Value or Growth? Is it finally time for Value to play catch up? The debate rages on!! Let’s take a step back for a moment to set the stage for this conversation.

Do you remember middle school math classes where your math teacher asked you to create a factor tree and you ended up with something like this:

If this sounds unfamiliar to you, a factor is merely a fact or circumstance that contributes in a predictable way to an outcome. In this case, each number contributes in a logical way toward the outcome of 48.

When we talk about factors in an investor’s portfolio, it helps to keep the factor tree in mind. We quite simply are talking about a characteristic of an investment holding which rigorous analysis and research has identified as a component of durable market returns.

We will discuss three specific factors of excess market return: Value, Momentum, and Quality. What about Growth, I hear you ask? Ah, well that is largely the point…Growth, in and of itself, is not a reliable factor of long-term excess returns.

As Blackrock’s Andrew Ang points out, though, there are times when it makes sense to pay a higher price for stocks. The factor composition of the Russell 1000 Growth Index will change with time, but the Quality and Momentum constituents consistently comprise a substantial portion of the index and drive the long-term returns, and it is those factors that it is desirable to invest in within the Growth stock universe. Ang notes, “even for those growth managers that are able to generate positive returns with non-quality / momentum holdings, those returns may be fleeting, while holdings classified as quality or momentum have demonstrated their ability to deliver long-run excess returns over decades.”

So, when we talk about Growth versus Value, we are actually framing the situation incorrectly. The factor story is more about Value and the two Growth factors of Momentum and Quality, and how they work together through time.

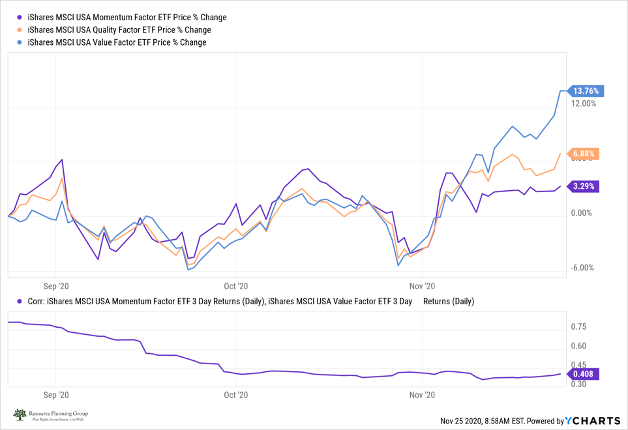

Recent months provide an example of how factors work together. The time period is short, but we have seen the correlation of daily performance decrease, while each factor has contributed to positive returns over the period.

Factors ought not compete for our attention. When it comes to the Value vs. Growth debate, it’s not either / or, but rather the story is the power of “and.” We will share more proprietary research in the near future that demonstrates the importance of how factors work together. Be on the lookout!

Leave A Comment