Note that an updated explanation of the tax impact under the 2017 Tax Cuts and Jobs Act exists here.

We wrote this article in 2015 about a simple tax credit (the QEE Tax Credit) that provided an opportunity for taxpayers in Georgia who face alternative minimum tax (AMT) to reduce their tax liability by $700. The popularity of this tax credit subsequently expanded (which clearly was attributable to our publishing of a blog post highlighting the opportunity). Because of the way this credit is capped by the state of Georgia, the increased popularity reduced the benefit of the credit. What was once an easy way for many taxpayers to save $700 in taxes is still beneficial but now provides less than 50% of the original benefit.

Legislation passed last month in Georgia to expand the benefit of a different tax credit that has two significant advantages relative to the initial QEE tax credit. First, the new credit has a $60 billion state-wide cap and limited marketing so usage of the credit by your friends and neighbors is not likely to limit the amount of the credit available to you. Secondly, the allowable size of the new credit is 4 times the size of the QEE tax credit so the potential tax savings are significantly higher – roughly $2,500 for married filers. Considering the simplicity of the credit, the universal applicability, and the appeal of significant tax savings, it would be a mistake for high income Georgia taxpayers to ignore the usage of this credit.

History of the Georgia Rural Hospital Tax Credit

On August 22, 2016, Senate Bill 258 was initially signed into law in Georgia. The bill established the Georgia Rural Hospital Tax Credit whereby taxpayers could make contributions to any of 49 hospital organizations in the state of Georgia deemed eligible to receive donations and receive a tax credit for the contribution. Initially, the tax credit equaled 70% of the contribution amount but the new tax credit failed to stimulate contributions to struggling rural hospitals that lawmakers intended. In March 2017, Senate Bill 180 raised the tax credit from 70% to 90% and passed the Georgia House by a vote of 173-0. The Governor signed the bill into law on May 8th.

What is the Benefit?

Keep in mind that when you typically contribute to a charitable organization, you receive a tax deduction for the amount of the contribution. This charitable tax deduction offsets your income meaning that the value of the deduction equals your marginal tax rate. A taxpayer with a marginal tax rate of 35% who makes a $100 charitable donation saves $35 in taxes. Alternatively, a tax credit – like the Georgia Rural Hospital Tax Credit – provides a dollar for dollar reduction of your income tax liability for charitable gifts to eligible rural hospitals.

Yet even though the new tax credit is decidedly better than a deduction, the credit is only worth 90% of the donation amount. Save for taxpayers who would have already donated to a rural hospital without the credit, donating $100 to save $90 on taxes may not seem worth the trouble. However, the new credit provides a significant, but less obvious, benefit to many high-income taxpayers in Georgia.

In Georgia and in other states with a state income tax, most families with annual income between $200,000 and $600,000 are likely to face alternative minimum tax (AMT) because of the way the alternative tax is calculated. Taxpayers who face additional AMT on line 45 of their 1040 end up losing some or all benefit of traditional federal tax deductions such as state income tax deductions, real estate tax deduction, or other miscellaneous itemized deductions.

Without alternative minimum tax, a $100 contribution to one of these rural hospitals under the new law results in a $100 charitable deduction on the federal return, a $90 savings on state taxes, and $90 less of federal income tax deductions for the reduced state income taxes. At the end of the day, the taxpayer saves on federal and state taxes but not enough to offset the $100 contribution.

However, Georgia residents who face AMT stand to significantly benefit from the credit by converting what would otherwise be a non-deductible state tax liability into a deductible charitable contribution. In the case of the $100 contribution example above for a taxpayer facing AMT, they contribute $100 to save $90 on state taxes so they’re $10 behind. Importantly, they don’t lose any benefit from a reduced state tax deduction because the deduction was not a benefit to begin with under AMT and they now have a $100 charitable deduction on the federal return which more than offsets the $10 deficit.

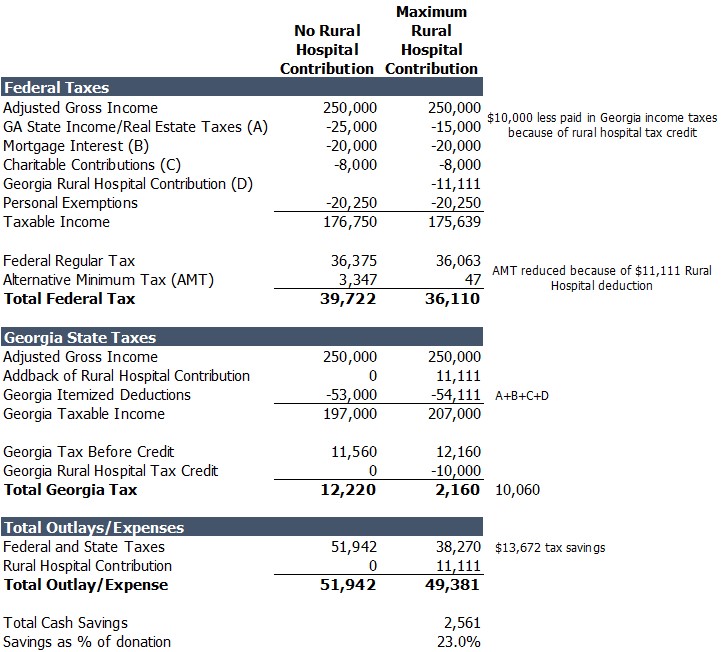

The example below demonstrates how this works for a married filing joint filer subject to AMT using a real life scenario. The left column shows the math of the taxpayer not making a rural hospital contribution whereas the right column shows the same taxpayer making the full contribution of $11,111 (the maximum credit is $10,000 which algebraically means that the maximum contribution to yield the full 90% tax credit is $11,111). In this example, contributing $11,111 to an eligible rural hospital resulted in a total federal plus state tax savings of $13,672. After subtracting the $11,111 cost of the contribution, the taxpayer in this scenario walks away with a total savings of $2,561.

How to Claim the Benefit

Applying for the tax credit requires less than three minutes. This website for the Georgia Heart Hospital Program has the one-page form to complete. Contributions of any amount are permitted but the maximum tax credit peaks with contributions of $11,111 for married filing jointly taxpayers and $5,556 for single filers. The list of eligible rural hospital organizations can be found here or you can have the organization automatically selected on your behalf.

Should I Bother?

Georgia tax filers who annually face alternative minimum tax will benefit nicely from the rural hospital tax credit. The total savings for married filers who typically pay a healthy amount of AMT will likely exceed $2,000 per year. Expected savings will be half of that for single filers. Given the simplicity of the credit and the material dollar benefit, it seems worth the few minutes of time it takes to complete the gift.

For tax filers who don’t expect to face AMT, there is a small financial cost (because the credit is only 90% of the contribution amount and not 100%). Still, the upside is that you get to direct where your state tax dollars go without a significant financial cost. Georgia tax filers who are not confident that they will face AMT may want to hold off on making the contribution until later in the year when they have more clarity on their tax picture.

Final Thoughts

Both parties of the Georgia state government clearly want to incentivize contributions to Georgia rural hospitals and they have provided a tasty tax carrot to achieve this mission. It is not a complex, hard-to-qualify-for, time-consuming tax credit. It literally requires 2-3 minutes to potentially save more than $2,000 in taxes. As long as the Georgia Rural Hospital Tax Credit is available, taxpayers who regularly face AMT and who regularly look for ways to minimize taxes would be wise to exploit this valuable tax credit.

7/17/2017 Addendum: It should be noted that the Rural Hospital Credit requires 30 days for approval from the Georgia DOR and then the taxpayer has 60 days to submit payment, once approved. As a result, it is suggested that the credit application be submitted before November 1.

[…] A Credit For Those Who Face The Alternative Minimum Tax- Legislation passed this year in Georgia to expand the Rural Hospital Tax Credit has several benefits especially for high income tax payers. Considering the simplicity of the credit, the universal applicability, and the appeal of significant tax savings, it would be a mistake for high income Georgia taxpayers to ignore the usage of this credit. Read more… […]