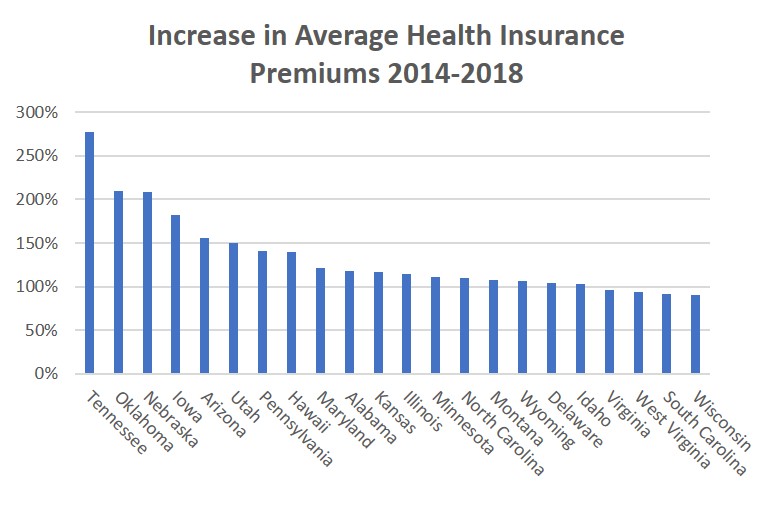

Like it or not, the Affordable Care Act will again rule the health insurance marketplace in 2018 regardless of what happens in Congress with tax legislation or whether the individual mandate holds up over the coming weeks. Also like it or not, there has been a dramatic increase in insurance premiums from the onset of the ACA program in 2014 to 2018. Figures from the Kaiser Family Foundation indicate that individual insurance premiums have increased by 76% across the country. Many states and counties have seen much larger premium spikes in that short stretch.  The point here is not to meddle in the causes, economic impact, or the political implications of these massive premium hikes. Instead, the point is to shine a bright light on one of the key results that gets lost in the political debate. The dramatic increase in health insurance costs around the country actually stand to benefit one large demographic who intelligently plan: early retirees. That is, the significantly increased premiums go hand-in-hand with significantly increased tax credits because of the way the credits are calculated. What was a $6,000 – $9,000 tax credit for early retirees in 2014 can now be more than $24,000.

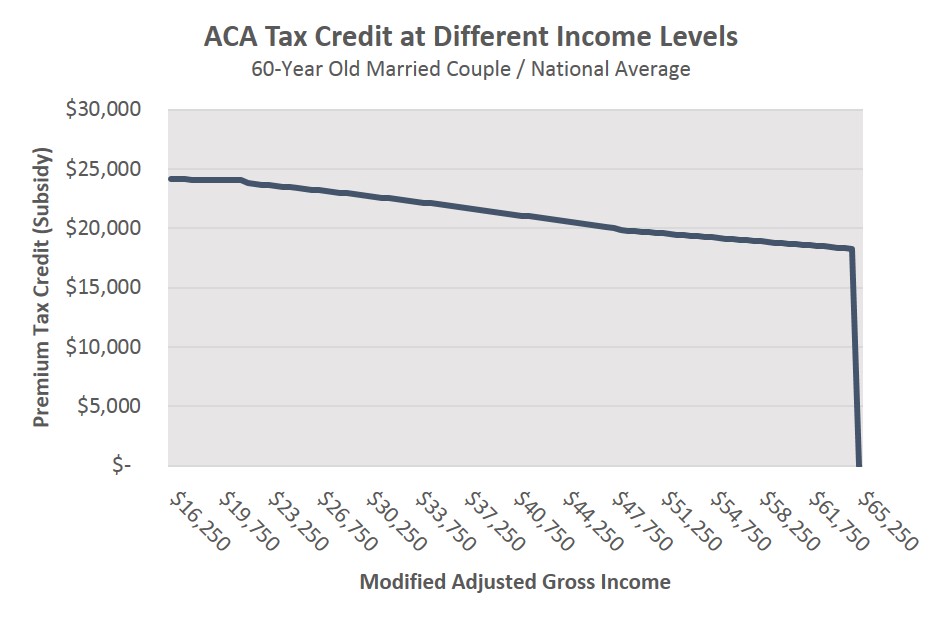

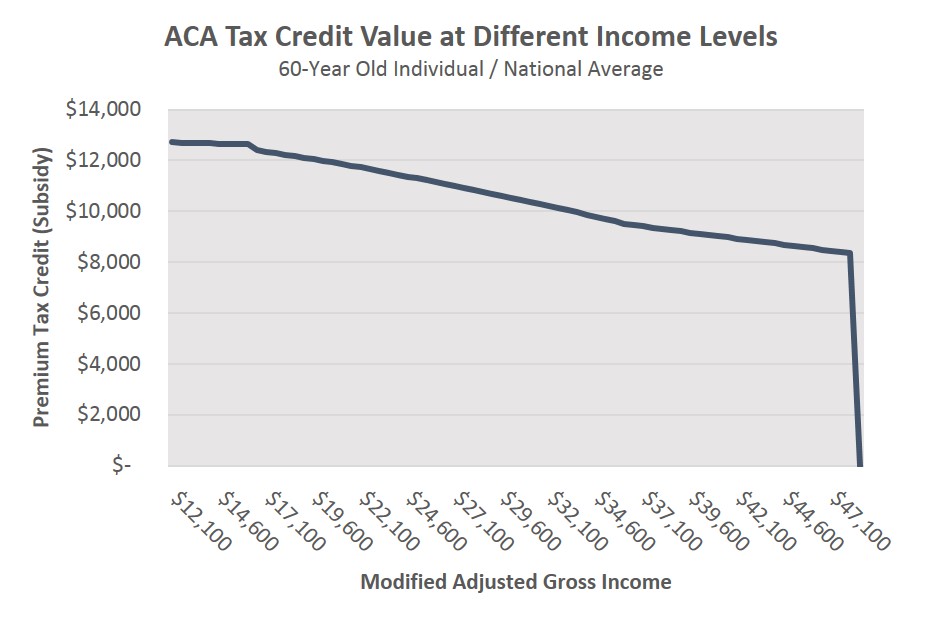

The point here is not to meddle in the causes, economic impact, or the political implications of these massive premium hikes. Instead, the point is to shine a bright light on one of the key results that gets lost in the political debate. The dramatic increase in health insurance costs around the country actually stand to benefit one large demographic who intelligently plan: early retirees. That is, the significantly increased premiums go hand-in-hand with significantly increased tax credits because of the way the credits are calculated. What was a $6,000 – $9,000 tax credit for early retirees in 2014 can now be more than $24,000.

These dollars clearly provide a large financial planning and tax saving opportunity. Retired individuals under age 65 and married couples, where at least one spouse is under age 65, have a tax planning opportunity that can provide significant tax savings – or lost tax savings, if not properly planned. And because the tax credits are refundable, these savings do not require that someone owe a lot in taxes to be rewarding.

How Early Retirees Can Take Advantage of the Huge Tax Saving Opportunity

Most, but not all, early retirees have modest to high control over their taxable income. This is dramatically different from the working years where employment wages or self-employment income are largely an uncontrollable result of how successful the work year was.

It is also worth the reminder that taxable income and cash flow are two very distinct items. Plenty of well-advised taxpayers can have annual cash flow in excess of $100,000 for spending with only a fraction of that amount in taxable income.

Granted, early-retirees may still have a few sources of uncontrollable income such as pensions, investment income, or deferred compensation. To the extent that these uncontrollable income sources are far greater than $70,000 for a married couple or $50,000 for an individual, there may not be any valuable ACA credit tax planning. For everyone else, wise planning is likely to create valuable rewards in the form of health insurance tax credits.

The key 2018 income figures for retirees are $64,960 for married couples and $48,240 for individual taxpayers. Married retirees who can employ tax-planning strategies to reduce or keep modified adjusted gross income at or below the threshold income level will see resulting tax savings that range between $24,137 and $18,253. Individual taxpayers can expect roughly half of these benefits.

These are obviously not savings to ignore when most tax planning strategies are simply trying to save a few hundred dollars here or there. If bad planning or just bad fortune puts a married couple at $64,961 of income – one dollar over the 2018 income threshold – the couple receives zero ACA tax credits such that the extra dollar of income legitimately costs them $18,253 in additional taxes (again, because this is a refundable credit, it costs them this much whether they owe taxes or not). That becomes an expensive extra dollar of income.

So what kind of strategies should be considered in light of this massive tax saving opportunity? The following are all tools in the ACA tax credit planning toolkit:

- Minimizing Traditional IRA and 401k distributions;

- Delaying the start date of Social Security;

- Delaying the start date of pension income;

- Taking advantage of the maximum HSA contribution;

- Delaying any Roth conversions until after age 65;

- Aggressively harvesting capital losses and avoid recognition of capital gains;

- For any part-time retirement income (either self-employment or 1099 income), making use of a solo 401k plan to reduce adjusted gross income.

Notably, this is not a comprehensive list of the tax planning strategies to minimize modified adjusted gross income in order to qualify for the tax credits. It does, however, lay out some of the options to consider. The following examples show these strategies in use.

Example 1. Jack and Kate are a 64-year old married couple with $3 million of investments – all held in tax deferred IRA and 401k accounts. They spend $70,000 per year and would normally need to withdraw roughly $90,000 per year from their tax-deferred accounts to cover their living expenses and the associated taxes.

One useful tax planning strategy would be for them to distribute only some of their spending needs from the tax deferred accounts and take the rest from a home equity line of credit. For example, consider that Kate distributes $35,000 from her IRA (plus the associated tax withholding) at the start of the year and then she and Jack draw from a home equity line of credit around the middle of the year to cover the remaining $35,000 of spending needs. This keeps them under the key income threshold of $64,960 and provides roughly $20,000 of ACA tax credits that would otherwise go wasted. On January 1, 2019, they then distribute funds from an IRA to pay off the line of credit (since they’ll now be Medicare-eligible and no longer eligible for ACA tax credits). At a conservative 5% interest rate, the line of credit costs them an additional $875 in borrowing costs which is a far cry from the $20,000+ of tax savings that would have otherwise gone wasted.

Example 2. George and Jane are a 57-year old married couple. They have $60,000 of income from a pension and investments and $10,000 of income from George’s part-time consulting work which put their total income of $70,000 over the important $64,960 level. Among the planning options for them to consider are George terminating the consulting work in 2018 (because it’s actually costing (not earning) him somewhere around $11,000 to work (~$19k in lost ACA credits plus ~$2k in additional income taxes minus the additional $10,000 he actually makes). An even better planning strategy would be to open an individual 401k plan and defer nearly all of George’s $10k income to the 401k which then puts them below the threshold.

Example 3. Bob is a 62-year old recently retired individual with $2 million of investments that are mostly held in a taxable brokerage account. He has no pension income sources but his portfolio generates interest and dividends of roughly $50,000 per year. He spends $80,000 annually and is considering taking Social Security benefits of $1,500/month immediately to reduce the near-term drain on his portfolio.

Bob’s portfolio income already puts him slightly over the key $48,240 income level and beginning Social Security would only make matters worse. Instead, Bob could defer Social Security, seek to harvest taxable losses in his portfolio, and maximize an HSA contribution in 2018, reducing his modified adjusted gross income by roughly $6k to qualify for a subsidy. By taking these steps, Bob earns approximately $8,700 by way of ACA tax credits and increases his future Social Security benefit, which provides added security in retirement.

Example 4. Jim and Pam are a 60-year old married couple who fund their living expenses from investment income and the tax-smart sale of assets within their portfolio. Their taxable income is $25,000 per year – all of which results from capital gains and investment income. They have the option to buy health insurance from Pam’s old employer which covers them both and costs $900/month ($10,800 for the year).

Importantly, the IRS issued a ruling in 2015 that provides retirees like Jim and Pam who are eligible for employer-provided health insurance with a valuable option – something that does not exist for most employees while they are working. The rule allows retirees to decline retiree health insurance coverage provided by a former employer and still qualify for a federal subsidy. We find that while this retirement option has huge potential value, it tends to get ignored as retirees simply choose the path of least resistance – signing up for retirement health insurance from their former employer.

Jim and Pam instead could buy health insurance through the ACA exchange and would be starting with more than $24,000 of insurance subsidies. A silver plan would end up costing them roughly $34/month after the subsidies – a savings of over $10,000 from Pam’s employer-provided coverage.

Example 5. Eric and Tammi are married retirees. Eric is 65 and on Medicare while Tammi is 60 and has to buy private insurance. They have investment income of $35,000 which is currently their only source of taxable income. Tammi just retired and is eligible for a pension of $20,000 per year which she can take immediately or defer to age 65 for a higher benefit.

While the additional pension income would keep them below the key $64,960 income level to qualify for the tax credits, they may be well served to push pause on the pension benefits. The ACA includes a second and less-publicized subsidy called the cost sharing reduction (CSR) that gets added to the premium tax credit. The CSR has a 2018 income limit of $40,600 for a married couple so that if Tammi defers the pension, she is likely to qualify for both the premium tax credit plus the cost sharing reduction.

Closing Comments

Again, you can agree or disagree with the Affordable Care Act (i.e. Obamacare) but the reality is that ignoring the lucrative tax credits that are available to early retirees is just leaving 4- and 5-figure personal tax savings on the table each year. Pre-65 retirees may not qualify for the credits or it may not make sense to claim them but, with the sheer dollars at play, anyone who fails to properly plan for these tax credits could be making the single costliest tax miscue of a lifetime.

The good news is that there is still time to plan for 2018 tax credits but the clock is quickly ticking towards midnight (i.e. December 15).

Leave A Comment