Last week, Georgia Governor Nathan Deal signed House Bill 769, expanding a Georgia tax credit that supports rural hospital organizations across Georgia. We explained the value of the rural hospital tax credit in this 2017 Astute Angle post but the recently expanded tax credit under HB 769 combined with provisions of the Tax Cuts and Jobs Act dramatically increase both the benefit and the audience of beneficiaries. In fact, the tax credit is now so valuable that we believe that most Georgia taxpayers who face state income tax should go through the steps necessary to utilize the credit. That’s the good news. The bad news is that the credit is limited to $60 million per year statewide. So as Georgia taxpayers realize the value of the credit, it is likely to be quickly consumed.

Brief History Of The Georgia Rural Hospital Tax Credit

In August 2016, Senate Bill 258 first established the Rural Hospital Tax Credit, allowing taxpayers to make donations to any of the approved Rural Hospital Organizations (RHO) across Georgia and receive a state tax credit equal to 70% of the donated amount (up to a $10,000 credit per married couple). Because the credit failed to generate much usage in 2016, the Georgia legislature expanded the credit to 90% of the donation amount in March 2017 with Senate Bill 180. The new bill passed the Georgia House by a 173-0 vote but still only raised $10 million of rural hospital donations in 2017 versus the targeted $60 million.

Desiring to address Georgia’s health care problems, lawmakers introduced HB 769 in January 2018 to further expand the rural hospital credit’s appeal in three ways:

- Expanding the credit to 100% of the contribution amount;

- Allowing owners of pass-through entities to qualify as eligible contributors; and

- Removing the annual $10,000 credit cap for married taxpayers ($5,000 for single filers) after June 30th of each year.

Governor Deal signed the bill on May 2, 2018 and the new provisions become effective on July 1, 2018.

What Is the Benefit?

It’s widely understood that a taxpayer who donates to a charity gets to claim a charitable itemized deduction on their federal income taxes. For a married filing jointly taxpayer who faces a 32% marginal federal tax rate and has enough itemized deductions to exceed the $24,000 standard deduction before making any charitable donations, a $10,000 charitable contribution has an economic value of -$6,800. That is, the taxpayer gives away $10,000 to get a tax deduction worth $3,200 ($10,000 x 32% tax rate) resulting in a net economic return on investment of -68% (of course, this ignores the psychological “feel good” benefit of philanthropy).

Now, consider the difference for a Georgia taxpayer who makes a donation to one of the 58 approved rural hospitals. Keeping all the same numbers as above, the taxpayer gives away $10,000, gets a federal deduction worth $3,200, and additionally gets a Georgia tax credit of $10,000. The return on investment in this example is +32%.

The fact that taxpayers get both the charitable deduction and the state tax credit is what makes this economically advantageous. Prior to 2018, the increased charitable contribution was offset by a reduced state tax deduction on the federal return so that most taxpayers who contributed to an RHO walked away without any benefit (aside from AMT taxpayers). However, the Tax Cuts and Jobs Act now imposes a limit on the deduction for state and local taxes paid – the oft-referenced “SALT” limitation. This change in the code means that many taxpayers will get to have their cake and eat it, too.

Who Stands to Benefit?

Anyone who pays state income taxes in Georgia can benefit from the credit although the benefit will vary based on the unique circumstances. The biggest advantage in dollar terms and in return on investment will accrue to taxpayers with high taxable income who itemize deductions on their tax return. A few examples may help demonstrate the benefit.

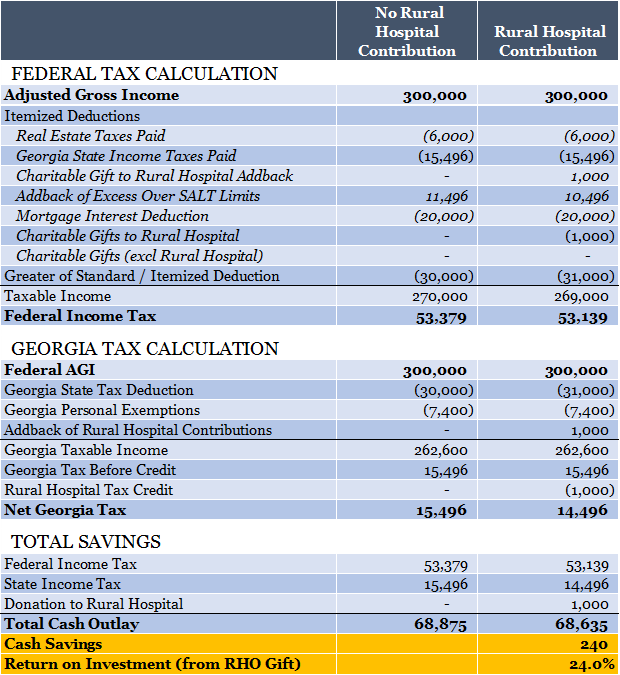

Example 1: A married couple, Anna and Bryan, have $300,000 of adjusted gross income. They own a house and pay property taxes of $6,000 and annual qualified mortgage interest of $20,000. For every $1,000 that they contribute to a Rural Hospital Organization (RHO), they get back $1,240 ($240 less in federal taxes plus $1,000 Georgia credit) providing a 24% return on investment.

Example 2: Now assume that Anna and Bryan have the same deductions ($6k property taxes and $20k mortgage interest) but their adjusted gross income increases to $800,000. For every dollar they contribute to an RHO, they get a 37% return on investment because of their now higher federal income tax bracket.

What About Taxpayers Who Would Otherwise Use the Standard Deduction?

For taxpayers who have itemized deductions that add up to less than the standard deduction ($24,000 married; $12,000 single), there can still be a benefit to the rural hospital contribution as long as the adjusted itemized deductions following the contribution exceed the standard deduction. Consider the following example.

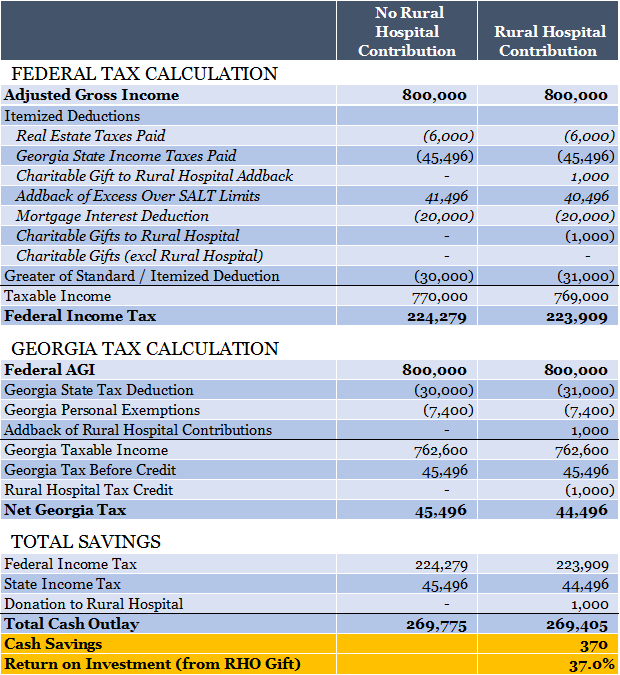

Example 3: Carol and David have $300,000 of adjusted gross income. They pay annual qualified mortgage interest expense of $5,000, real estate taxes on their primary residence of $10,000, and make $2,000 of charitable contributions to their alma mater. Because their total itemized deductions of $17,000 fall short of the $24,000 standard deduction, they use the standard deduction.

Now assume that they make a rural hospital contribution of $10,000. This contribution pushes the itemized deductions from $17,000 to $27,000 and now their itemized deductions exceed the $24,000 standard deduction. The increased deduction results in a total savings of $720 on the federal return. But it gets better – they’re also now able to itemize on their Georgia state tax return which means less taxable income and a $660 savings on Georgia taxes. All in, the $10,000 RHO contribution nets a 13.8% return.

Who is Unlikely to Benefit from the Rural Hospital Tax Credit?

Anyone who has enough itemized deductions to exceed the standard deduction hurdle will financially benefit from making an RHO gift. That said, consider the taxpayer who has limited itemized deductions and does not owe much in state income taxes such that making an RHO gift will still leave them short of the standard deduction and even a clumping strategy will take many years to recoup the credit.

In many cases, this scenario will unfold for a retired Georgian taxpayer due to a few reasons:

- The standard deduction increases at age 65 by $1,300 for each married taxpayer and by $1,600 for an unmarried taxpayer.

- The Georgia Retirement Income Exclusion reduces Georgia taxable income for taxpayers over age 62. This leaves many Georgia taxpayers over age 62 without much or any Georgia income taxes.

- Most retirees no longer have a mortgage which reduces the amount of itemized deductions.

As a result, Georgia retirees are less likely to benefit significantly or at all from the rural hospital tax credit.

What is the Optimal Gift Size?

The optimal rural hospital gift size for most taxpayers is equal to the amount of their expected state income tax liability that exceeds their SALT limitation ($10,000). As a result, for any taxpayer with more than $10,000 of deductible real estate taxes, the optimal rural hospital gift will usually equal their state tax liability. For any taxpayer with annual real estate taxes that fall short of $10,000, the optimal rural hospital gift size will usually equal the sum of state income taxes and real estate taxes less $10,000.

Example 4: Assume that Carol and David from the previous example estimate their Georgia tax liability to slightly exceed $16,000 and, consequently, elect to donate $16,000 to a rural hospital rather than just $10,000 in Example 3. Because of the higher federal deduction, their total dollar return on investment increases from $1,380 to $2,820.

Example 5: Chris and Dana have $300,000 of adjusted gross income. They pay annual qualified mortgage interest expense of $5,000, real estate taxes on their primary residence of $8,000, and make $2,000 of charitable contributions to their alma mater. Everything is the same as Carol and David in the example above except that Chris and Dana pay real estate taxes of $8,000 rather than $10,000. Instead of the optimal rural hospital contribution for Carol and David of $16,000, their optimal contribution amount is roughly $14,000 ($8,000 real estate taxes plus $16,000 state income taxes minus $10,000 SALT limit).

Georgia taxpayers can donate more than their state income tax liability but the credit is non-refundable so they’ll have to wait a year to recapture the amount of the RHO donation that exceeds the state tax liability. However, some taxpayers may find it advantageous to gift more than their state income tax liability to an RHO – a strategy known as charitable lumping or “clumping” that has become popular under the new tax code.

Consider the following “clumping” example of a high-income taxpayer who rents a home so has neither a property tax deduction nor a mortgage interest deduction.

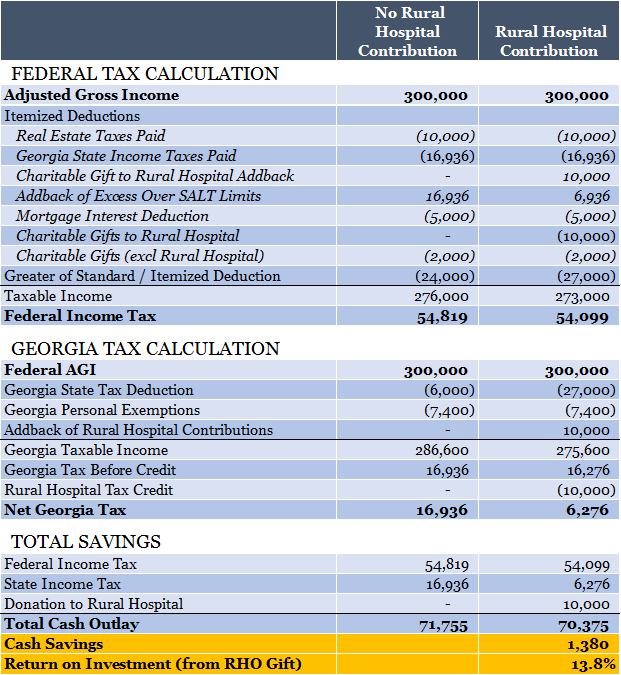

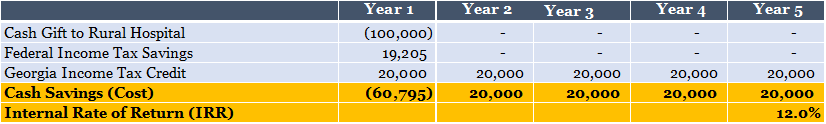

Example 6: Esther and Frank together make $351,065 of adjusted gross income. They rent a home and make no charitable gifts so their only itemized deduction is their state income tax liability which gets capped at $10,000. Because their aggregate itemized deductions amount to $10,000, they use the standard deduction of $24,000.

Esther and Frank could make a $20,000 rural hospital donation but it would serve no financial benefit for them. Under this scenario, they’re still taking the standard deduction on the federal return so their federal income tax would stay the same and they would come out with nothing lost and nothing gained.

However, assume that Esther and Frank have the financial resources to make a much larger gift to a Georgia rural hospital and elect to donate $100,000 to an RHO. As a result of this gift, they’re able to now claim a $100,000 itemized deduction on their federal tax return, reducing their federal taxes by $19,205. While they have a state tax credit of $100,000, they’re only able to use $20,000 of the credit in year 1 and must wait until years 2-5 to recoup the outstanding $80,000 of additional state tax credits. After they’ve recouped all the credits, they net a 12.0% internal rate of return on the $100,000 investment.

Notably, the further a taxpayer is from itemizing, the higher the return will be for this clumping technique.

Aside from Clumping, Are There Other Creative Ways to Leverage the Rural Hospital Credit?

Up to this point, the assumption has been that RHO gifts are made with cash. However, donating appreciated investments to an RHO instead of cash leverages the economic value of the credit as demonstrated in the following example.

Example 7: George and Heather have adjusted gross income of $500,000, pay real estate taxes of $10,000 and another $20,000 of annual qualified mortgage interest. As a result, they face Georgia state income taxes of $27,496. Contributing $27,000 of cash to an RHO saves them $9,450 for a return of 35% on their $27,000 gift.

Now assume that George and Heather have a highly appreciated $27,000 mutual fund investment that they bought several years ago for $10,000 and plan to sell. Rather than gifting cash, they instead contribute the appreciated investment to the RHO, avoiding $4,046 of capital gains tax that would have been due had they sold the position. Their return on this $27,000 gift is now a whopping 50% – $9,450 of savings plus the $4,046 of avoided capital gain taxes.

Closing Thoughts

The Rural Hospital Tax Credit gathered little fanfare or usage in 2017, despite its wide appeal for high income taxpayers. With the recent tax credit expansion making the credit more valuable for more people in Georgia, it would be shocking if the $60,000,000 statewide limit was not hit later this year. Consider that Georgia taxpayers with income of $1,000,000 have historically used film tax credits to save roughly 5-10% off their state income taxes for a total savings of approximately $3,000 – $6,000 per year. Using the rural hospital tax credit saves the same taxpayer roughly $20,000 – $22,000. Provided these high income taxpayers become wise to the new RHO tax credit, it should not take long before the statewide limit is reached. There is clearly a benefit to acting sooner rather than later.

Finally, the logistics of determining the appropriate gift size, assessing the clumping strategy, correctly applying for the credit, and deciding upon how it will be funded should first be discussed with your tax advisor or financial planner. We provide specific examples above but there are enough nuances to the new credit that professional guidance will be valuable for almost all Georgia taxpayers.

Have questions about the credit or the specific tax impact on your unique situation? Use the comments section below, call us at 770-671-9500, or click here to send an email.

Amendments:

1) It should be noted that only four hospitals accept investment gifts in lieu of cash: Higgins General Hospital, Morgan Memorial Hospital, St. Mary’s Good Samaritan Hospital, Tift Regional Medical Center.

2) Also, following this post, the IRS issued a notice on state and local tax deductions: https://www.irs.gov/pub/irs-drop/n-18-54.pdf

Georgia HEART responded with this notice: https://mailchi.mp/6b6987c725d2/irs-notice-2018-54?e=1649eb2af1

3) There is a state-wide cap on available credit dollars of $60 million and Georgia DOR has indicated that they will use a first come, first served approach in allocating credits. This means that taxpayers would be well-served to apply for a credit sooner rather than later.