Among the most consequential decisions that parents make is choosing the primary and secondary education venue for their children. For parents with resources, the decision often begins with the dilemma of private vs. public school. Parents are also often confronted with the financial costs of college education and helping a child choose between institutions with significantly different price tags.

As financial planners, we seek to add value where we can in the process. This often means helping assess the economic cost and weighing the financial impact on retirement plans. Every purchase today has a future cost. In most cases, the question is not “Can I afford this expense?” but rather questions such as:

- “How much longer does this expense push out my projected retirement date?

- “If we pay for private school, how does this impact our ability to retire at or before age 65 and the amount we can spend in retirement?”

This trade-off analysis generally happens within a robust financial plan but some of the work we have done recently for specific client situations may be useful on a broad level.

Cost of Private School

Before diving into the discussion of financial costs, we should first be very clear – the decision to send children to public or private school goes far beyond the economics. Advantages of private school can include more advanced classes, electives that don’t exist in public schools, smaller class sizes, or simply a better academic reputation. Conversely, public schools can offer advantages beyond cost such as special needs programs, broader class options, and larger athletic programs.

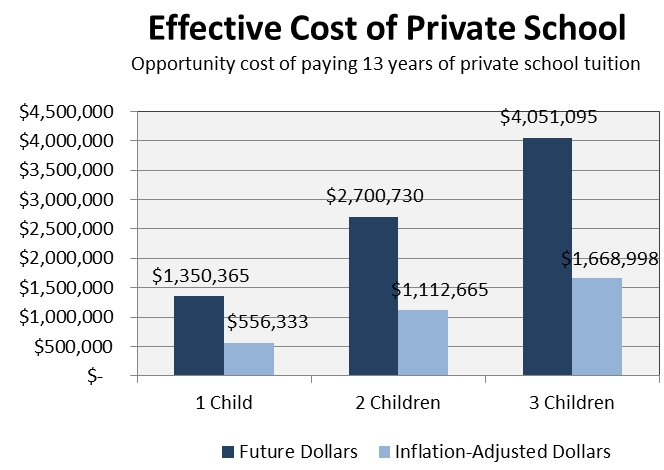

With that said, we all appreciate that the costs of private school are high. Rarely do parents stop to consider how high and how these costs will impact their retirement. To better understand the economics of the private school decision, we gathered the costs of six well-known Atlanta private schools with Kindergarten through 12th grade classes. The current average cost of these schools is $19,881 for K-5th grade and $22,631 for 6-12th grade. These figures are in-line with the costs we researched for top private schools in other southeastern cities such as Charlotte, Nashville, and Birmingham. It is also important to note that we ignore the impact of both scholarships as well as the additional costs of private school such as annual fund requests or extracurricular activities.

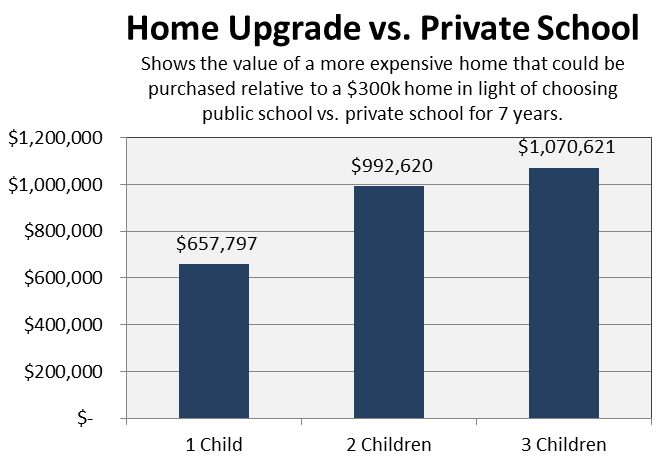

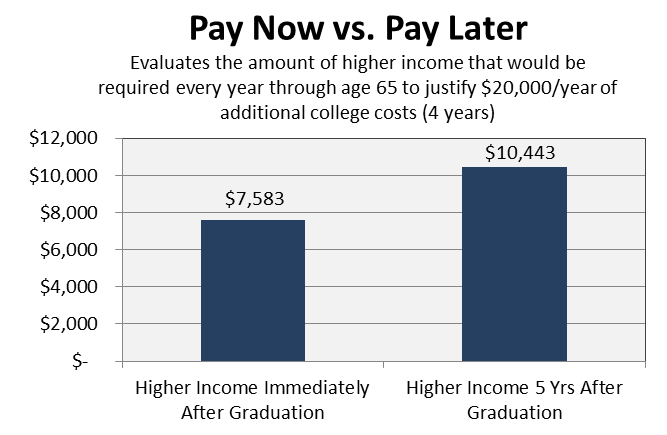

Using these average costs, we calculated the effective cost of putting just one child through private school for 13 years (K-12) We recently helped a client evaluate the economic cost of private school versus public school, but not in the traditional sense. In this case, the client was uncomfortable with the public school district to which their two children would eventually feed. If they stayed in their current residence, they planned to send the children to private school for grades 6-12. The alternative was to move to a more expensive home in a different school district with public schools that far better fit their objectives. To help evaluate the economics of this decision, we analyzed the expected cost of seven years of private school for two children against the cost of moving to a more expensive home and (in their view) upgrading to a better public school district. The analysis considered variables such as property taxes, home insurance, mortgage expense, maintenance costs, and home price appreciation[ii]. Our goal was to determine how much more house the family could buy in a better public school district and break-even with the cost of staying put and sending two kids to private school. Using the average private school costs from above ($22,631) for just grades 6-12, we determined that the family in this situation could move from a $300,000 house to a house worth more than $990,000. Higher mortgage payments, interest expense, insurance costs, property taxes, maintenance were all offset by the savings of public school vs. private school. Families face similar economic decisions when it comes to college and graduate school costs. We often help evaluate the payback break-even of different post -secondary education expenses or the true cost of loan packages. In a recent situation, we helped a client and their son evaluate the costs of two choices – one school where an aid package was offered and one where they would have to pay the full price of admission. In the revised scenario below, we use a difference in costs of $20,000/year for four years. This cost difference could result from aid packages or simply from lower tuition costs. The analysis answers the question: “How much more would one have to make in salary through retirement to financially justify the higher college costs?”[iii] Again, this is all not intended to imply that economic cost is the only factor or even the most important factor in education decisions. It is simply a factor in the decision. But as education costs increase at all levels, the economic factor becomes more consequential and more impactful. Our objective when families face such decisions is to help consider costs beyond just the dollar amount of next year’s tuition. In many cases, the math simply helps rising college students understand the true financial impact of college choices or parents understand how long retirement might need to be deferred. As with most decisions, there is real value in evaluating the bigger picture. [i] We use a 6.0% opportunity cost which assumes that any saved funds could be reinvested at an annual after-tax return of 6.0%. Tuition expenses are assumed to increase by 3.0% annually. The cost is calculated using the assumption of 13 years of tuition expenses followed by an additional 17 years before retirement (30 total years between the start of Kindergarten expenses and retirement). Schools used in the average were Pace, Westminster, Wesleyan, Davis, Lovett, and Marist. [ii] In the client scenario, we used actual city and county millage rates, exemptions, and assessed value rates to arrive at total property taxes for the specific situation. In this example, we use a flat 1.2% of home value. For home insurance costs, we estimated an annual cost of 0.47% using actual data from 51 different insurance companies. We used annual maintenance cost of 1.0% of home value, based on historical nationwide evidence. We used a 4.0% mortgage rate and assumed that the starting equity value in both scenarios was 20% of the higher home value. Home price appreciation was assumed to be 1.0% annually. Additional home price appreciation beyond this assumed level would just further benefit the public school scenario and increase the value of new home that could be purchased. This analysis uses the average private school costs above and the same 6.0% discount rate. It also assumes that the two children are 2-years apart in school. [iii] Assumes a 6.0% opportunity cost and applies a 25% tax rate to income earned after graduation.

More Home vs. Private School

College Costs and Higher Income

Conclusions on the Cost of Education

Leave A Comment