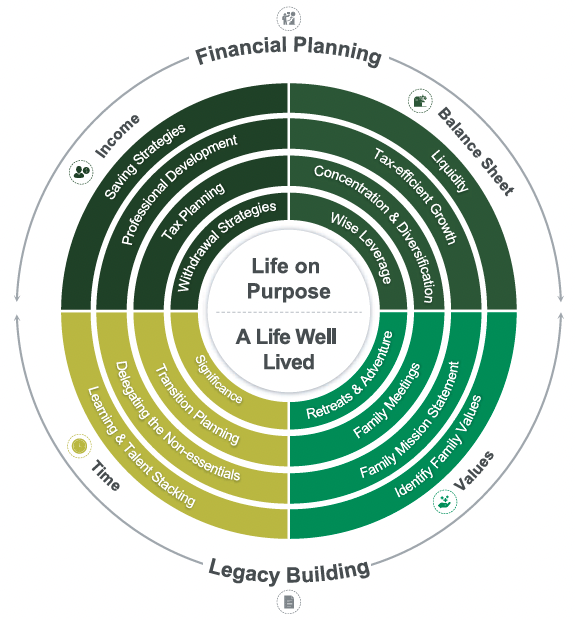

Low Rates and High Valuations Have You Down? Don’t Worry…Plan Right!

Since the advent of the Great Financial Crisis in 2008, catalyzed by successive rounds of quantitative easing and ever more stimulative monetary policy from the Federal Reserve, we have found ourselves in an environment of extremely low interest rates. In this environment, fixed-income investors and savers seeking stable income streams have been punished, receiving ever [...]