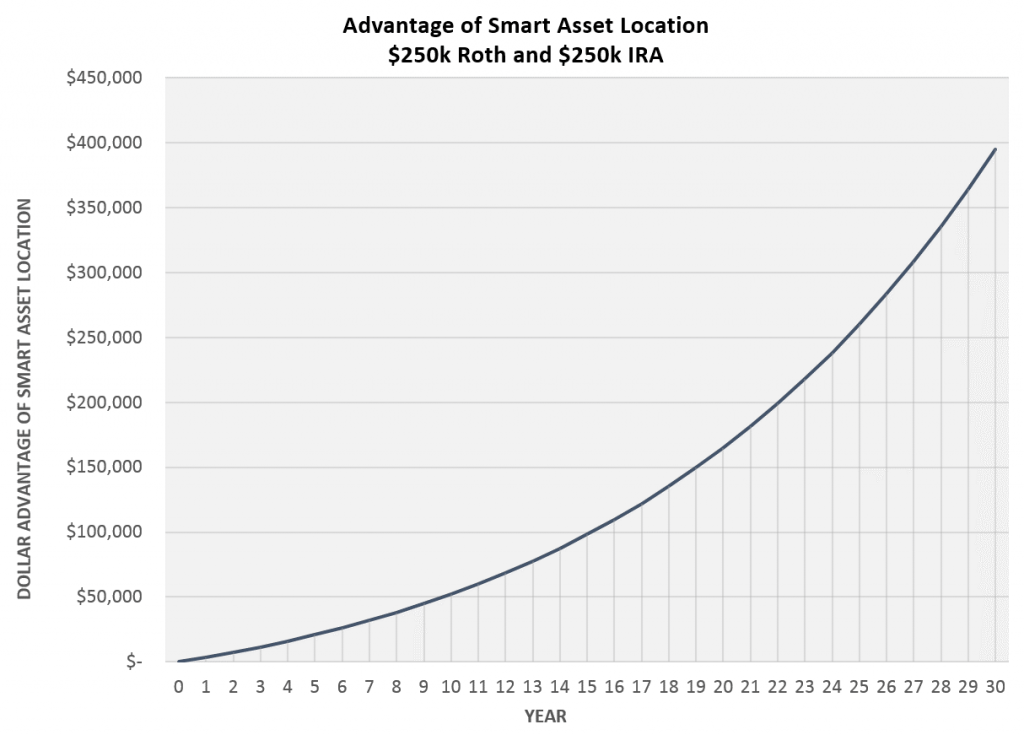

The cost to the inefficient organization of a kitchen is time and frustration (unless you’re buying a separate chili pot for each cabinet). The cost to the inefficient organization of an investment portfolio can be hundreds of thousands of dollars in extra taxes and transaction costs over a lifetime. Recent research from Vanguard suggests that smart asset location can add up to 0.77% per year in after tax-return. That 0.77% per year alternatively reflects the cost to those who ignore efficient asset location. The extra tax costs add up quickly.

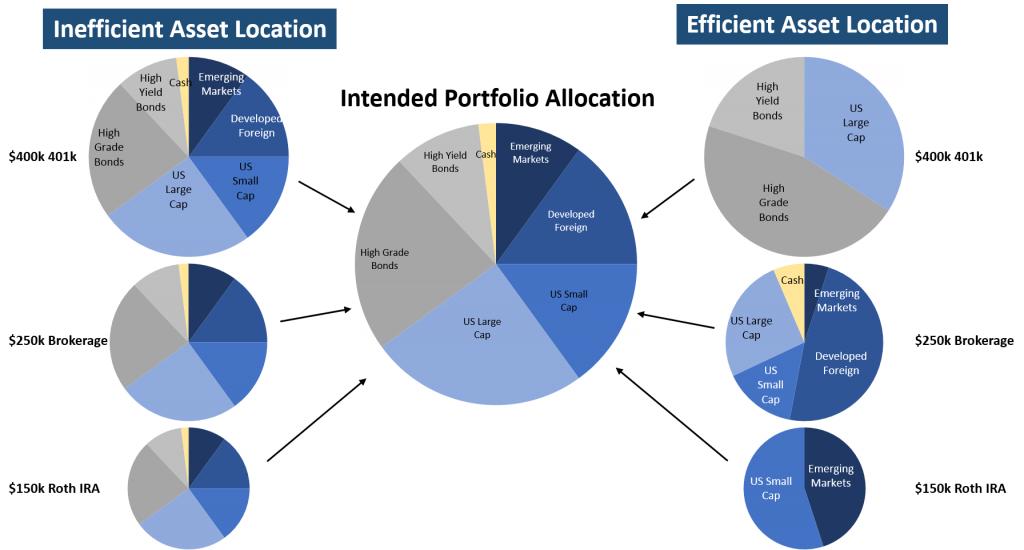

Efficiently organizing an investment portfolio is really not that dissimilar from effectively organizing a kitchen. In a kitchen, you may have drawers, cabinets, pantries, etc. In an investment portfolio, you basically have three kind of accounts and each account type has a different role:

- Tax Free Accounts (Roth IRA, Roth 401k) – Priority is high growth, tax-inefficient investments. Second priority is high growth investments.

- Tax Deferred Accounts (IRA, 401k) – Priority is consistent, lower-growth, tax-inefficient investments. Second priority is any tax-inefficient investments such as high yield bonds or high turnover stock funds.

- Taxable Accounts (Traditional Brokerage) – Priority is low turnover stock funds or ETFs. This is true for many reasons including the favorable long-term capital gain tax treatment, loss harvesting opportunity, step-up in basis at death, favorable charitable planning treatment, etc.

With these three different account types in mind, now it’s time to think about constructing your investment portfolio like you would efficiently organize your kitchen.

- Start with what you need. In a kitchen, you don’t buy 17 place settings because you have 17 cabinets – you determine how many place settings you need and then determine where they fit best in your kitchen. When investing, too many people go the opposite direction – starting with each individual account and hoping that if they get each account properly allocated, the total will be right. Just because you and your spouse have seven accounts (2 IRAs, 2 Roth IRAs, 2 401ks, and a joint brokerage), does not mean that you need seven foreign stock funds – one for each account. Your 401(k) is not a cabinet that needs one of everything. Your first job is to determine how much should be invested in each asset category such as foreign stocks or domestic bonds.

- Once you determine what you need, evaluate the best location for everything. You’ve decided that you need 12 place settings and then you determine where they go. In the case of investing, assume you determine in step one that you want 15% of your total portfolio in emerging market stocks by way of passive exchange traded funds (ETFs). The next step is to determine where this asset best fits. This specific asset class tends to be relatively tax efficient (especially via ETFs held more than a year) with higher expected volatility and higher expected returns. Such characteristics make it well suited for tax free Roth accounts and taxable accounts but terribly inefficient for tax deferred accounts. A less tax efficient investment like high grade fixed income with low expected returns and low expected volatility would conversely be well suited for tax deferred accounts but a very poor choice for tax free Roth accounts.

- Make use of your most precious space first and then fill in everything else. Once you determine where your place settings are best suited, it is time to put them there. Eventually, you’ll fill up your prime real estate with the most essential items and then begin filling up the secondary cabinets or drawers. Similarly, when we’re investing a portfolio, we start by filling in the tax free Roth accounts since this is valuable and limited space for most investors. If the Roth account is a small enough percentage of the whole, we may only hold a single investment in this account because we’re seeking to make the most efficient use of this precious space.

Why Asset Location Matters

The example below shows the advantage of smart asset location in dollar terms using a real example. In this case, an investor with $250,000 in a Traditional IRA and $250,000 in a Roth IRA invests for 30 years with 50% in stocks and 50% in bonds This part of the investment process is admittedly boring. It is much more glamorous to talk about the fancy investment you just bought than how you are saving in taxes by intelligently locating assets in the best location. Yet the fancy investment provides unknowable benefit or loss whereas the modest efforts of asset location provides knowable gain. [i] Also assumes 6.5% growth rate of stocks, 2.5% growth rate of bonds, 35% blended tax rate, and distribution of IRAs at end of 30 years. All expressions of opinion reflect the judgment of the author as of the date of publication and are subject to change. The information is believed to be accurate, but is not guaranteed or warranted by Mercer Advisors. Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Diversification and asset allocation do not ensure a profit or protect against a loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio.

Leave A Comment