There are an estimated 50 million Amazon Prime members in the United States which means that a household in this country is more likely to have an Amazon Prime membership than to have a dog. It actually seems to be more challenging to find a Gen X or Millennial family who does not use Amazon Prime than to find a family who still uses rotary dial phones at home.

The benefits of Amazon Prime like free unlimited music streaming, free video downloads, and free e-books plus the convenience of free two-day shipping make it hardly worth an evaluation of the $99 annual price tag. Whereas frugal shoppers build complex spreadsheets to compare the 97 variations of Disney World theme park passes (trusting I’m not the only one who partakes in such activity), the assessment of an Amazon Prime membership cost unlikely gets even a back-of-the-envelope evaluation in these same households. Prime is simply a convenience that most modern households treat with the same necessity as running water.

The Mutual Fund Equivalent of Amazon Prime

A little known reality is that nearly all mutual fund companies offer investors a choice that looks a lot like Amazon Prime. Mutual funds come in the Amazon Prime version with free shipping (no trading fee) or an identical alternative where shipping costs are an added charge. In mutual fund vernacular, the Amazon Prime option is referred to as a no-transaction fee (NTF) share class. These free shipping or NTF funds cost nothing to buy or sell (zero trading fees) but they charge a higher ongoing expense ratio which usually amounts to 0.25% – 0.35% per year. Think of this ongoing expense as the $99 annual cost of Amazon Prime although it would be as if Prime’s annual charge was variable depending on the value of your purchases. Buying the NTF version of a $100,000 mutual fund may avoid a one-time $50 trading fee but the annual cost of ownership could be 7 times that amount.

The alternative option, where you pay for shipping, is called a transaction-fee fund (also called an institutional fund). This share class of funds have a fixed cost to buy or sell that generally ranges anywhere from $20 to $75, depending on the brokerage firm. Like with avoiding the $99 Amazon Prime annual cost, the advantage of paying for each transaction is reducing the fund’s expense by 0.25% – 0.35% per year.

What If Amazon Prime Cost $999 / Year

Regular Amazon users choose to subscribe to Prime because the convenience of free 2-day shipping and benefits of other Prime services far exceed the $99 annual expense. There is, however, an annual cost for Prime at which most people would spend more time evaluating the true economic benefit. If Amazon Prime cost $999 per year, would Amazon users still subscribe? Relatedly, if investors stopped to consider the costs of the mutual fund equivalent of the Amazon Prime-decision, they might be inclined to spend more time evaluating all their options.

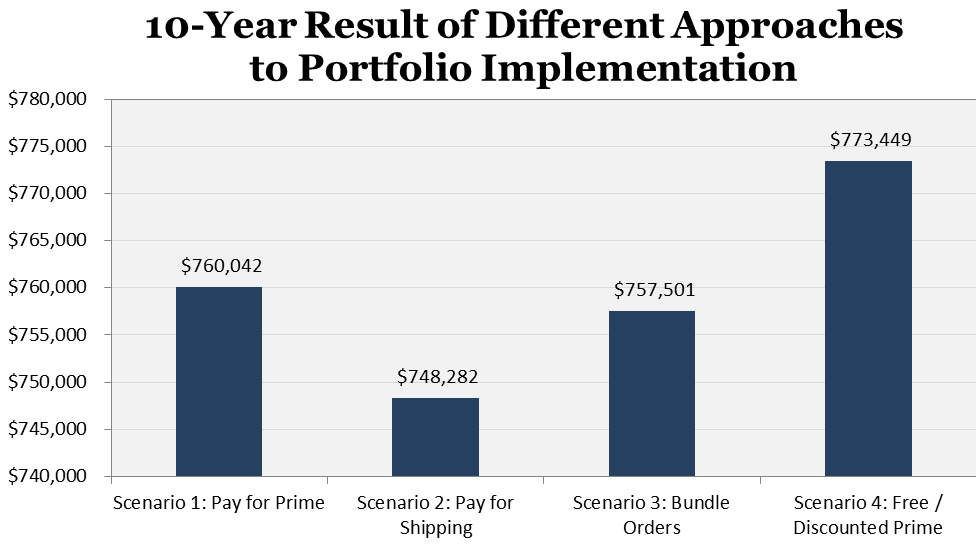

Consider a working professional who has $4,500 to save each month outside of any employer retirement plan and wants to invest equally in three funds. To demonstrate the high dollar importance of the seemingly trivial share class decision, we evaluated four iterations of this scenario using Amazon user analogies to help understand each.

- Scenario 1: Pay for Amazon Prime. Investor buys non-transaction fee funds each month and pays the higher ongoing expense ratios to avoid all transaction costs.

- Scenario 2: Skip Prime, Pay for Shipping. Investor buys the transaction-fee funds each month and pays the transaction costs (‘shipping fees’) to avoid the higher annual fund expenses (‘Amazon Prime fee’)

- Scenario 3: Skip Prime, Bundle Orders. This is analogous to the strategy of adding items to your Amazon cart each month without the Prime subscription and only purchasing when the order is of sufficient size to achieve discounted or free shipping. In mutual fund terms, it is a variation of scenario 2 where instead of buying the funds every month, the individual lets the $4,500 monthly contributions accumulate in cash until there is enough cash to justify the cost of fund purchases.

- Scenario 4: Free Amazon Prime. In August 2015, Amazon essentially eliminated the old ability for Prime subscribers to add friends, family, coworkers, etc. as Amazon Prime freeloaders. Aside from a free 90-day trial period, anyone who wants Amazon Prime now has to pay for it. The good news is that when it comes to buying mutual funds, there is still an almost free version of Amazon Prime. The investor in our scenario can purchase $1,500 of the three no-transaction fee share classes each month and pay no transaction costs. After a few months when the balances in each fund have reached critical mass, the investor can execute a “tax-free share class exchange”. This exchange costs nothing, has no tax immediate or future implications, and transfers each position from the higher ongoing expense share class to the lower expense share class.

While the cost difference in deciding whether to subscribe to Amazon Prime or to pay for shipping throughout the year is likely trivial for most Amazon consumers, the cost difference on the investment side is far from trivial. We tested each of the four scenarios over a 10-year period to determine the difference in ending values. Keep in mind that the only performance variation between these approaches comes from the cost of any transactions and the difference in expense ratios between the two share classes. Many investors and financial advisors ignore or are not aware of this relatively simple technique to efficiently minimize costs. This optimization of expenses requires effort but the reward can easily be tens of thousands of dollars over an extended period of time. We are adamantly among the cohort of financial advisors who consistently voice the importance of expenses as the single most relevant metric when evaluating any investment asset. Yet we also strongly contend that the importance of fees goes beyond simply choosing investments with low expense ratios. Using low cost investments is certainly part of the battle but consistently draining the portfolio with excess transaction costs or leaving cash to accumulate until there are sufficient funds to invest is like a football team making a big play but having it called back due to a penalty. The costs of inefficient portfolio implementation can be avoided with just a little effort and foresight. Working professionals who are saving money each month beyond a 401(k) are most exposed to such costs and benefit the most from avoiding a lazy portfolio implementation approach. These working savers may find that the $99 annual cost of Amazon Prime is a small price to pay for the added conveniences but they would be well-advised to question which of the approaches described above is most advantageous for investing their monthly portfolio contributions. [i] Test assumes a 7.0% annual return of the institutional share class and a 6.65% annual return (reduced by 0.35%) of the NTF share class. Fund trading fee assumed to be $50. In Scenario 3, contributions were held in cash until there was enough cash to purchase $10,000 of each fund. In Scenario 4, a share class exchange was executed when the value of each NTF fund exceeded $10,000. Even if a $50 trading fee was incurred in scenario 4 in lieu of the share class exchange, the ending value would be $769,846 which still dramatically outpaces all other approaches.Truly Minimizing Expenses

Leave A Comment