An estimated 20 million Americans do not have access to Medicare, Medicaid, or employer provided insurance and will be left to purchase their own health insurance in 2019. If you’re among that 20 million, the news is relatively good. In most states, premiums next year will be relatively flat (or even down in some states), a far cry from 2018 when health insurance premiums across the country rose by 37%. Additionally, a non-ACA compliant form of health insurance will be available without some of the onerous and costly restrictions that existed prior to 2019. This insurance coverage may not be for everyone but it does provide an additional low-cost option for healthy individuals and families.

Below, we provide three suggestions for consumers buying health insurance on their own to consider during the 2018 open enrollment season that runs through December 15 in most states.

1) Consider Short-Term Health Insurance – But Understand the Limitations

In years prior to 2019, this was a misguided and imprudent option for most people. Short-term health insurance was, by ACA rules, limited to covering only up to three months at a time. Importantly, this insurance excludes pre-existing conditions so while such insurance could be renewed throughout the year for 3-months at a time, any illness or injury suffered during one three-month window would automatically be excluded and not covered once that window ended.

Assume that a healthy woman named Samantha purchased a 3-month short-term policy to start on January 1, 2018 and then was diagnosed with breast cancer in late-February. Most costs for Samantha’s cancer treatment would be covered through the end of March (subject to the deductible and out-of-pocket maximum) but from April 1st until the end of the year, she would have no insurance to cover the costs of her treatment. This clearly has the potential to be a 6-figure out-of-pocket expense for Samantha.

The other problem of short-term health insurance prior to 2019 was the “individual mandate.” These short-term policies did not meet the “minimum essential coverage” requirements as qualifying health insurance under the Affordable Care Act (and still do not). This meant that anyone purchasing a short-term plan would face the ACA’s individual mandate tax penalty – equal to a hefty 2.5% of household income. For high income earners, the tax penalty could easily be higher than the cost of simply purchasing qualifying health insurance.

Two big changes make short-term health insurance plans a far more reasonable option for consumers starting in 2019. First, the Tax Cuts and Jobs Act enacted by Congress in late 2017 eliminated the individual mandate and the associated penalty for failing to enroll in an ACA plan beginning on January 1, 2019. This means that short-term insurance can be purchased without facing a tax penalty (at least in most states – more on that, later). Second, the Trump administration cleared the way during 2018 for insurers to sell short-term insurance with a duration of up to 12 months starting in 2019. These 12-month plans remove the financial risk of a serious injury or diagnosed illness becoming excluded from coverage during the year of the injury or diagnosis. Assuming that Samantha in our example above received her cancer diagnosis in February, she would be covered under the 12-month policy for the entire calendar year and could then elect to join an ACA plan at the start of the next year that, by law, could not exclude pre-existing conditions.

Short-term insurance plans can dramatically reduce the cost of coverage compared to ACA compliant health insurance. The price of a 12-month policy can be as little as $60/month for a 30-year old or $100/month for a 50-year old. For a generally healthy family without any pre-existing conditions, the premium savings can exceed $10,000 in a calendar year.

There are drawbacks. As suggested already, these plans are usually not appropriate for anyone with pre-existing conditions as those would be excluded from coverage. This includes any conditions that you have been treated for in the prior five years. Additionally, the short-term plans typically do not cover maternity care, physical therapy, mental health treatment, rehabilitation, or prescription drugs. There are potential gaps in coverage so no one should look at these plans as an apples to apples alternative to traditional ACA plans. They are an option – not the answer.

The last point to make about short-term insurance plans is that several states are restricting their benefit or usage. States including New York, Massachusetts, Illinois, and New Jersey have either have an outright ban the sale of short-term health insurance or impose a financial penalty for not having ACA compliant health insurance. This map provides a state-by-state summary.

2) Pay Attention to Where You Shop for Insurance

When shopping for ACA plans, there are effectively two routes:

- The health insurance exchanges – either healthcare.gov for the 39 states that use the federal platform or a state-run exchange in the remaining states.

- An insurance company or insurance broker.

For the ACA compliant plans that provide comprehensive coverage, these two options will provide identical options and prices. But if you want to consider the less costly short-term insurance plans that do not meet ACA requirements, you will have to use the second route since such plans will not be available through healthcare.gov or the state-run exchanges.

There are several great online options for comparing prices and eventually buying insurance including online insurance brokers such as Health Sherpa (our favorite site for the simplicity and user-friendly interface), Stride Health (a site that may make the best algorithm-derived suggestion for health insurance based on your specific circumstances), HealthPocket and eHealth. On any of these sites, you can see price quotes for yourself or family within less than three minutes of answering a few questions. Moreover, the enrollment process via healthcare.gov is painfully slow and tedious such that these online brokerage sites can easily shave 60-90 minutes off the entire process. It should be noted that of these four options, only HealthPocket and eHealth provide pricing for the short-term, non-ACA compliant insurance.

The one time where it is critical to enroll through the health insurance exchanges is when individuals or families might qualify for an insurance subsidy (see below). In these cases, the only way to get the potentially lucrative subsidy is by applying through the insurance exchange. That said, all of the websites above will determine if you are likely to qualify for a subsidy and then divert you to the insurance exchange if it appears that you will.

3) Do Not Overlook the Lucrative Tax Subsidies

Somewhere between 85% – 90% of taxpayers in the United States will qualify for a health insurance subsidy in 2019. But many are not aware of the huge potential benefit or don’t plan properly to qualify for the subsidy benefit. Because the subsidy test is dependent on income, high income earners will likely not qualify for subsidies (for a family of four, the maximum adjusted gross income limit to qualify in 2019 is $100,400). But for early retirees without high income or young professionals early in their career, the potential savings are significant.

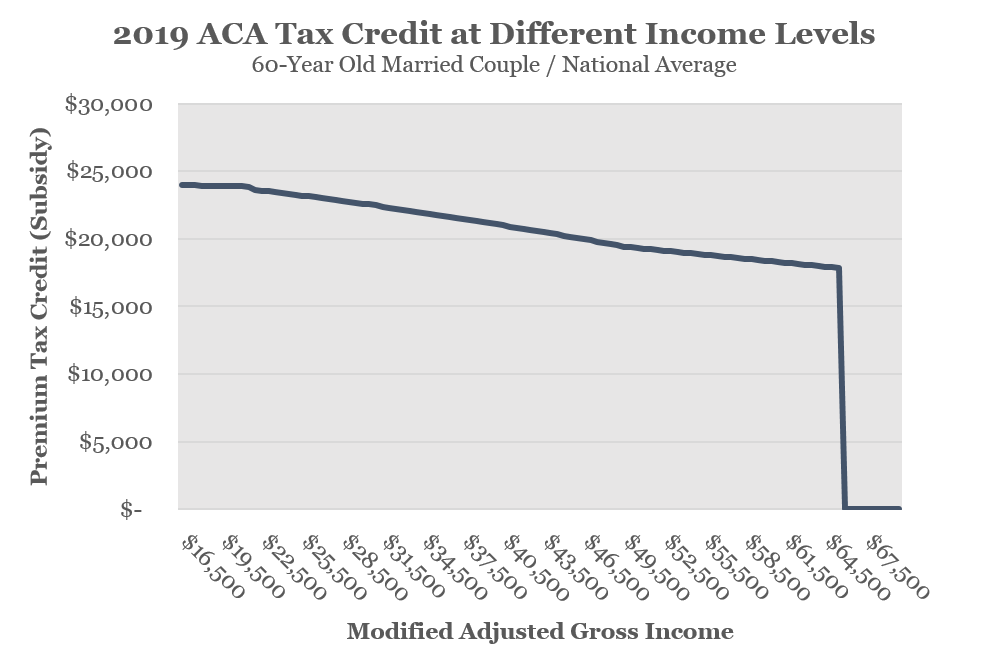

In this article we wrote last year, we called health insurance subsidies the “Tax Saving Opportunity of a Lifetime for Early Retirees.” Many pre-65 retirees, even those with several million dollars saved, can qualify for over $20,000 in tax credits (masquerading as health insurance subsidies) next year. We explain the planning strategies to qualify for the subsidies in last year’s article and the reality is that early retirees who fail to properly plan for the subsidy are likely ignoring the single-greatest tax saving opportunity of their lives.

There is one subsidy-related change to note for 2019 (although it actually happened in 2017). In years prior to 2018, it often made sense for families who qualified for cost sharing reductions to purchase a silver plan since these subsidies were only available for consumers who purchased silver plans. However, the Trump administration abruptly eliminated federal funding for cost sharing reductions in October 2017 meaning that insurance companies did not receive reimbursements for the cost sharing reductions in 2018 and will not receive these reimbursements in 2019.

Although this reimbursement elimination news came after insurance companies had finalized rates for 2018, many insurance companies were expecting such a measure and effectively priced it into their 2018 costs for silver plans. This year, all insurance companies were aware that they would not receive such government reimbursements in 2019 and they built the added cost into pricing for 2019. What this effectively means is that the former advantage of “cost sharing reductions” is no longer a real advantage since the insurance companies have built the expected costs into the premiums. That is to say that healthy consumers shopping for health insurance who might qualify for the cost sharing reductions (married couple with income below $41,150 or individual with income below $30,350) should strongly consider bronze plans where the monthly premiums should be significantly lower than the silver plan options.

Closing Comments

The bottom line is that the health insurance market for 2019 will look similar to 2018 but with some important changes that could and should impact consumer decisions.

Leave A Comment